"Customer-Customized Products and Refund Strategies"

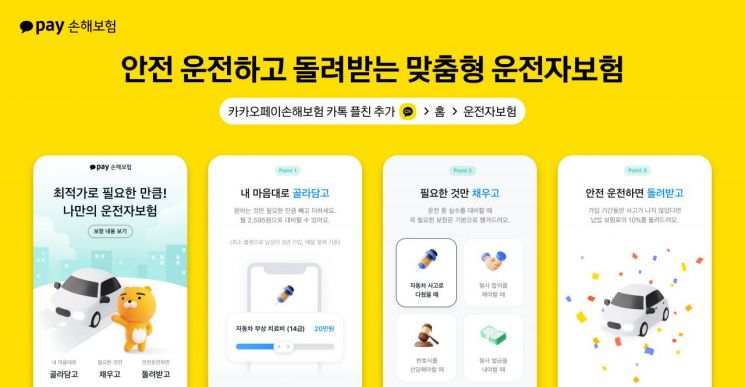

Kakao Pay Insurance announced on the 8th that it has launched a DIY (Do It Yourself) style driver insurance with customized coverage design. Similar to the overseas traveler insurance and mobile phone insurance launched last year, it refunds 10% of the paid premium to customers if no accidents occur.

The driver insurance introduced by Kakao Pay Insurance is a product that maximizes customized design like the previous two products to calculate the optimal premium. Customers can select only the coverage they need and choose an insurance period between 1 to 3 years, allowing flexible responses according to driving experience or financial situation.

For example, a novice driver who has just obtained a driver's license can subscribe to the maximum necessary coverage to prepare for the high risk of traffic accidents. Investors who want to adjust the proportion of premium expenses according to market conditions can flexibly adjust the premium level each year.

Following the Safe Return Discount Refund (overseas travel insurance) and Cherished Discount Refund (mobile phone insurance), a 'Safe Driving Discount Refund' is introduced for driver insurance. If no claims are made during the insurance period, 10% of the paid premium will be refunded at maturity.

Jang Young-geun, CEO of Kakao Pay Insurance, said, "Until now, driver insurance has been inconvenient because customers had to bear high premiums for a long insurance period with fixed plans that included unnecessary coverage. We hope everyone can receive insurance benefits at the optimal price according to their situation and respond flexibly to changing traffic laws."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.