Korea International Trade Association Publishes Report on Digital Tax

200 Domestic Companies Subject to Global Minimum Tax

"Need to Prevent National Disputes Arising from Digital Tax Implementation"

As the introduction of digital taxes accelerates worldwide, advice has emerged that taxable companies need to review their global tax strategies. It emphasizes closely monitoring legislative trends in each country and managing the effective tax rates of overseas subsidiaries at the group level. Since disputes between countries may arise during the digital tax implementation process, it is also advised that governments strengthen information sharing and cooperation with other countries.

The Korea International Trade Association's International Trade and Commerce Research Institute published a report titled 'Key Contents and Legislative Trends of Digital Tax' on the 20th, containing these insights.

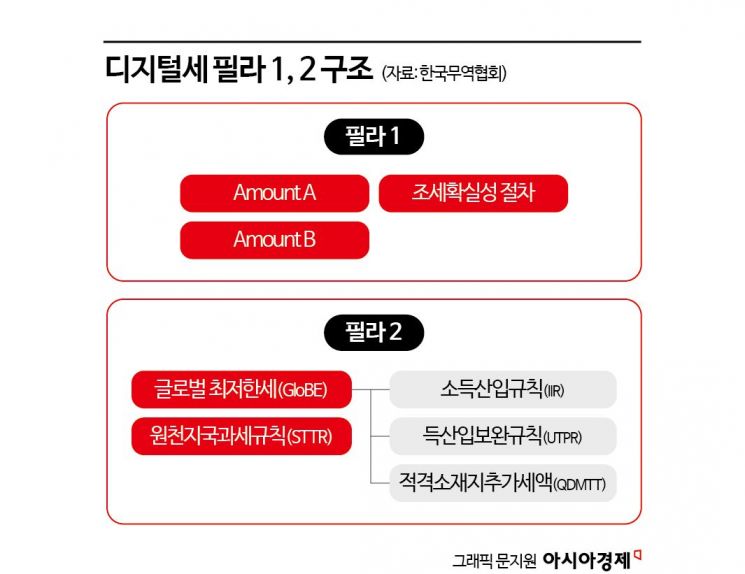

The digital tax is a new international tax system developed over the past decade through consultations among about 140 countries centered on the OECD and G20. It consists of two pillars: 'Pillar 1,' which is scheduled to take effect next year, and 'Pillar 2,' which was implemented last month.

Pillar 1 is a tax system that grants taxing rights to the market jurisdiction where sales occur. Its purpose is to secure taxing rights over digital companies conducting business without a physical establishment. The Pillar 1 tax applies to global multinational corporations with consolidated revenues exceeding 20 billion euros and a pre-tax profit margin over 10%.

Pillar 2 includes a provision requiring multinational corporations with global revenues of at least 750 million euros to pay taxes at a minimum effective tax rate of 15%. More than 20 countries, including South Korea, Canada, Australia, and Japan, have implemented the global minimum tax starting this year. If an overseas subsidiary of a multinational corporation headquartered in South Korea pays taxes below the minimum tax rate (15%) locally, the parent company’s country, South Korea, collects the shortfall as additional tax.

According to the report, about 200 domestic companies are subject to the Pillar 2 global minimum tax. These companies must reflect the global minimum tax-related corporate tax expenses in their financial statements starting from the first quarter closing this year and disclose related information. This is why there is advice to expedite preparations.

As more countries adopt the global minimum tax, it is necessary to continuously monitor legislative trends in each country and manage the effective tax rates of overseas subsidiaries at the group level. Currently, Hong Kong, Indonesia, Singapore, Taiwan, and the United Arab Emirates (UAE) have expressed intentions to introduce the global minimum tax.

For Pillar 1 to take effect, at least 30 countries must ratify the agreement. The ratification by the United States is especially essential. However, ratification and legislation are delayed due to opposition from Republicans in the U.S. Congress. Consequently, individual countries such as Canada are pushing to introduce a Digital Services Tax (DST) to secure taxing rights over companies that do not have a physical presence in the jurisdiction where digital services are consumed.

The United States has clashed with Canada, threatening retaliatory measures against such moves. The report notes that developing countries opposing the OECD-centered digital tax are pushing to establish an international tax working group within the UN, suggesting that digital tax discussions may become divided between these two international organizations.

Kang Geum-yoon, a senior researcher at the Korea International Trade Association, advised, "As the global minimum tax is fully implemented starting this year, Korean companies that have established factories in low-tax countries or receive various tax benefits such as foreign investment tax credits should be cautious about additional tax burdens," and added, "due to the complexity of digital taxes, tax authorities may face difficulties in compliance, so the government should prevent tax disputes in advance through information sharing and cooperation between countries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)