Samsung Financial's Net Profit Last Year 4.8743 Trillion KRW Surpasses KB Financial

Meritz Financial Joins '2 Trillion Club' for the First Time

Non-Life Insurers' Progress... Life and Non-Life Insurance Competition Intensifies with IFRS17 Adoption

Insurance family financial groups are threatening banking family financial groups. The combined net income of Samsung Financial Networks, including Samsung Life Insurance, Samsung Fire & Marine Insurance, Samsung Card, and Samsung Securities, nearly reached 5 trillion won last year, surpassing KB Financial Group, the top financial holding company. Meritz Financial Group joined the '2 trillion won club' in net income for the first time in history.

Insurance Families Threatening Banking Families

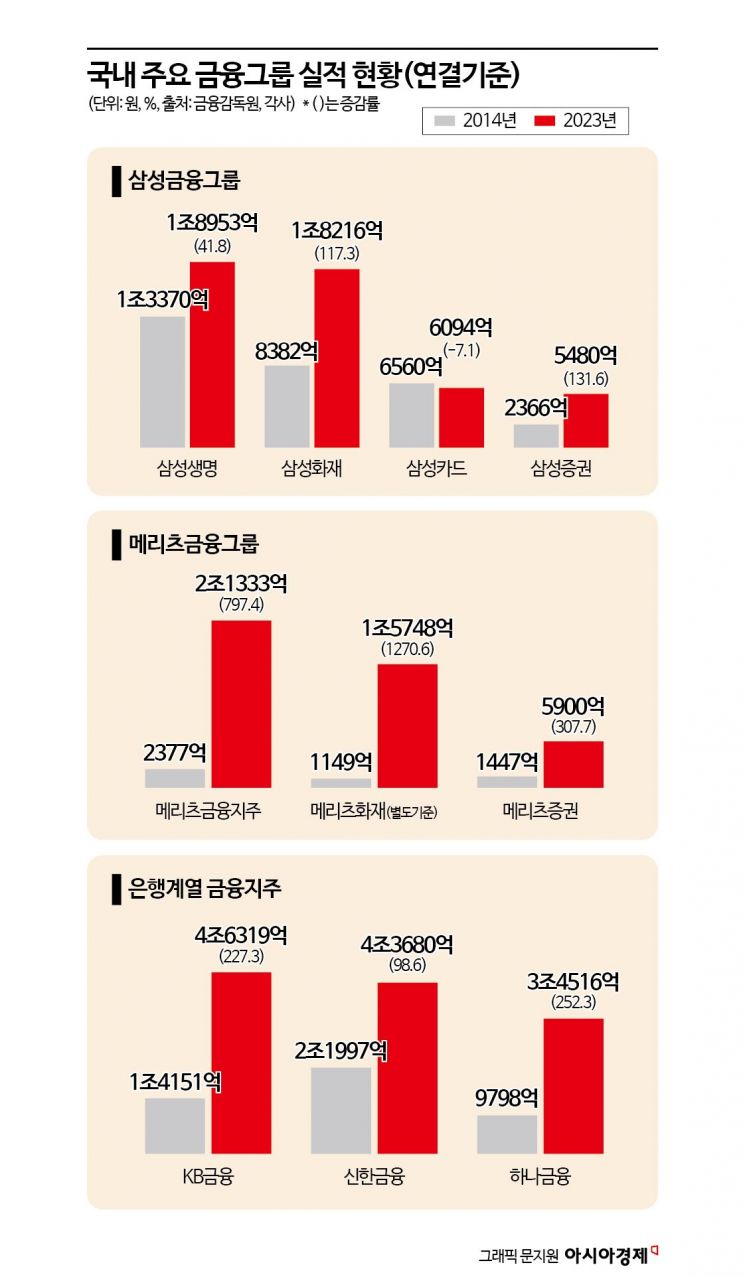

According to the financial industry on the 26th, the combined net income of the four affiliates under Samsung Financial last year was 4.8743 trillion won. Compared to 2014 (3.0678 trillion won), when insurance companies changed their fiscal year-end to December, this represents a 58.9% increase.

Samsung Financial's net income last year even surpassed KB Financial (4.6319 trillion won). It is the first time in seven years since 2016 that Samsung Financial's net income has outpaced leading financial holding companies such as KB and Shinhan. However, the consolidated net income of holding companies is calculated by summing the net income of all subsidiaries controlled by the holding company and excluding double counting from internal transactions. Since Samsung Financial is not a holding company, this consideration does not apply. Samsung Life Insurance holds 71.9% of Samsung Card and 29.4% of Samsung Securities.

