Possible Further Rise in Japanese Stock Market Due to Yen Depreciation and Corporate Value Enhancement

AI and Healthcare Companies Perform Well, Boosting European Stocks

Pedestrians are passing in front of the stock market status board in downtown Tokyo, Japan.

Pedestrians are passing in front of the stock market status board in downtown Tokyo, Japan. [Image source=Yonhap News]

As major advanced countries' stock markets, including Japan and Europe, continue to hit record highs day after day, market interest in how long this upward trend will last is growing. Experts believe that with improved investment conditions, the stock market rises in Japan and Europe could continue for some time.

In Japan's case, the stock market is expected to maintain its additional strength thanks to improved exports of major companies and the long-lasting weak yen phenomenon. The Japanese government's efforts to enhance corporate value also support the outlook for a strong Japanese stock market. Although there are concerns about a stock market bubble in Europe, it is expected that the upward trend can continue, centered on advanced companies in IT and healthcare sectors.

Outlook for Strong Japanese Stock Market Due to Weak Yen and Corporate Value Enhancement Policies

The Nikkei 225 average price (Nikkei Index) recorded an all-time high of 39,233 yen at the close on the 26th. It also showed an upward trend in early trading on the 27th. The Nikkei Index had been in a long-term slump following the bubble burst after recording its previous highest level of 38,916 yen on December 29, 1989. However, it has made a spectacular comeback this year, hitting new highs day after day.

Experts expect the weak yen phenomenon, which is likely to continue for a considerable period, the revitalization of the tourism industry, and corporate value enhancement policies to drive further gains in the Japanese stock market.

The Korea Center for International Finance forecasts that the current weak yen trend will persist for the time being. This is because Japan's base interest rate hikes are not expected to be faster than anticipated. The U.S. is increasingly delaying the timing of its expected interest rate cuts. Kim Sun-kyung, a senior researcher at the Korea Center for International Finance, stated, "As the strong dollar phase is maintained more strongly than initially expected and the Bank of Japan's monetary policy shift is expected to proceed gradually, the yen's appreciation in the future may not be as significant as anticipated."

The weak yen is analyzed as a positive factor for the Japanese economy and stock market. Hi Investment & Securities evaluated that the high likelihood of the weak yen phenomenon continuing for some time will have a positive impact on Japan's economy and stock market.

The effects of the weak yen are being confirmed in various areas. First, the number of tourists visiting Japan has surged. Last year, foreign visitor spending in Japan reached a record high of 5.3 trillion yen, driven by the recovery in the number of foreign visitors and an increase in per capita spending. This surpassed the 4.8 trillion yen travel expenditure recorded in 2019, when the number of foreign visitors to Japan was at its peak. Tourism also played a significant role in Japan's relatively high economic growth last year.

Park Sang-hyun, a researcher at Hi Investment & Securities, emphasized, "If the super weak yen effect continues for the time being and the tourism industry remains active, it is clear that there will be a positive impact on the domestic demand sector."

The weak yen also greatly benefits Japanese companies' exports. Toyota Motor recently raised its operating profit forecast for this year from 4.5 trillion yen to 4.9 trillion yen, an increase of 400 billion yen, of which 235 billion yen is analyzed as the exchange rate effect due to the weak yen.

The Japanese government's ongoing efforts to enhance corporate value are also positive. The Japan Exchange Group strongly requested companies with a price-to-book ratio (PBR) below 1 last year to disclose management improvement plans and to improve capital profitability through share buybacks or dividend increases. Since this year, the exchange has been publishing monthly lists of companies that have documented their corporate value enhancement efforts in corporate governance reports. The recent large influx of foreign investors into the Japanese stock market is also seen as part of the government's corporate value enhancement efforts.

Yoo Seung-min, head of the Global Investment Strategy Team at Samsung Securities, stated, "The Japanese government's specific demands for corporate value enhancement have become a trigger for stock market revaluation. In particular, policies targeting low PBR stocks have improved the overall PBR of the Japanese stock market."

Strong AI and Healthcare Stocks in European Stock Market

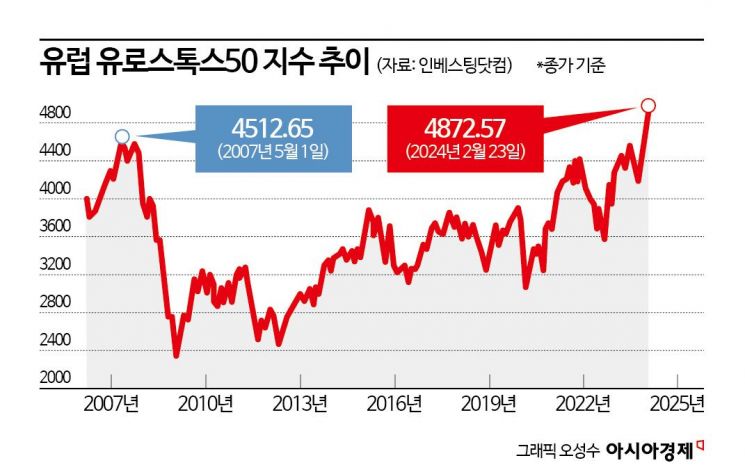

The European stock market is also expected to continue its upward trend. Like other advanced countries' stock markets such as the U.S. and Japan, the European stock market is hitting new highs.

The European stock market is being led by semiconductor companies such as ASML and BESI, buoyed by expectations for AI industry activation, while advanced healthcare companies like Novo Nordisk, a leader in the obesity treatment market, have also seen their stock prices rise.

Oh Han-bi, a researcher at Shinhan Investment Corp., analyzed, "With the continued rise in stock prices of major European companies in healthcare and semiconductors, along with the ongoing downward stabilization of inflation and slowing consumption, conditions are closer to interest rate cuts than in the U.S., which is a factor supporting the extension of the upward trend in the European stock market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.