Private Placements Continue to Avoid Procedures Like Securities Registration and Demand Forecasting

Prolonged Use Risks Tarnishing Company Reputation and Facing Interest Rate Disadvantages

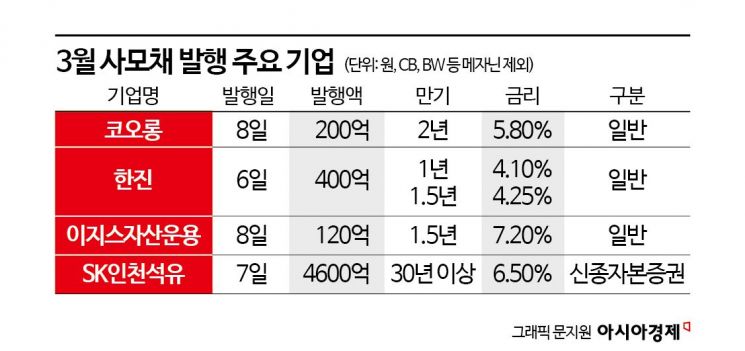

Hanjin, Kolon, and others have consecutively issued private placement bonds (private bonds) to raise funds since March. They continue private placements to secure funds for debt maturity responses, operating capital, or investments. However, there are criticisms that they persist with private funding methods to avoid mandatory submission of securities registration statements and demand forecasting (interest rate determination) procedures required for public bond issuance.

Kolon and Hanjin’s Major Fundraising Means: Consecutive Issuance of Private Bonds

According to the investment banking (IB) industry on the 12th, Hanjin, a logistics company affiliated with the Hanjin Group, recently issued private bonds worth 40 billion KRW with Hanyang Securities as the lead manager. The interest rate was set at 4.10% for 9 billion KRW of 1-year maturity bonds and 4.25% for 31 billion KRW of 1 year and 6 months maturity bonds. Hanjin has been using private bonds as a major fundraising tool, having issued 46 billion KRW worth of private bonds in January as well.

The Kolon Group is similar. Kolon, the group’s holding company, recently issued private bonds worth 20 billion KRW with Heungkuk Securities as the lead manager. The bond maturity is 2 years, and the interest rate was set at 5.80%. Earlier in February, Kolon issued 2-year maturity private bonds at an interest rate of 5.70% with Yuanta Securities as the lead manager. In March and July of last year, they also consecutively issued private bonds with interest rates in the 6% and mid-5% ranges, respectively.

Ajis Asset Management, the largest real estate specialized asset management company in Korea, recently issued private bonds worth 12 billion KRW under the lead management of NH Investment & Securities. The maturity was 1 year and 6 months, with an interest rate reaching as high as 7.20%. In February, they issued public bonds worth 60 billion KRW with Samsung Securities as the lead manager, with the interest rate set at 7.20%. SK Incheon Petrochem also recently issued 460 billion KRW worth of hybrid capital securities (perpetual bonds) through private placement.

Different Circumstances... Criticism for Avoiding Public Offering Procedures

The reasons these companies raise funds through private bonds instead of public bonds vary. However, the IB industry points out that it is often a means to avoid public bond procedures such as submitting securities registration statements and determining interest rates through demand forecasting. Companies that avoid public bond issuance for a long time inevitably face criticism for lack of transparency.

Kolon Group affiliates have not issued public bonds for several years. Since Kolon restructured its governance by splitting Kolon Industries in 2010, it has continuously raised funds only through private placements. The last public bond issuance was in May 2009, amounting to 100 billion KRW. Kolon Industries, which separated from Kolon through the split, also raises funds only through private bonds. Kolon Global and Kolon Glotech have also not appeared in the public bond market for years.

Hanjin has continued issuing private bonds since last July. Although fundraising has increased due to planned large-scale investments, there is a clear atmosphere of avoiding public offerings. Hanjin plans to invest 1.1 trillion KRW by next year in logistics infrastructure and IT platforms, aiming to become Asia’s leading smart solution logistics company.

Ajis Asset Management’s preference for private bonds has deepened amid issues with real estate project financing (PF) and overseas commercial real estate defaults. Recently, there have been rumors that the major shareholder is selling management control shares.

An IB industry official said, "When issuing public bonds, companies must relatively detail major shareholders, governance issues, and investment risk factors in the securities registration statement," adding, "On the other hand, private bonds do not have disclosure burdens, so private bonds are often used to avoid public offering procedures." A bond market official pointed out, "Although private bonds are one of the fundraising methods, continuous issuance of private bonds can give the impression of a non-transparent company, and if prolonged, it can negatively affect fundraising interest rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.