Last year, the eldest sibling Samsung Life Insurance led with a net income of 1.8953 trillion won, a 19.7% increase from the previous year. Despite declining demand for whole life insurance due to low birth rates and aging population, it maintained its top industry position by diversifying third insurance products such as health insurance. Samsung Fire & Marine Insurance recorded a net income of 1.8216 trillion won, up 12%. Samsung Card earned 609.4 billion won, down 2.1%, and Samsung Securities earned 548 billion won, up 29.7% in net income.

Meritz Financial posted a net income of 2.1333 trillion won last year, entering the '2 trillion won club' for the first time in history. It closely followed NH Nonghyup Financial Group, the 5th largest banking-affiliated holding company, which posted 2.2343 trillion won. Meritz Financial's growth trend is outstanding recently. Compared to 2014 (237.7 billion won), net income increased by 797.4%. Meritz Fire & Marine Insurance's separate net income last year was 1.5748 trillion won, up 25.2% from the previous year, while Meritz Securities' net income was 424.2 billion won, down 44.8%.

Non-life Insurers Driving Insurance Family Performance

The performance growth of Samsung and Meritz Financial was led by insurance companies. Among them, non-life insurers have played a solid supporting role over the past decade. Unlike life insurers, which are directly impacted by low birth rates and aging populations, non-life insurers have expanded by developing insurance products for new 'risks' brought about by climate crisis, artificial intelligence (AI), and new industries.

Samsung Fire & Marine Insurance's net income increased from 838.2 billion won in 2014 to 1.8216 trillion won in 2023, a 117.3% increase over nine years. During the same period, Samsung Life Insurance grew by 41.8%, making Samsung Fire & Marine's growth 2.8 times greater.

Samsung Fire & Marine Insurance's pre-tax profit last year reached 2.4446 trillion won, surpassing 2 trillion won for the first time since its founding. Insurance profit within the pre-tax profit was 2.0101 trillion won, up 18.6% from the previous year, and investment profit reached 418.8 billion won. The insurance profit from the industry's top automobile insurance was 189.9 billion won, up 14.8% year-on-year. General insurance's insurance profit was 204.2 billion won, growing 112.3% from the previous year. A Samsung Fire & Marine Insurance official explained, "Insurance revenue increased due to expansion of special and marine insurance and growth in overseas business," adding, "The decrease in high-cost accidents lowered the loss ratio, which also contributed to the growth of general insurance."

Meritz Financial's performance is also driven by its non-life insurer Meritz Fire & Marine Insurance. Meritz Fire & Marine Insurance's separate net income increased from 114.9 billion won in 2014 to 1.5748 trillion won in 2023, a 1270.6% increase. Compared to Meritz Securities' growth from 144.7 billion won to 590 billion won (307.7%) during the same period, Meritz Fire & Marine Insurance grew 4.1 times more.

Meritz Fire & Marine Insurance's rapid growth was triggered when Kim Yong-beom, Vice Chairman of Meritz Financial Group, took office as CEO in 2015 and focused on 'performance-based' and 'value-centered' management. Kim transformed Meritz Fire & Marine Insurance's structure over nine years and handed over the baton to CEO Kim Jung-hyun at the end of last year. A Meritz Fire & Marine Insurance official said, "Under Kim Yong-beom's leadership, we boldly reduced the proportion of automobile insurance, which has a high loss ratio, and focused on long-term life insurance, which is favorable for long-term profitability," adding, "Early organizational and product structure changes in line with the introduction of the new International Financial Reporting Standard (IFRS17) were also a background for rapid growth."

Second Year of IFRS17... Real Competition Between Life and Non-life Insurers Begins

Many experts cite the introduction of IFRS17 last year as the reason behind the strong performance of insurance companies. It is said that companies that thoroughly prepared during the decade-long process leading up to IFRS17 adoption achieved high results.

Under the previous accounting standards, earned premiums were the main source of revenue, but under IFRS17, the insurance contract service margin (CSM) is the core of profit. CSM is an indicator that represents the present value of future profits from insurance contracts held by an insurer. Professor Seo Ji-yong of Sangmyung University's Department of Business Administration said, "With the introduction of IFRS17, the solvency ratio was changed to the K-ICS (new solvency ratio), which improved profitability," adding, "Insurance companies also responded by increasing protection-type insurance, which is advantageous for securing CSM, rather than savings-type insurance, and the effect has appeared this time."

In the second year of IFRS17 adoption, competition to secure CSM between life and non-life insurers is fiercer than ever in the insurance market this year. The third insurance market, which covers disease, injury, and nursing care, is expected to become a battleground between life and non-life insurers.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.