High Organizational Understanding and Talent Directly Developed by the Group

Must Lead Daegu Bank's Transition to a Commercial Bank Upon Appointment

Increasingly Tough Competition Makes the Path Challenging

Hwang Byung-woo, the current CEO of DGB Daegu Bank, has been nominated as the next chairman of DGB Financial Group. He is considered the right candidate at a time when organizational stabilization is needed, having been directly nurtured by DGB Financial Group. Since his inauguration in March, he faces the task of advancing the group into a commercial bank holding company.

On the 26th, the DGB Financial Group Chairman Candidate Recommendation Committee announced that it had selected CEO Hwang as the next chairman candidate. The committee listened to business plans and vision presentations from the three final candidates, including Hwang, former Woori Bank CEO Kim Kwang-seok, and former KB Financial Group President Kim Ok-chan, and selected the final candidate after a meeting on the same day. Hwang is expected to be appointed chairman at the shareholders' meeting scheduled for next month.

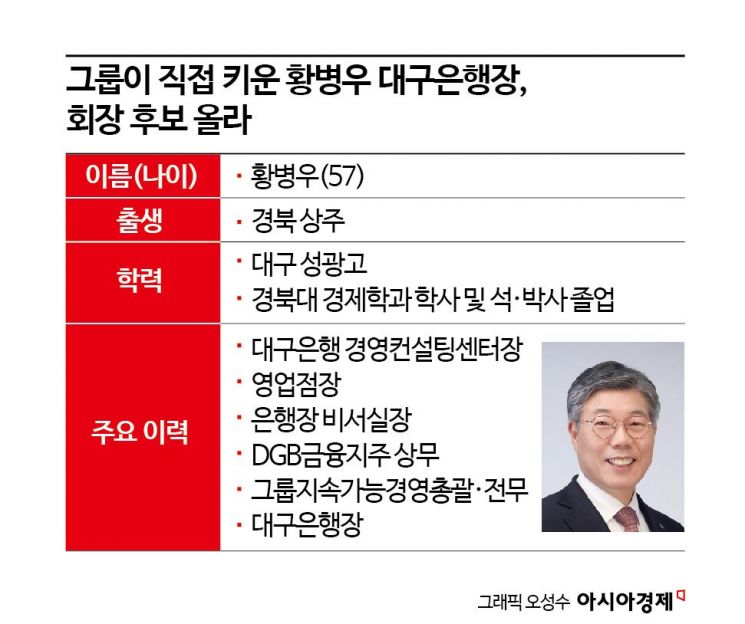

The reason CEO Hwang was nominated as chairman of DGB Financial Group is that he has a high level of understanding of the organization and can demonstrate stable leadership. Hwang is from Daegu and Gyeongbuk, where DGB Financial Group is rooted, and he led Daegu Bank, a regional bank, well by understanding the regional characteristics. Born in 1967 in Sangju, Gyeongbuk, he graduated from Daegu Sungkwang High School and earned a bachelor's degree in economics from Kyungpook National University, followed by master's and doctoral degrees from the same university's graduate school. Since joining the bank in 1995, he prepared management solutions for over 300 local companies and organizations during his tenure as head of Daegu Bank's Management Consulting Center in 2012. After becoming an executive such as managing director of DGB Financial Group, he oversaw group M&A, acquiring Hi Investment Partners and New Stock, thereby enhancing DGB Financial's competitiveness in the non-banking sector.

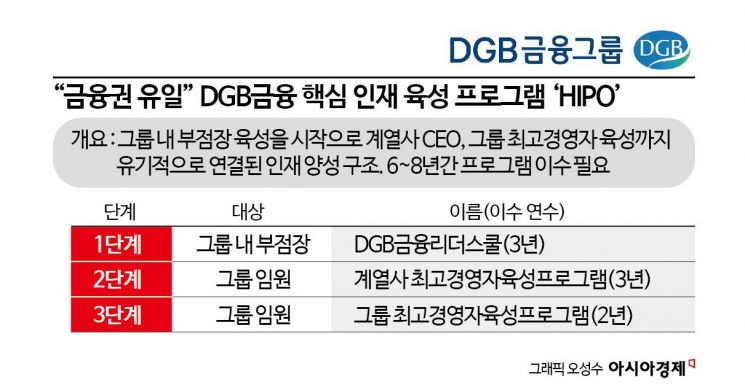

He is also considered suitable because he is a talent directly nurtured by the holding company. CEO Hwang completed the only CEO development program in the financial sector designed by the current DGB Financial Group Chairman Kim Tae-oh and was appointed CEO of Daegu Bank. Specifically, to become the group CEO, he went through the ‘HIPO’ program, a core talent development program within the group, for 6 to 8 years. The group has established programs to nurture talents required by type. The first stage is completing the DGB Financial Leaders School for branch managers within the group for three years. He also completed the ‘Affiliate CEO Development Program’ for executives for three years. After this process, he completed the ‘Group CEO Development Program,’ which is a higher-level CEO development program.

CEO Hwang went through 16 detailed programs linked with external professional institutions over two years, received the highest evaluation, and was promoted to CEO of Daegu Bank. The recommendation committee evaluated CEO Hwang as “a highly suitable candidate with a deep understanding of the group, who presented feasible visions and strategies based on excellent insight, possesses outstanding management capabilities, and is capable of successfully completing the transition to a commercial bank holding company, leading DGB Financial Group’s new future and sustainable growth.”

Upon his inauguration in March, CEO Hwang must successfully lead Daegu Bank’s transition to a commercial bank. This is because he must overcome the ‘size gap’ in net profit and branch network compared to the five major commercial banks. Last year, Daegu Bank’s net profit was 363.9 billion KRW, about 20% of NH Nonghyup Bank’s 1.7805 trillion KRW, which had the lowest net profit among the five major commercial banks.

Regarding branches, after the transition to a commercial bank, Daegu Bank must add regions such as Chungcheong, Gangwon, and Jeolla, which were not previously designated as business areas. In Chungcheong, where Daegu Bank is expected to enter first, Shinhan Bank has the most branches with 43, followed by Hana Bank and Kookmin Bank with 35 and 34 branches, respectively. Although it is expected that Daegu Bank will be able to raise funds at prices as low as commercial banks, the difference is already small. Regional banks pay about 0.25 percentage points higher interest rates than commercial banks when issuing bonds due to the ‘regional bank discount,’ even with the same credit rating. However, since this month, the difference is reported to be only 0.015 percentage points.

The increasing number of competitors such as internet banks is also a challenge. Kakao Bank, the number one internet bank, recorded a net profit of 354.9 billion KRW last year, growing to a level only 9 billion KRW behind Daegu Bank. Consortia preparing to launch the fourth internet bank (U Bank, Soso Bank Establishment Preparation Committee, KCD Bank) are also emerging rapidly.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)