Coupang Surpasses 30 Trillion KRW in Sales Last Year... Largest Revenue in Retail Industry

Closely Chasing Shinsegae Group's Total Sales

Fierce Competition Ahead... "Many Obstacles to Overcome"

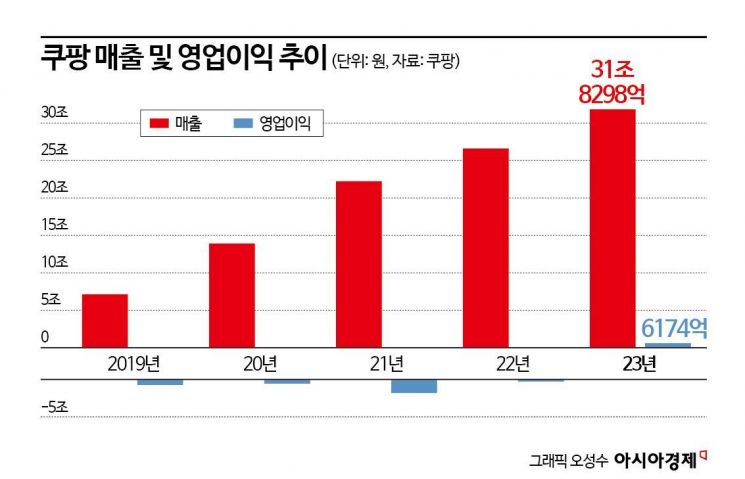

Coupang recorded an operating profit of over 600 billion KRW last year, achieving an annual surplus for the first time since its founding. Last year's sales exceeded 30 trillion KRW, marking external growth, and net profit also surpassed 600 billion KRW annually. The number of paid members of the ‘Wow Membership’ exceeded 14 million, and Coupang's performance improvement trend is expected to continue for the time being.

On the 28th, Coupang announced in its Q4 earnings report that its annual operating profit last year was $473 million (approximately 617.4 billion KRW). With this, Coupang achieved its first-ever annual surplus since its establishment in 2010. During the same period, sales amounted to $24.383 billion (approximately 31.8298 trillion KRW), a 20% increase compared to the previous year. This is the first time Coupang's sales have exceeded 30 trillion KRW.

Coupang achieved an operating profit of over 600 billion won last year, marking its first annual profit in 14 years since its founding in 2010. The photo shows Coupang headquarters in Songpa-gu, Seoul, on the 28th. Photo by Jinhyung Kang aymsdream@

Coupang achieved an operating profit of over 600 billion won last year, marking its first annual profit in 14 years since its founding in 2010. The photo shows Coupang headquarters in Songpa-gu, Seoul, on the 28th. Photo by Jinhyung Kang aymsdream@

In Q4 last year, Coupang also recorded its highest quarterly sales. Coupang's Q4 sales last year were $6.561 billion (approximately 8.6555 trillion KRW), growing about 20% year-on-year. Operating profit during the same period was $130 million (approximately 171.5 billion KRW), a 51% increase compared to the same period last year. Coupang recorded its first quarterly operating profit (103.7 billion KRW) in Q3 2022 and succeeded in achieving its first annual surplus last year.

Coupang's adjusted net profit last year was $465 million (approximately 607 billion KRW). The adjusted net profit for Q4 last year was $137 million (approximately 180.7 billion KRW), similar to the operating profit figures for each period. However, Coupang explained in the report, "The accounting-reported net profit was $1 billion for Q4 and $1.36 billion for the year, but this includes a one-time adjustment of $895 million due to deferred tax asset recognition, which is not actual cash inflow." Reflecting this, the net profit for Q4 and the full year last year were $137 million and $465 million, respectively.

Sales in growth business sectors such as Coupang Eats, Coupang Play, and the Taiwan market in Q4 last year reached $273 million (approximately 360.1 billion KRW), doubling compared to the same period last year. This growth is attributed to the expansion of Rocket Delivery in the Taiwan market and the growth of Coupang Eats domestically.

