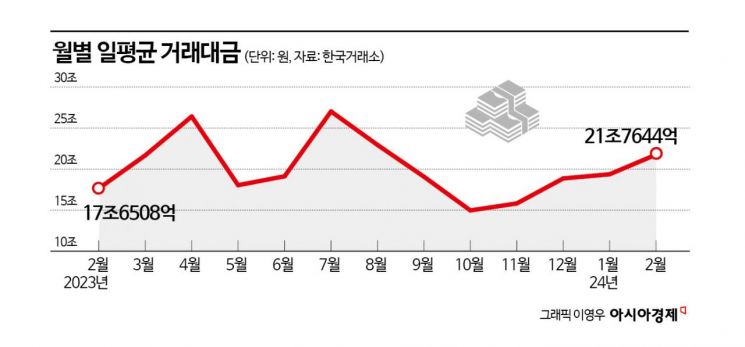

Average Daily Trading Value of 21.7644 Trillion This Month

Surpasses 20 Trillion for the First Time Since August Last Year

Investor Deposits Also Recovering... Reaching 54 Trillion Range

With expectations for the government's corporate value-up program, the domestic stock market showed strength, recovering the average daily trading volume to the 20 trillion won level. Investor deposits, which are standby funds for the stock market, also showed an increasing trend, indicating that funds are flowing back into the stock market.

According to the Korea Exchange on the 21st, the average daily trading volume of the domestic stock market this month was 21.7644 trillion won, recovering to the 20 trillion won level for the first time since August last year. The monthly average daily trading volume had been declining since it recorded 27 trillion won in July last year. It decreased to 22 trillion won in August and fell to the 14 trillion won level in October when the market was under correction. Since then, the stock market has been recovering as it rose toward the end of the year.

Investor deposits are also increasing. According to the Korea Financial Investment Association, as of the 19th, investor deposits recorded 54.0247 trillion won. This is an increase of 3.2813 trillion won compared to the end of last month. Investor deposits refer to the money that investors deposit in securities accounts to buy stocks or money that has not been withdrawn after selling stocks, representing standby funds preparing to enter the stock market. Investor deposits, which had increased to the 59 trillion won level at the beginning of the year due to the strong stock market at the end of last year, fell to the 49 trillion won level last month as the market showed a sluggish trend. Since the end of January, as the stock market has risen again, investor deposits have also shown a recovery trend.

The balance of credit loans, which are funds borrowed from securities companies to invest in stocks, increased from 17.809 trillion won at the end of last month to 18.1301 trillion won.

The return of funds to the stock market is interpreted as a result of the recent stock market strength. Although the KOSPI's upward momentum faltered at the beginning of the year, dropping to the 2400 level, after the government's corporate value-up program plan was announced, low price-to-book ratio (PBR) stocks led the rise, recovering the index to the 2600 level. The KOSPI has risen more than 8% in the past month.

Kim Dae-jun, a researcher at Korea Investment & Securities, explained, "The Korean stock market was the worst performer among the G20 countries in January this year, but it rebounded in February due to improvements in the macroeconomic environment and expectations for the government's corporate value-up program. In terms of February returns, it showed remarkable performance, ranking among the top in the G20."

As the speed of sector rotation has accelerated, there are opinions that proactive responses are necessary. Roh Dong-gil, a researcher at Shinhan Investment Corp., said, "The average monthly trading volume of the KOSPI in February increased by 36.2% compared to the previous month, and the average monthly trading volume in February increased by 19.2% compared to the average of the fourth quarter of last year. Although trading was active, it means that the speed of sector rotation was fast, making short-term sector and style strategies difficult to outperform benchmark returns in this period. Therefore, the current period is a time to wait for the next event and take proactive measures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)