The conflict between the mother and sons over the integration of Hanmi Pharmaceutical Group and OCI Group has escalated into a legal battle. As the preliminary injunction hearing to block the integration commenced, both sides engaged in sharp disputes over one of the key transactions: the issuance of new shares to a third party.

The Suwon District Court Civil Division 31 (Presiding Judge Jo Byung-gu) held the first hearing on the preliminary injunction case filed by brothers Lim Jong-yoon and Jong-hoon against Hanmi Science to prohibit the issuance of new shares on the afternoon of the 21st.

The issuance of new shares by Hanmi Science is one of the core links in the integration of the two groups. This integration is proceeding in a way that OCI secures a 27.0% stake in Hanmi Science by combining Hanmi Science's issuance of new shares (8.4%) to OCI Holdings, the sale of shares by Song Young-sook, Chairwoman of Hanmi Science, and Lim Ju-hyun, President of Hanmi Pharmaceutical, and the contribution of shares by Song and Lim to OCI in kind. President Lim Ju-hyun and others will hold a 10.4% stake in OCI Holdings through the in-kind contribution. If the preliminary injunction is granted, one of the pillars of the integration process will be shaken.

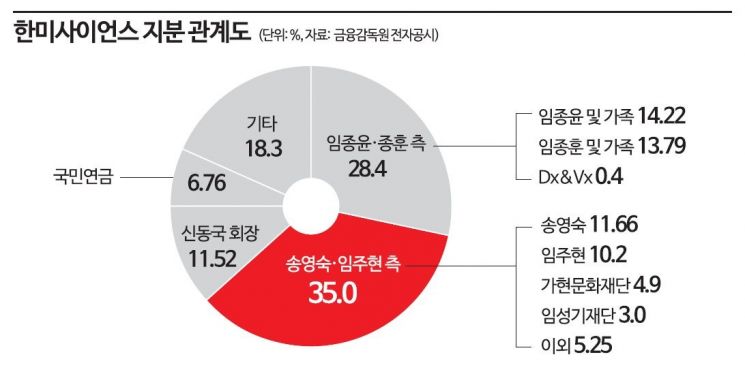

The biggest point of contention between the two sides was the purpose and circumstances of the new share issuance. The law firms Jipyung and Gwangjang, representing the brothers, defined it as "an illegal issuance of new shares to prepare for the inheritance tax of Song Young-sook and Lim Ju-hyun and, furthermore, to realize a private purpose of gaining control over management." Currently, the shares of the brothers and the mother and daughter are roughly equal, but if this transaction is completed, the shareholding structure will be reversed, and the mother and daughter will gain control over management.

On the other hand, the mother and daughter side emphasized that Hanmi Pharmaceutical Group is experiencing severe financial difficulties and that the integration with OCI is a "clever move to achieve management objectives." The law firm Hwawoo, representing Hanmi Science, pointed out that as of the third quarter of last year, the liquidity ratio of Hanmi Science was 24.9% and Hanmi Pharmaceutical was 50%, which is lower than competitors' 100-300%, indicating that the group's current financial structure is very fragile. In this process, they emphasized, "Although Hanmi Pharmaceutical's R&D investment ratio relative to sales in 2020 was the highest in the industry at 21%, it sharply dropped to 13.45% repeatedly in 2021 and 2022," and "Securing funds to maintain stable R&D investment has become a prerequisite for Hanmi Pharmaceutical."

Moreover, they pointed out that financial shortages have hindered Hanmi Pharmaceutical's growth at key points such as the failure of the lung cancer drug Olita's development and the abandonment of the acquisition of the U.S. partner Spectrum, emphasizing that "OCI has 1 trillion won in cash assets and has the ability to provide the R&D investment costs needed by Hanmi Pharmaceutical in a long-term and stable manner."

Another major issue raised was whether there was an actual management dispute before the integration resolution. Since the Supreme Court does not recognize new share issuance for the purpose of defending management rights through precedent, if a dispute existed, it could be a major basis for invalidating the new share issuance.

The brothers explained, "Although we did not have a shameful conflict with our mother, the shareholdings were similar, so the conflict structure continued." Although it was not expressed externally, the mother and daughter side blocked the brothers' participation in management, causing conflict. In particular, they cited the fact that "other major shareholders in the family were not informed in advance about this transaction" as evidence.

Hanmi Science argued that since it was agreed within the family that Chairwoman Song would inherit twice the shares compared to her children during the inheritance process, there was no dispute. They also presented as key evidence that President Lim Ju-hyun lent a large sum of 26.6 billion won unsecured to Lim Jong-yoon and that Lim Jong-yoon sold Hanmi Science shares to raise funds for the acquisition of DXVX (DXVx). The logic is that lending money unsecured to the other party or selling core assets such as shares is unlikely to occur in a management dispute situation.

Since only the sharp opposing positions of both sides were confirmed at the hearing, the court plans to hold another hearing to further ask for opinions from both sides. The next hearing is scheduled for the 6th of next month.

Meanwhile, the hearing also revealed specific collaboration models between Hanmi Pharmaceutical and Bukwang Pharmaceutical, a pharmaceutical company under OCI Group, as well as the negotiation targets of Hanmi Pharmaceutical Group, which had not been disclosed until now.

The mother and daughter side explained, "Bukwang Pharmaceutical focuses on central nervous system diseases, while Hanmi Pharmaceutical focuses on obesity and anticancer drugs," adding, "Hanmi Pharmaceutical also sought opportunities to enter the central nervous system treatment drug market but failed due to financial issues, so cooperation with Bukwang Pharmaceutical is an attractive proposal." Bukwang Pharmaceutical has been focusing on expanding its portfolio in the central nervous system disease area, including obtaining approval last year for Latuda, an antidepressant drug introduced from Japan.

They also explained the background of this integration by saying, "Hanmi Science has continuously sought cooperation with other companies to secure R&D funds and expand its sales network," and "In addition to OCI, they explored integration possibilities with listed companies such as Samsung Biologics, Hyosung, and Soulbrain, but negotiations with OCI progressed rapidly." In fact, Hanmi Pharmaceutical Group reportedly entered negotiations with these companies, but the negotiations broke down due to mismatched demands regarding management rights and other issues.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.