Looking at Coupang's sales by business sector last year, product commerce sectors including Rocket Delivery, Rocket Fresh, Rocket Growth, and Marketplace recorded sales of $23.594 billion (approximately 30.7998 trillion KRW), a 19% increase from the previous year. Growth business sectors such as Coupang Eats, Taiwan, Coupang Play, and Coupang Pay recorded sales of $789 million (1.0299 trillion KRW), a 27% increase compared to the previous year.

So far, Coupang has stated that its accumulated losses are ‘planned losses’ for expanding logistics centers. Coupang has made large-scale investments to build its own logistics network, represented by ‘Rocket Delivery.’ In fact, the total operating losses from 2018 to 2022 amount to about 4 trillion KRW. However, the scale of operating losses sharply decreased from $1.49396 billion (approximately 1.7097 trillion KRW) in 2021 to $112 million (approximately 144.7 billion KRW) in 2022.

One in Four South Koreans Is a Coupang ‘Wow’ Member

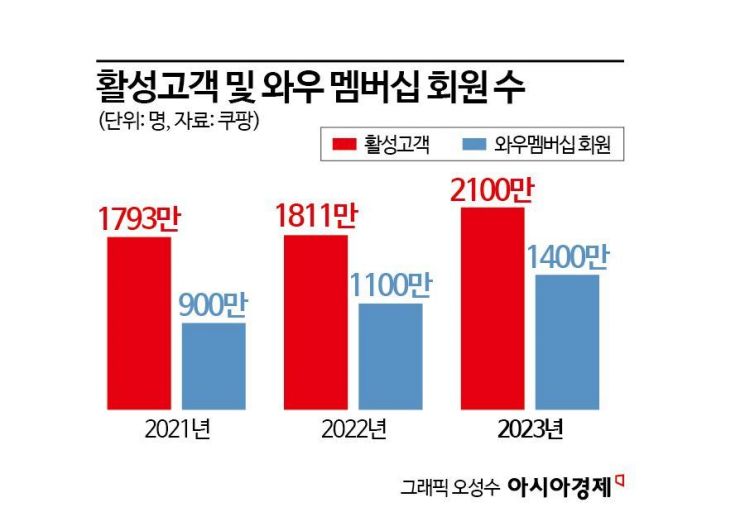

The number of customers using Coupang is steadily increasing. At the end of last year, Coupang's active customers were counted at 21 million, a 16% increase compared to 18.115 million in the same period the previous year. Active customers refer to the number of customers who purchased a product at least once in a quarter.

Customer growth rates have been sprinting every quarter. Quarterly customer growth rates last year were 5% in Q1, 10% in Q2, 14% in Q3, and 16% in Q4. The total active customers increased by about 600,000 from 20.42 million in the previous quarter. Sales per customer were 411,600 KRW (312 USD) in Q4 last year, a 3% increase compared to the same period last year.

The number of paid members of Coupang’s ‘Wow Membership’ was about 14 million at the end of last year, a 27% increase compared to 11 million at the end of 2022. Coupang offers Wow Membership members benefits such as dawn delivery, free returns, and the online video streaming service (OTT) Coupang Play.

Kim Beom-seok, Coupang’s founder, said, "Last year, we provided Wow members with record benefits and cost savings worth $3 billion (approximately 3.9162 trillion KRW)." He added, "More customers are discovering unprecedented value offered by Coupang, including exclusive discounts on Coupang products, Coupang Eats, dawn delivery, and Coupang Play streaming service." He continued, "The growth in Coupang’s sales, active customers, and Wow members reflects our relentless efforts to deliver ‘Wow’ to customers through diverse product selections, prices, and services. We are committed to providing even higher levels of cost savings and value to Wow Membership."

