Record High Prices Broken with Rising Illegal Activities

Investment Fraud Accounts for 73.3%, the Highest

Disappeared After Promoting Using Celebrities

Recently, as Bitcoin has been reaching all-time highs, virtual asset crimes have more than doubled in the past year. Although illegal activities decreased after virtual asset prices peaked in November 2021 and then sharply dropped, they are once again surging amid the market boom.

On the 5th, the Bitcoin price was displayed on the electronic billboard at the Upbit Customer Support Center in Gangnam-gu, Seoul.

On the 5th, the Bitcoin price was displayed on the electronic billboard at the Upbit Customer Support Center in Gangnam-gu, Seoul. [Photo by Jo Yongjun]

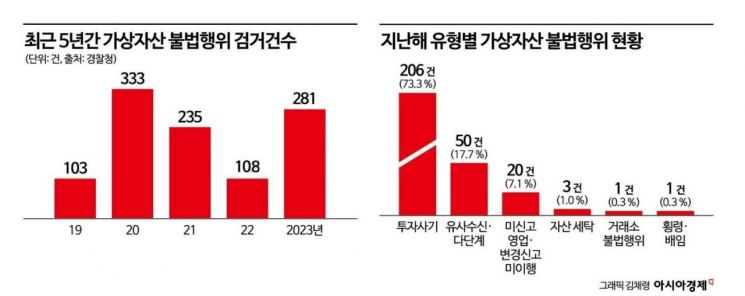

According to the National Police Agency's 'Virtual Asset Illegal Activity Arrest Status' on the 7th, there were 281 arrests and 988 individuals apprehended last year. By crime type, 'investment fraud' accounted for 206 cases (73.3%), 'fraudulent fundraising and multi-level marketing' 50 cases (17.7%), 'unregistered business operation and failure to report changes' 20 cases (7.1%), 'asset laundering' 3 cases (1%), 'illegal activities at exchanges' 1 case (0.3%), and 'embezzlement and breach of trust' 1 case (0.3%), in that order.

The number of arrests by year increased from 103 cases (289 people) in 2019 to 333 cases (560 people) in 2020, and 235 cases (862 people) in 2021. Then it decreased to 108 cases (285 people) in 2022 but has returned to an upward trend. This closely correlates with virtual asset price trends. According to Investing.com, Bitcoin reached a peak of $66,927 on October 1, 2021, hit a low of $16,320 on December 1, 2022, and then rebounded. Currently, Bitcoin prices are approaching all-time highs. Consequently, the possibility of an increase in virtual asset crimes has also grown.

Until 2022, virtual asset illegal activities were classified into three types: fraudulent fundraising and multi-level marketing, illegal activities at exchanges, and other proxy purchase frauds. However, as new crimes continue to emerge, the police have subdivided the classification and analysis to effectively respond to illegal activities. Newly added categories include embezzlement and breach of trust involving virtual asset investment funds, money laundering (violations of the Act on the Aggravated Punishment of Specific Economic Crimes and the Foreign Exchange Transactions Act), and unregistered business operations and failure to report changes (violations of the Act on Reporting and Using Specified Financial Transaction Information).

In fact, allegations of virtual asset fraud involving YouTubers, athletes, and celebrities continue unabated. The so-called 'scam coin' method is used, where investments are solicited under the pretense of creating a cryptocurrency and then the perpetrators disappear. Recently, it was revealed that a famous YouTuber, Oh King (real name Oh Byung-min), invested a large sum in the platform company 'Winners,' which is suspected of scam coin activities, sparking controversy.

'Golden Goal Coin' also attracted investors by claiming that former national soccer player Lee Cheon-su was registered as a director. Lee stated, “I heard that the Golden Goal business direction involves combining youth soccer tournaments with non-fungible tokens (NFTs). I only allowed the use of my portrait rights for the Lee Cheon-su soccer shoe NFT lottery event,” and clarified, “I have no connection with the coin.” Jo Hyun-young, a former member of the idol group 'Rainbow,' denied involvement in the 'Youth Pay Coin' scandal, stating, “I am completely unrelated” and “I did not expect it to be associated with fraud.”

Last month, the police announced a public pledge to eradicate new types of fraud crimes that infringe on people's livelihoods. In particular, they plan to establish a comprehensive response system including 'prevention → investigation → tracking and arrest' to eradicate increasingly sophisticated virtual asset financial fraud and investment leading room scams.

Yoon Hee-geun, Commissioner of the National Police Agency, said, “Enhancing prevention and response capabilities against crimes and accidents that infiltrate people's daily lives is the foundation and core of public safety. We will prioritize protecting the peaceful daily lives of citizens and focus our efforts on policing activities that resonate with the public based on this pledge.”

Starting in the second half of this year, the Virtual Asset User Protection Act will be enforced, prohibiting market manipulation, unfair trading, and the use of undisclosed important information related to virtual assets. The Financial Services Commission has announced the legislative notice for the enforcement decree of the Virtual Asset User Protection Act and the Virtual Asset Business Supervision Regulations. Violations may result in criminal penalties including imprisonment of one year or more and fines ranging from three to five times the amount of illicit gains.

If illicit gains exceed 5 billion won, the maximum sentence can be life imprisonment, and a surcharge of twice the illicit gains may be imposed. Financial authorities will supervise virtual asset operators and may take measures such as business suspension, corrective orders, prosecution, or notifying investigative agencies if violations are found.

Professor Lee Woong-hyuk of Konkuk University's Department of Police Science said, “When the virtual asset market is booming, people's interest increases, making it easier to exploit for crimes. This is because the psychology of wanting to gain more profit with a small investment comes into play. There are still blind spots in legal and institutional aspects.” He added, “A typical method is using celebrities to build trust and deceive investors. In such cases, the celebrity may have been unknowingly exploited or may have given tacit consent. Each case should be considered differently.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.