February Seoul Apartment Transactions Expected to Exceed 2,000

Higher Than December, Lower Than January

Sale Price per 3.3㎡ at 40.47 Million KRW, Slight Decrease from Previous Month

Impact of Newborn Special Loan, 57% of Transactions Under 900 Million KRW

Last month, the volume of apartment transactions in Seoul was expected to remain around 2,000 cases, raising hopes for an escape from the transaction cliff. This is attributed to the implementation of the Newborn Special Loan, which increased the proportion of apartment transactions under 900 million KRW, and the effects of apartment price adjustments since the fourth quarter of last year.

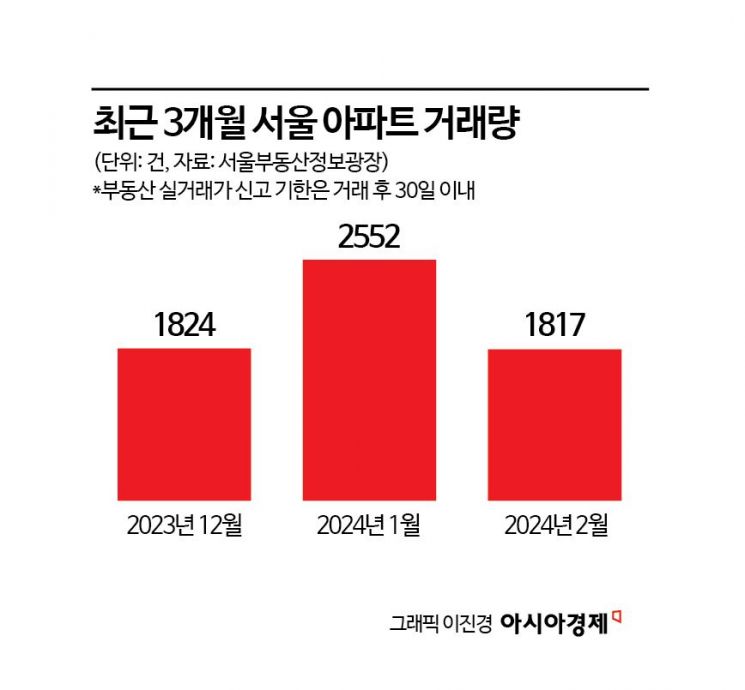

According to the Seoul Real Estate Information Plaza on the 11th, the actual number of apartment transactions in Seoul in February recorded 1,817 cases, close to the transaction volume in December last year (1,824 cases). Considering that reports for February transactions are accepted until the end of March, the number of transactions last month is likely to exceed 2,000. Although it falls short of January's transaction volume (2,552 cases), the possibility of exceeding 2,000 cases for two consecutive months has increased.

Apartment buying sentiment is gradually recovering, centered on Seoul. The Seoul apartment supply-demand index announced by the Korea Real Estate Board has risen for four consecutive weeks since the first week of February (82.9), reaching 84.7 as of the second week of March. A figure above the baseline of 100 indicates that more people want to buy houses in the market.

Due to the influence of policy financial products such as the Newborn Special Loan implemented earlier this year, transactions of apartments priced under 900 million KRW accounted for more than half of the total. The proportion of apartment transactions under 900 million KRW in Seoul was 57.7% in February and 55.1% in January.

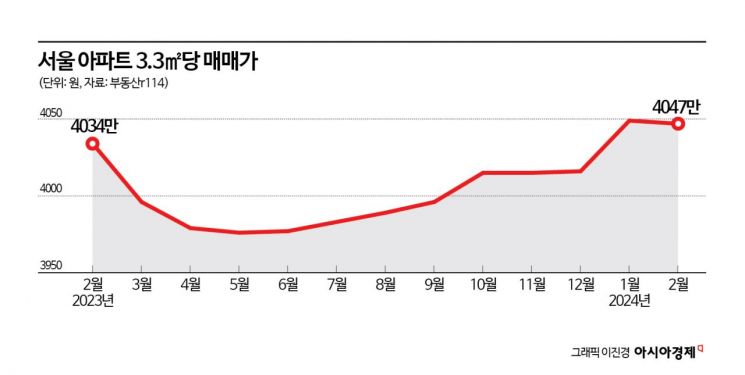

There is not yet a situation where prices are rebounding. According to Real Estate R114, as of February, the sale price per 3.3㎡ of apartments in Seoul was 40.47 million KRW. This is a slight decrease from January (40.49 million KRW) and close to February 2023 (40.34 million KRW). The price per pyeong has fluctuated in the 39 million KRW range from March to September 2023 and has remained in the low 40 million KRW range since October.

According to the real estate big data platform Asil, the areas in Seoul with the highest increase rates in the sales price index over the past three months were Yongsan-gu 1.07, Yangcheon-gu 0.88, Seodaemun-gu 0.73, Songpa-gu 0.65, and Gangdong-gu 0.55.

The price increase was particularly notable in areas where reconstruction, redevelopment, or development plan announcements were made. On the 18th of last month, a 95㎡ (2nd floor) unit in Mokdong New Town 5 Complex, Yangcheon-gu, was traded for 2.28 billion KRW. On the 8th of the same month, a 1st-floor unit was traded for 2.01 billion KRW, which is 270 million KRW less. An 84㎡ unit in Hangaram, Ichon-dong, Yongsan-gu, was traded for 2.16 billion KRW (17th floor) on the 29th of last month, which is 190 million KRW higher than the 1.97 billion KRW (13th floor) transaction on January 13.

Ham Young-jin, head of the Asset Management Consulting Center at Woori Bank, said, "Due to the implementation of the Newborn Special Loan and the price adjustment effect continuing since the fourth quarter of last year, there has been some demand for purchasing low-priced urgent sales. Although it is difficult to see this as a recovery to the average level, comparing the transaction volumes of January and February shows that demand was concentrated mainly on houses under 900 million KRW, which can use policy financing."

There is also analysis that external variables such as the possibility of interest rate cuts in the second half of the year and the shortage of apartment supply in Seoul will influence the resolution of the transaction cliff. Doo Sung-gyu, head of the Mokmin Economic Policy Research Institute, explained, "Looking at the rising prices of new housing sales and the approval situation, the supply shortage in Seoul may continue for the next 2-3 years, changing buyer sentiment and gradually increasing transaction volumes. There is still room for positive factors to be reflected in Seoul and the metropolitan area, such as development issues like the Yongsan International Business District blueprint and improvements in transportation conditions like the opening of the Metropolitan Area Express Train (GTX)."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.