Citizen Group Holds 'Jang Inhwa Opposition' Rally in Jeonju

Activist Fund Conveys Opposition to KT&G's Next Candidate

National Pension Service Shows About 10% Opposition Rate on Executive Appointments

As the CEO appointment procedures for ownership-dispersed companies such as POSCO and KT&G are underway, there is a flood of demands urging the National Pension Service (NPS) to enforce the 'Stewardship Code' (active exercise of voting rights by institutional investors). A rally opposing the appointment of Jang In-hwa, former POSCO president and the designated next chairman of POSCO Holdings, was held at the NPS headquarters. Additionally, the NPS received a letter from an activist fund expressing opposition to some of KT&G's CEO candidates.

Ownership-dispersed companies refer to firms that were once government-invested or public enterprises but became privatized, resulting in dispersed ownership. They are sometimes called "ownerless companies." The NPS is the largest shareholder of POSCO Holdings, the holding company of POSCO, with a 6.71% stake. Jang In-hwa, the former POSCO president, is practically only awaiting the shareholder meeting's approval for appointment. In the case of KT&G, the NPS holds a 6.36% stake, making it the third-largest shareholder. KT&G has shortlisted four candidates for the next CEO?two internal and two external?and plans to select the final candidate soon.

"Calls for NPS Opposition" Letter Leads to Rally

Officials including the Citizens' Committee for the Relocation of POSCO Holdings Headquarters and Future Technology Research Institute to Pohang (Citizens' Committee) are delivering a resolution to a National Pension Service employee (far left) on the 21st.

Officials including the Citizens' Committee for the Relocation of POSCO Holdings Headquarters and Future Technology Research Institute to Pohang (Citizens' Committee) are delivering a resolution to a National Pension Service employee (far left) on the 21st. [Photo by Citizens' Committee]

On the afternoon of the 21st, four organizations including the POSCO Holding Company & Future Technology Research Institute Pohang Relocation Citizens' Committee (Citizens' Committee) held a press conference in front of the NPS headquarters in Jeonju, stating, "The new CEO of the national enterprise POSCO must be appointed through a fair process with public trust," and urged, "The NPS must actively exercise its legal authority." They also warned, "If the NPS neglects its rights as the largest shareholder of POSCO, legal actions such as filing charges against Chairman Kim Tae-hyun for dereliction of duty will be taken, and it will face strong resistance from the citizens of Pohang."

After the rally, the participants delivered a resolution letter to the NPS detailing reasons why former President Jang is unqualified. Their argument is that Jang, who is under investigation by authorities over allegations of extravagant business trips and violations of the Capital Markets Act, cannot become the next leader of the POSCO group. Therefore, they urged the NPS to activate the Stewardship Code and oppose Jang’s appointment.

Earlier, the Singapore-based activist fund Flashlight Capital Partners (FCP) sent a letter to the NPS urging active exercise of voting rights. The letter expressed opposition to two 'internal' candidates, including Bang Kyung-man, KT&G’s Senior Vice President. FCP argued that since Bang was promoted to executive director and senior vice president in 2021, the company’s operating profit has declined, and cited failures in the U.S. business as evidence of his lack of qualifications. Some say Bang has been a strong contender since the tenure of former CEO Min Young-jin. Due to such 'appointment rumors,' FCP preemptively sent a 'message of opposition' to the NPS even before the final candidate was selected. In response, KT&G emphasized, "The CEO appointment process is being conducted fairly through the governance committee and the CEO nomination committee, both composed solely of independent outside directors with expertise, culminating in final shareholder meeting approval."

Opposition to Executive Appointments Occurs About Once in Ten Votes

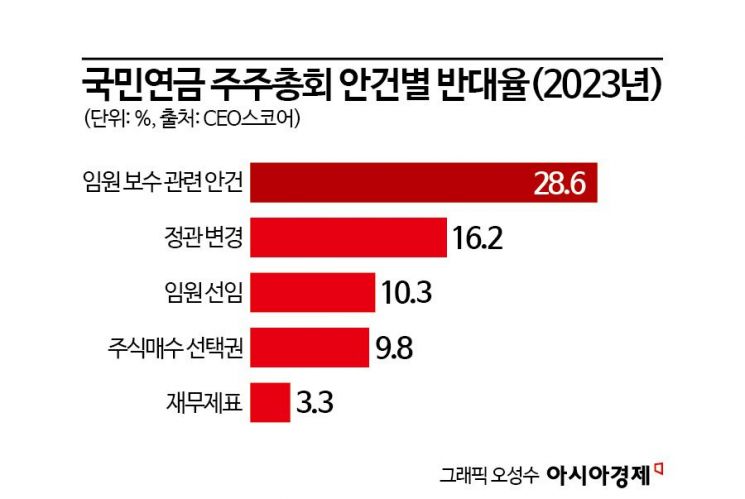

Since adopting the Stewardship Code, the NPS has gradually increased its proportion of opposing votes but saw a decline last year. According to CEO Score, the NPS’s opposition rate to shareholder meeting agenda items was 11.2% in 2020, 11.4% in 2021, and 15.3% in 2022. However, it decreased to 13.8% last year. Narrowing down to agenda items related to 'executive appointments,' the opposition rate dropped further to 10.3% (as of 2023). In other words, the NPS did not oppose 9 out of 10 times.

A representative from the NPS’s Stewardship Responsibility Committee, which decides voting directions, stated, "If there are no major issues, we decide to support." Last year, the NPS exercised voting rights in 601 companies. Among them, 237 cases (39.4%) received 100% approval. An investment banking (IB) industry official commented, "The NPS’s silence can be interpreted as approval," adding, "This is why those opposing are demanding the NPS’s Stewardship Code and engaging in a series of related actions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.