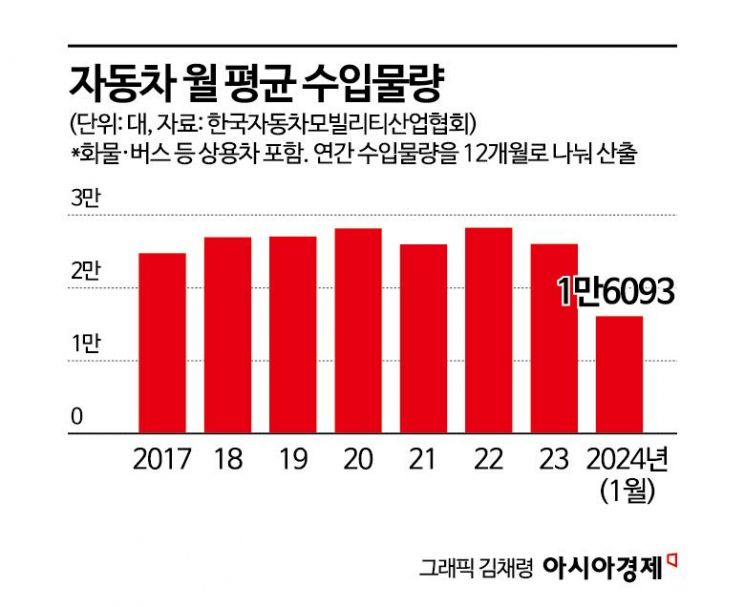

January Car Imports Reach 16,093 Units

Domestic Car Competitiveness Rises and Electric Vehicle Demand Increases

High-Priced Imported Cars Lose Popularity

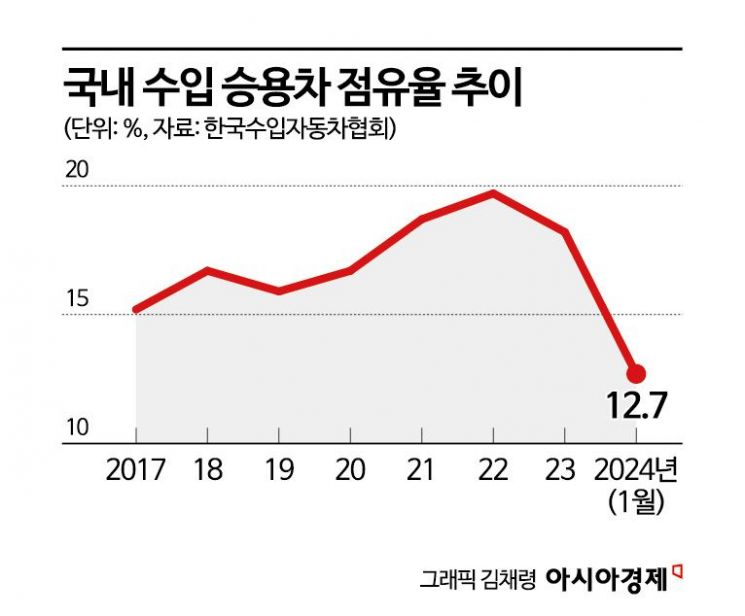

Domestic Market Share at 12.7%... Lowest Since 2016

Last month, the number of imported cars brought into South Korea dropped to the lowest level since 2017. Imported cars once entered the domestic market at over 30,000 units per month, rapidly increasing their market share in the domestic finished car market, but recently they have shown a stagnation. As the competitiveness of domestic cars improves and demand for electric vehicles rises, relatively expensive imported cars seem to be taking a bigger hit.

According to monthly statistical data released by the Korea Automobile Mobility Industry Association on the 28th, the number of imported cars brought into the country last month was recorded at 16,093 units. This was the lowest monthly import volume in seven years since January 2017, when 15,440 units were imported.

This figure is based on customs clearance data from the Korea Customs Service and can be used to estimate future imported car sales. Considering that imported cars are usually delivered to consumers with a delay of one or two months after entering the country, the sales volume of imported cars this month and next month is also expected to decrease compared to the past.

The market share of imported cars in the domestic market also appears to be declining. According to the Korea Imported Automobile Association, the market share of imported cars as of January this year was 12.7%, the lowest since December 2016, when it was 12.4%. Although electric vehicle subsidies have been applied relatively more to domestic cars, the analysis that imported cars are not as popular as before is gaining credibility.

The decline in preference for imported cars is related to the decrease in consumer purchasing power due to high interest rates and other factors. Additionally, the improved product quality of domestic cars has had an impact. In particular, recently, when purchasing a car, aspects related to the vehicle's infotainment system and user experience (UX) have become major factors in choice, leading more consumers to turn to domestic cars. Furthermore, the Korean won has remained weak for several years, which is also believed to have negatively affected the overall financial performance of the imported car industry.

According to statistics from the Korea Imported Automobile Association, the sales volume of imported cars in South Korea has steadily grown every year since the market began to expand in 2000. Sales declined for the first time in 2019 but then recovered, peaking at over 280,000 units sold in 2022. Last year, 271,034 units were sold, about 4% less than the previous year.

The market share of imported cars in the domestic passenger car market first exceeded 10% in 2012 and reached its highest level of 19.7% in 2022, but has been declining since then. Last year, it stalled at 18.2%. The imported car industry agrees that the business environment has become challenging since the second half of last year. Most brands, including top-selling brands like BMW and Mercedes-Benz, saw their sales decline compared to the previous year.

An industry insider said, "Most of the accumulated waiting demand was resolved last year, and with high interest rates, it is not easy to sell cars."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)