The Bank of Korea Keeps Base Rate at 3.50%

High Inflation Leads to One-Year Freeze Since February Last Year

Economic Recovery and High Household Debt Support Maintaining High Rates

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Financial Monetary Policy Committee plenary meeting held at the Bank of Korea in Jung-gu, Seoul, on the morning of the 22nd.

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Financial Monetary Policy Committee plenary meeting held at the Bank of Korea in Jung-gu, Seoul, on the morning of the 22nd.

The Bank of Korea has kept the base interest rate steady at 3.50% for the ninth consecutive time. The Bank reaffirmed its stance to maintain a high interest rate policy until inflation stabilizes.

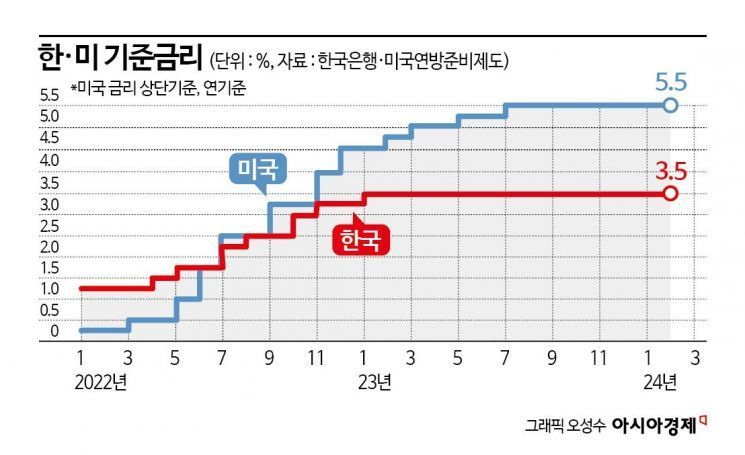

Even considering the historically largest interest rate gap (2.0 percentage points) with the United States, where the base rate is 5.50%, analysts say there is no reason for the Bank of Korea to lower rates ahead of the U.S.

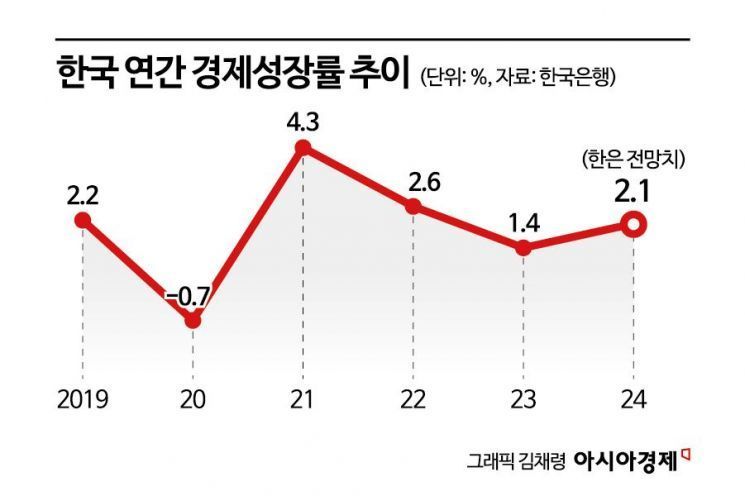

This year, South Korea's economic growth forecast remains at 2.1%, and the inflation rate forecast is maintained at 2.6%. It is predicted that the economic situation will improve compared to last year, driven by increased exports centered on semiconductors.

Bank of Korea Holds Base Rate Steady for One Year Since February Last Year

The Monetary Policy Committee (MPC) of the Bank of Korea held the base interest rate (annual 3.50%) steady at a meeting on the morning of the 22nd at the Bank’s headquarters in Jung-gu, Seoul. The MPC has kept the base rate unchanged for nine consecutive times since February last year.

The main reason for the Bank of Korea’s rate freeze is that the consumer price inflation rate still exceeds the target. Last month, the domestic consumer price inflation rate was 2.8%, down from the previous month but still higher than the Bank’s target of 2.0%.

