March Business Outlook Index 81.8, Up 6.4P from Previous Month

Rebound After 5 Consecutive Months of Decline

Manufacturing Production and Employment Deteriorated Over 3 Years

Domestic small and medium-sized enterprises (SMEs) forecast that the economy will improve in March compared to February.

The Korea Federation of SMEs announced the results of the "March 2024 SME Business Outlook Survey" on the 28th. The survey was conducted from the 13th to the 20th of this month, targeting 3,074 SMEs.

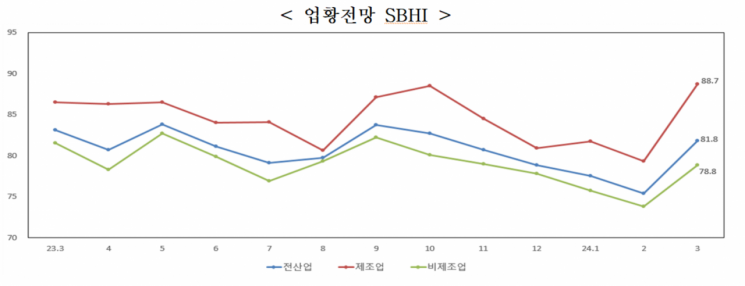

The Business Outlook Index (SBHI) for March showed a rebound to 81.8 after five consecutive months of decline since September last year (83.7). Compared to the same month last year, it decreased by 1.3 points. The SBHI is displayed above 100 when the number of companies expecting better business conditions next month exceeds those expecting worse conditions, and below 100 in the opposite case.

The March business outlook for manufacturing rose 9.4 points from the previous month to 88.7, while non-manufacturing increased by 5.0 points to 78.8. Construction (73.2) rose 1.5 points from the previous month, and services (80.0) increased by 5.8 points.

By industry, in manufacturing, 18 sectors showed month-on-month increases centered on rubber and plastic products (69.8→86.3), metal processing products (68.1→84.4), other machinery and equipment (80.1→96.1), and non-metallic mineral products (68.1→80.5). Conversely, five sectors including primary metals (88.1→84.4), furniture (78.7→76.3), and paper and paper products (81.7→80.6) declined compared to the previous month.

In non-manufacturing, construction (71.7→73.2) rose 1.5 points month-on-month, and services (74.2→80.0) increased by 5.8 points.

Within services, seven sectors including arts, sports, and leisure-related services (70.5→82.3), publishing, video, broadcasting, telecommunications, and information services (82.2→89.8), and wholesale and retail trade (70.9→78.2) showed increases. However, three sectors including transportation (83.7→80.3) and education services (88.9→86.4) declined.

Looking at the outlook by item across all industries, domestic sales (74.7→81.4), exports (76.3→84.2), operating profit (72.4→79.5), and financial conditions (76.2→78.9) all rose compared to the previous month. Employment level (95.0→94.9), which is a counter-trend indicator, is also expected to slightly improve month-on-month.

Comparing the March 2024 SBHI with the average SBHI for the same month over the past three years, manufacturing showed deterioration in production and employment, while inventory remained stable. Other items are expected to improve compared to the previous three-year average. In non-manufacturing, export outlook worsened, but other items are expected to improve compared to the previous three-year average.

In February, the biggest management difficulty for SMEs was sluggish domestic demand (61.6%), followed by rising labor costs (47.1%), excessive competition among companies (34.8%), and rising raw material prices (33.1%).

Regarding management difficulties, the response rates for excessive competition among companies (33.4→34.8), rising labor costs (46.2→47.1), high interest rates (25.8→26.0), and rising raw material prices (29.6→33.1) increased compared to the previous month. The response rates for sluggish domestic demand (62.0→61.6) and delayed sales payment collection (19.2→18.5) decreased compared to the previous month.

The average operating rate of small and medium-sized manufacturing enterprises in January 2024 was 72.1%, down 0.3 percentage points from the previous month and up 1.6 percentage points from the same month last year. By company size, small enterprises (68.6%→68.4%) decreased by 0.2 percentage points month-on-month, and medium enterprises (76.6%→76.1%) decreased by 0.5 percentage points. By company type, general manufacturing (71.2%) remained flat month-on-month, while innovative manufacturing (75.7%→74.4%) declined by 1.3 percentage points compared to the previous month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)