Gaurav Anand, Coupang’s Chief Financial Officer (CFO), said, "Our market share in South Korea, where massive retail spending occurs, is only in the single digits, and Taiwan is even smaller," but added, "We are more optimistic than ever about the opportunities to continue satisfying customers and creating long-term shareholder value in 2024."

Coupang Dominates Domestic Distribution Market... The Rise of Chinese Direct Purchase Apps ‘Ali’ and ‘Temu’ Is a Challenge

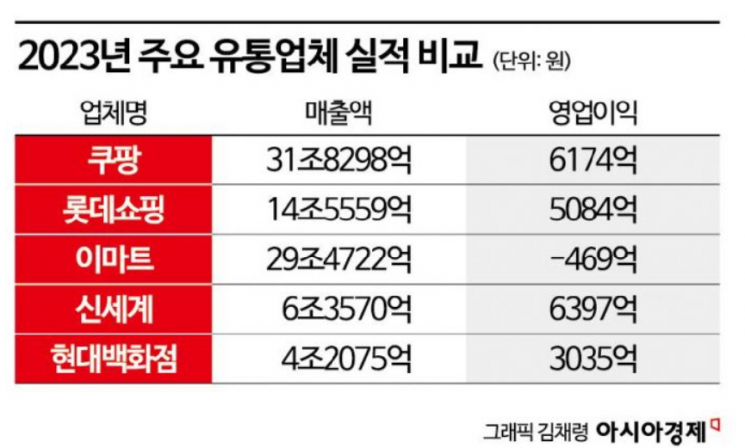

Coupang recorded sales exceeding 30 trillion KRW last year, becoming the number one in the domestic distribution industry. Following its first-place ranking in the 2022 e-commerce market, last year it achieved the highest sales in the combined domestic online and offline distribution market.

Emart, the previous number one in the distribution industry, recorded sales of 29.4722 trillion KRW last year, yielding the throne to Coupang. The combined sales of Emart and Shinsegae Department Store (35.8292 trillion KRW) are closing in. Additionally, Coupang ranked second in operating profit, following Shinsegae (639.7 billion KRW). Considering Emart’s operating loss of 46.9 billion KRW last year, Coupang surpassed Shinsegae Group’s operating profit (592.8 billion KRW).

Naver, the biggest competitor in the domestic e-commerce market, recorded a transaction volume of 47.8 trillion KRW in commerce last year, but its sales were 2.5 trillion KRW. Since Naver operates an open market, the commission fees from sellers are recorded as sales. According to the Korea Fair Trade Commission, Coupang held a 24.5% market share in the domestic e-commerce market in 2022, ranking first, followed by Naver Shopping (23.3%) and SSG.com (10%).

However, the competition in the distribution industry is expected to intensify as Chinese direct purchase applications such as AliExpress and Temu have recently strengthened their domestic market presence. According to app and retail analysis service WiseApp, the number of AliExpress app users reached 7.175 million last month, a 113% increase from 3.364 million in January last year. Temu app users also surged from 520,000 in August last year to 5.709 million last month, more than a tenfold increase. Such user growth is rare among domestic e-commerce companies.

Traditional distribution giants are preparing countermeasures. Lotte Shopping, Shinsegae, and Emart are undergoing major management reforms. Emart liquidated the film production company ‘Electroman’ in September last year and consolidated the pet specialty store ‘Molly’s’ as part of business restructuring. They are also strengthening offline stores such as Suwon Starfield and Gwangju complex shopping mall, which attracted over 1.8 million visitors in a month, and exploring various survival strategies including a ‘lowest price strategy.’

The ongoing discussion about lifting mandatory weekday closures for large marts is also a variable. If large marts start dawn delivery, competition with Coupang, which has grown through fresh food delivery, is expected to intensify. An industry insider said, "The distribution industry is currently in a survival competition regardless of online or offline channels. Since it is difficult for an ‘absolute number one player’ with over 50% market share to emerge in the distribution market, rankings can change anytime, making competition even fiercer."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)