Kim Woong, Deputy Governor of the Bank of Korea, said at a price situation review meeting on the 2nd, "The consumer price inflation rate continues to slow due to weakening demand pressures and falling international oil prices," but added, "Geopolitical risks have increased oil price uncertainty, and prices of daily necessities such as agricultural products remain high."

Professor Cho Sung-hoon of Yonsei University’s Department of Economics explained, "Since inflation has not yet reached the target of 2%, it is premature to lower interest rates. Also, from an external perspective, as the possibility of the U.S. lowering rates is becoming more distant, there is no reason or justification for South Korea to preemptively cut rates."

Economic Improvement and High Household Debt Also Behind Maintaining High Rates

Improvement in the domestic economy, led by exports, is another factor for keeping the base rate steady. According to the Ministry of Trade, Industry and Energy, South Korea’s exports last month amounted to $54.69 billion, an 18% increase compared to the same period last year. This is the first time in 20 months since May 2022 (21.4%) that the monthly export growth rate recorded double digits. Exports of key items such as semiconductors and automobiles have greatly improved.

Economist Ahn Jae-kyun of Shinhan Investment Corp. said, "Considering the favorable export trend and the slower-than-expected domestic demand slowdown, the base rate is likely to remain steady for a while. There is a possibility of a rate cut in the third quarter when the contribution of export growth declines."

High household debt levels also contribute to maintaining high interest rates. According to the Bank of Korea, household credit (debt) outstanding at the end of the fourth quarter last year reached a record high of 1,886.4 trillion won, an increase of 8 trillion won from the previous quarter. This was due to the continued rise in mortgage loans despite high interest rates.

Household loans from deposit banks (including policy mortgage loans) have been increasing for ten consecutive months through last month. In particular, mortgage loans including jeonse (key money) loans increased by 4.9 trillion won to 855.3 trillion won in January alone, marking the second-largest increase for January after January 2021 (+5 trillion won).

Professor Kang In-soo of Sookmyung Women’s University’s Department of Economics said, "In South Korea’s case, lowering the base rate could reduce interest burdens but may also trigger an increase in household debt. Since rate cuts could worsen the household debt problem, caution is necessary."

South Korea’s interest rates are significantly influenced by the U.S. situation, so the U.S. developments must also be monitored.

According to the minutes of the January Federal Open Market Committee (FOMC) released by the U.S. Federal Reserve on the 21st (local time), members reaffirmed a cautious stance to maintain current rates until inflation clearly slows. Market expectations for a rate cut in March, which were present until last month, continue to be pushed back.

The current U.S. base rate is 5.25?5.50%, which is 2.0 percentage points higher than South Korea’s. Given the much higher U.S. rate, there is no need for South Korea to preemptively lower its rates.

Ultimately, inflation must stabilize and the U.S. must cut its base rate first before South Korea can lower its own base rate. NH Investment & Securities researcher Kang Seung-won said, "The most critical condition for South Korea’s rate cut is a signal from the Fed to lower rates," adding, "It is expected that the Fed will give such a signal in May."

Economic Growth Forecast for This Year Remains at 2.1%

In the revised economic outlook announced on the same day, the Bank of Korea forecast that South Korea’s economy will grow by 2.1% this year. The Bank had predicted 2.1% growth in November last year and maintained this forecast.

In the resolution of last month’s monetary policy direction meeting, the MPC projected that although consumption and construction investment recovery will be slow, the economy will continue to improve due to sustained export growth. South Korea’s economic growth rate was 1.4% last year, and it is expected to improve this year mainly driven by exports.

The Bank of Korea’s growth forecast for this year is slightly lower than that of the government and major domestic and international research institutions. The government expects 2.2% growth this year. The Korea Development Institute (KDI) and the Organisation for Economic Co-operation and Development (OECD) also forecast 2.2%, while the International Monetary Fund (IMF) projects a slightly higher 2.3%.

The Bank also maintained its consumer price inflation forecast for this year at 2.6%. Last year, South Korea’s consumer price inflation was 3.6%. It is expected that inflation will slow due to weak domestic demand including investment and consumption.

The MPC expects domestic inflation to continue slowing but at a gradual pace due to the cumulative impact of cost pressures. It also noted high uncertainty regarding the inflation path related to movements in international oil and agricultural product prices and domestic and global economic trends.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.