11 Companies Struggling to Secure Funds Issue Private Bonds at 4-6%

Including AJ Networks, Eugene Corporation, Ido, and Others Eligible for Support

As polarization in the bond market deepens due to the insolvency of real estate project financing (PF), companies struggling to raise funds independently secured 280 billion KRW in financing with government support. Large corporations such as Daewoo Construction and SGC Energy, as well as mid-sized companies like Yujin Enterprise and AJ Networks, issued privately placed corporate bonds guaranteed by the Korea Credit Guarantee Fund (KODIT) to secure liquidity.

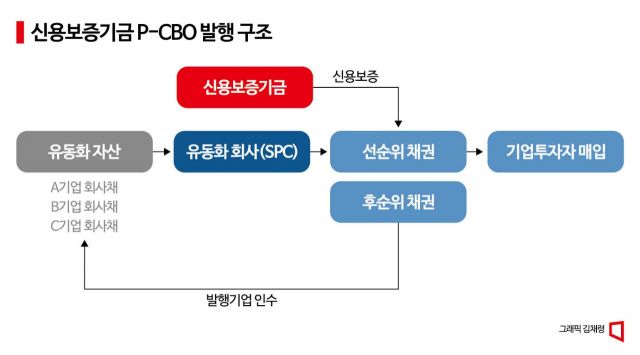

According to the investment banking (IB) industry on the 27th, 11 large and mid-sized companies issued a total of 280 billion KRW worth of private bonds with KODIT support on the same day. KODIT acquired all the private bonds issued by these companies through a special purpose company (SPC). Then, by providing guarantees to the SPC, credit enhancement was made, and primary collateralized bond obligations (P-CBOs) were issued to institutional investors. Senior CBOs are sold to institutional investors, while subordinated CBOs are divided and acquired by the bond-issuing companies. When these companies repay the principal and interest of the private bonds, senior CBO investors are repaid first.

The KODIT support recipients included large corporations such as Daewoo Construction and SGC Energy. Daewoo Construction, backed by KODIT support, issued 40 billion KRW in private bonds at an interest rate in the 5% range. Although its credit rating is A and not bad, market evaluations vary due to concerns over construction insolvency. A Daewoo Construction official stated, "In a situation where market interest rates are high, we diversified our funding sources by supporting P-CBOs that allow us to raise funds at relatively low interest rates."

SGC Energy (credit rating A) also issued 50 billion KRW in private bonds at an interest rate in the mid-5% range. As an energy company affiliated with SGC E-Tech Construction, it faced difficulties securing liquidity due to concerns over construction insolvency. Recently, it raised 220 billion KRW through Meritz Securities and others, and with KODIT support, liquidity conditions are easing.

An IB industry insider said, "If these companies tried to issue corporate bonds based on their own credit, it would be difficult to find investment demand, and even if bond investors were found, they would have to pay high interest rates close to 10%. Through P-CBOs, they can now issue bonds at lower interest rates compared to the current market situation."

Among mid-sized companies, AJ Networks (BBB+), Yujin Enterprise (BBB), Ido (BB), Shinsung Tongsang (BBB), Daebo Distribution (BBB), and KR Industry (BBB-) were included in the KODIT support recipients. In particular, AJ Networks and Yujin Enterprise were able to raise funds ranging from 18 billion KRW to 30 billion KRW per company at low interest rates in the 4% range. Korea Investment & Securities, Hi Investment & Securities, Woori Investment & Securities, and Korea Asset Securities participated as private bond underwriters in this CBO issuance.

As polarization in the funding market intensifies due to concerns over PF insolvency, the number of low-credit companies seeking KODIT support is increasing, but since resources are limited, competition is also intensifying. A bond market official said, "Companies that find it almost impossible to issue bonds in the market are borrowing funds for refinancing or operating capital with government support, but KODIT's guarantee capacity is not sufficient."

Meanwhile, KODIT set the total amount of general guarantees this year at 61.8 trillion KRW and the total amount of securitization company guarantees at 13.9 trillion KRW, increasing the total guarantee amount by 4.7 trillion KRW from last year to 86.3 trillion KRW. In particular, it plans to concentrate about 57 trillion KRW in guarantees on government priority policy sectors, including export and new growth engine companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.