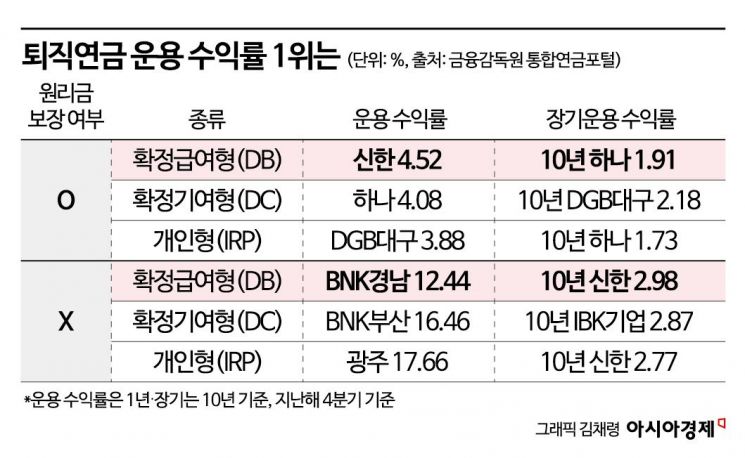

Principal and Interest Guaranteed Commercial Banks, Non-Guaranteed Regional Banks Strong

Different in Default Options

Recipients Flock to Safe Assets, Resulting in Low Returns

"Must Subscribe to Products Matching Investment Preferences"

Among the retirement pension returns of 10 domestic banks, principal-guaranteed products are strong in commercial banks, while non-principal-guaranteed products show strength in regional banks. Shinhan and Hana Bank stand out in long-term returns. In default option (pre-designated management system) returns, various banks compete according to risk levels.

According to the Financial Supervisory Service's integrated pension portal disclosure on the 22nd, among the six types of principal-guaranteed products operated by 10 domestic banks (excluding the Korea Development Bank) as of the fourth quarter of last year, Hana Bank ranked first in returns in three product types. Hana Bank's returns were the highest among commercial banks with a long-term (10-year) defined benefit (DB) of 1.91%, short-term (1-year) defined contribution (DC) of 4.08%, and long-term individual retirement pension (IRP) of 1.73%. Shinhan Bank showed strength in short-term DB returns (4.52%). DGB Daegu Bank ranked first in long-term DC (2.18%) and short-term IRP (3.88%).

Regional banks showed strength in non-principal-guaranteed products. In short-term product management, BNK Gyeongnam Bank (DB, 12.44%), BNK Busan Bank (DC, 16.46%), and Gwangju Bank (IRP, 17.66%) showed the highest returns. Looking at long-term returns, Shinhan Bank earned the highest profits with DB type at 2.98% and IRP type at 2.77%. IBK Industrial Bank of Korea ranked first in long-term DC products (2.87%).

In the default option created to improve retirement pension returns, different banks show strengths depending on risk levels. KB Kookmin Bank ranked first with a 20.01% return in high-risk products. DGB Daegu Bank (11.17%) led in medium risk, NH Nonghyup Bank (8.4%) in low risk, and IBK Industrial Bank of Korea (4.46%) in ultra-low risk products. Except for ultra-low risk products, all products do not guarantee principal.

Retirement pension beneficiaries tend to concentrate their accumulated funds in safe assets. Of the retirement pension accumulated funds (177.662 trillion KRW) in 10 banks, about 86.7% (153.9985 trillion KRW) is held in principal-guaranteed products. The same applies to default options. About 90.5% of the total accumulated amount (10.5488 trillion KRW) is concentrated in ultra-low risk products (954.25 billion KRW).

Returns are also low. Regardless of principal guarantee or product type, long-term operation yields particularly low returns. The average long-term (10-year) return of principal-guaranteed products in 10 banks is about 1.8%, and non-principal-guaranteed products about 2.4%. The average 1-year return of default option ultra-low risk products is about 3.1%. All are lower than the average basic interest rate of 18 commercial banks' time deposits (3.2% as of the 22nd, according to the Bankers Association Consumer Portal).

Retirement pension beneficiaries should subscribe to suitable products according to their investment tendencies. The DB type is a method where the company deposits and manages the employee's retirement pension with an external financial institution. The amount received as a pension after resignation or retirement is fixed. The DC type is where the company deposits the retirement pension, and the employee can manage it directly. The IRP type allows additional personal contributions and management, with benefits received as a pension or lump sum. The DB type is suitable for safety-oriented investments. The DC and IRP types are suitable for those who prioritize profitability. If a lump sum is needed, the DC type, which allows mid-term withdrawal, is appropriate. The default option is only available for DC and IRP types. Even here, if you have an aggressive investment tendency, you can consider subscribing starting from low-risk products that do not guarantee principal.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.