Japan's Kioxia and US WD Merger, SK Side "Opposes"

? Controversy Over Government's Alleged Persuasion for Approval

SK Hynix "Protecting Asset Value from Investor Perspective

Open to Cooperation Whenever Needed"

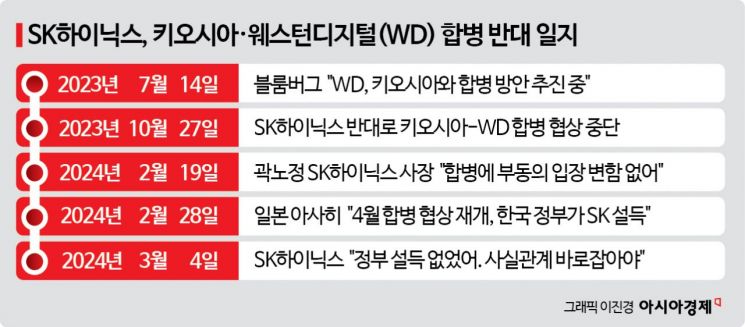

SK Hynix has belatedly denied reports from foreign media that the South Korean government tried to persuade SK Hynix to oppose the merger of Japan's Kioxia (formerly Toshiba Memory) and the U.S.'s Western Digital (WD) semiconductor divisions. This move is interpreted as a clear stance against the merger amid signs that the issue could escalate into a political controversy over 'government intervention,' especially following reports that SK Hynix proposed producing high-bandwidth memory (HBM) with Kioxia.

An SK Hynix official stated on the 5th, "As related information has recently spread even on social media (SNS), we felt the need to clarify the facts," emphasizing, "Our position remains unchanged that we will discuss with Kioxia any areas where we can cooperate while protecting our investment assets." Earlier, SK Hynix President Kwak No-jung also said, "There is no change in our position of not agreeing to the merger," adding, "We continue to maintain this stance from the perspective that we have a duty to protect asset value as an investor." However, he added, "We are always open to cooperation."

This contrasts with the non-response policy shown immediately after Japanese media reports surfaced late last month. The Asahi Shimbun, citing sources from SK Hynix and the Korea-U.S.-Japan consortium, reported late last month that "Kioxia and WD plan to resume semiconductor division merger negotiations in April, which had been halted last October due to SK Hynix's opposition." The newspaper added, "Then-Japanese Minister of Economy, Trade and Industry Yasutoshi Nishimura, U.S. Commerce Secretary Gina Raimondo, and the South Korean government tried to persuade SK, but SK did not agree." This was interpreted as the South Korean government deliberately intervening in the negotiation process to pressure SK, sparking widespread controversy. As the issue showed signs of becoming a political topic ahead of next month's general elections, SK Hynix officially stated belatedly that "this is not true."

SK Hynix made an indirect investment of about 4 trillion won in Kioxia in 2018. Kioxia needs SK Hynix's consent to merge with WD. The Japanese government, having recently decided to invest heavily in semiconductor development, is reportedly supporting the merger of Kioxia and WD as a symbol of U.S.-Japan cooperation. Securing SK Hynix's consent has thus become an urgent task.

Some are focusing on 'HBM cooperation' as another background to SK Hynix's delayed response. According to foreign media reports such as Jiji Press the previous day, SK Hynix recently proposed jointly producing HBM with Kioxia. Jiji Press analyzed, "SK seems to be aiming to quickly establish an expanded production system by utilizing Kioxia's factories in Yokkaichi and Kitakami."

If SK Hynix partners with Kioxia, it can further solidify its leading position in the HBM market. SK Hynix practically monopolizes HBM3 used in Nvidia's artificial intelligence (AI) accelerators and shares about half of the market with Samsung Electronics.

SK Hynix maintains that this cooperation proposal is separate from the merger. However, if Kioxia and WD merge, production cooperation is likely to fail because the enlarged Kioxia would have no reason to accept SK Hynix's cooperation proposal. Kioxia ranked 4th in the NAND flash memory market with a 14.5% share as of the third quarter last year, but merging with 3rd-ranked WD (16.9%) would put it ahead of 2nd-ranked SK Hynix (20.2%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["I'd Rather Live as a Glamorous Fake Than as a Poor Real Me"...A Grotesque Success Story Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)