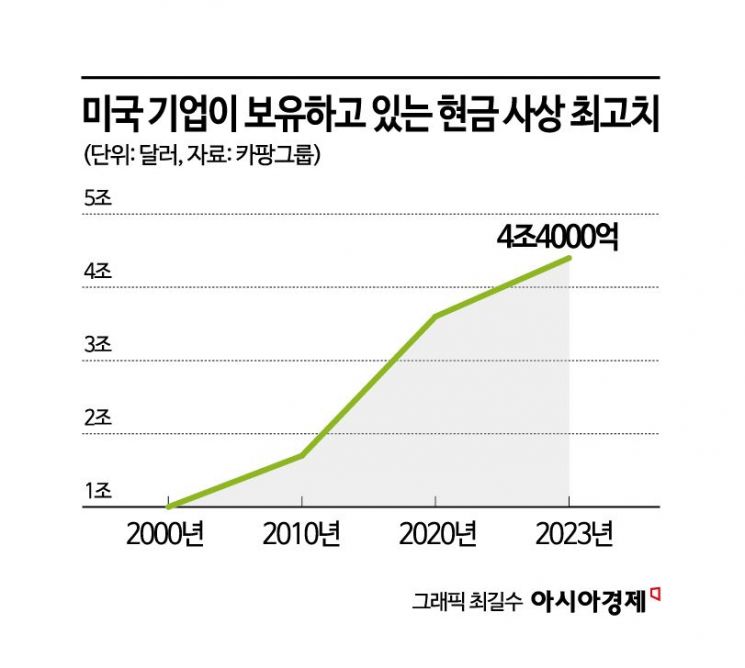

Last Year, Total Cash Assets of US Companies Surpassed $4 Trillion

Record High

Low Risk Asset Investment Due to High Interest Rates

This Year, With Delayed Interest Rate Cuts,

Cash Reserves Likely to Continue

Last year, the total cash assets held by U.S. companies exceeded $4 trillion, reaching an all-time high. This is attributed to the Federal Reserve (Fed) maintaining a high interest rate stance, leading companies to avoid risky asset investments and increase their cash holdings. A significant portion of these cash assets flowed into money market funds (MMFs), considered safe investment options. Although the Fed hinted at a pivot (change in direction) at the end of last year, the timing of interest rate cuts has continued to be delayed this year, suggesting this trend will persist.

On the 20th (local time), Bloomberg cited data from financial information firm Kaphan Group, reporting that the cash reserves held by U.S. companies reached $4.4 trillion as of the third quarter of last year. This is the largest cash holding ever recorded. The ratio of corporate cash holdings to gross domestic product (GDP) jumped from 12% in March 2020 to 16% in the third quarter of last year.

Risky Asset Investments Paused Due to High Interest Rates

As the Fed embarked on aggressive tightening amid recession concerns, companies avoided investing in risky assets such as stocks and instead increased cash in their portfolios. Starting in March 2022, the Fed raised the benchmark interest rate to 5.25?5.50% by July last year, maintaining the highest rate level since 2001.

The longer the high interest rate period lasted, the more companies expanded their cash holdings. For example, Meta Platforms, the parent company of Facebook and Instagram, increased its cash holdings from $29.6 billion in Q3 to $32.9 billion in Q4 last year. During the same period, Amazon raised its cash from $20.4 billion to $39.2 billion, and Qualcomm increased from $4.88 billion to $8.13 billion.

It is analyzed that a significant portion of the cash held by companies flowed into MMFs. MMFs are designed to invest in safe assets such as short-term government bonds and provide returns. They typically attract attention during high interest rate periods when risky asset investments lose appeal. Due to their ease of purchase and redemption, MMFs are considered standby funds. According to the Investment Company Institute (ICI), the total assets of U.S. MMFs reached a record high of $6.012 trillion last year.

Cash Hoarding Trend Likely to Continue This Year

It has been confirmed that an additional $128 billion flowed into MMFs this year. This is due to hawkish remarks from global financial figures, resurgent inflation, and strong employment data, which dampened market expectations for interest rate cuts. There are even views that the rate cuts will not be significant.

The phenomenon where short-term U.S. Treasury yields exceed long-term yields, often seen as a recession signal, continues. This indicates ongoing uncertainty about the Fed's targeted soft landing scenario this year. As of the close on this day, the 3-month Treasury yield stood at 5.378%, maintaining a 1.1 percentage point premium over the benchmark 10-year Treasury yield of 4.272%. The inversion between 3-month and 10-year yields also occurred just before the 2008 global financial crisis and during the COVID-19 pandemic in February 2020.

MMF market research firm Crane Data predicts that total MMF assets could grow to $7 trillion this year. Peter Crane, chairman, said, "Overall sensitivity to interest rates is still spreading, and there are no signs that large amounts of money are moving to other assets. If total MMF assets decrease this year compared to last year, I will retire from my position."

However, there is an opposing view. If companies judge that interest rates have peaked, they may withdraw funds from MMFs to secure yields. In this regard, Deborah Cunningham, Global Head of Liquidity Markets at Federated Hermes, stated, "Approximately $1 trillion of MMFs is expected to flow into the industry in 2024."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)