BC Card 'Foreign Sales by Nationality, Region, and Industry'

Spending Soars from 2019 to 2023, Top Nationalities Are

USA, Japan, Taiwan, UK, and Thailand

Cafes and Instant Photo Shops Lead Sales in Seoul Seongsu-dong

US Military Base Presence Boosts Consumption in Pyeongtaek, Gyeonggi

Busan Also Bustling with BTS Fandom and Tourist Attractions... 'Crowded'

During the COVID-19 pandemic, the number of Chinese tourists visiting Korea sharply declined, while Americans visiting Korea to experience K-content such as K-pop and K-food significantly increased their spending. While foreign sales at large department stores and duty-free shops in downtown Seoul, which were previously driven by Chinese tourists, plummeted, foreigners from the top five nationalities with increased sales?including the United States, Japan, Taiwan, the United Kingdom, and Thailand?mainly spent money on dining, shopping, and experiential activities in areas such as Seongsu-dong, Yeouido, and Busan.

Recently, crowds including foreign tourists have gathered on Yeonmujang-gil in Seongsu-dong, Seoul. Photo by Asia Economy DB

Recently, crowds including foreign tourists have gathered on Yeonmujang-gil in Seongsu-dong, Seoul. Photo by Asia Economy DB

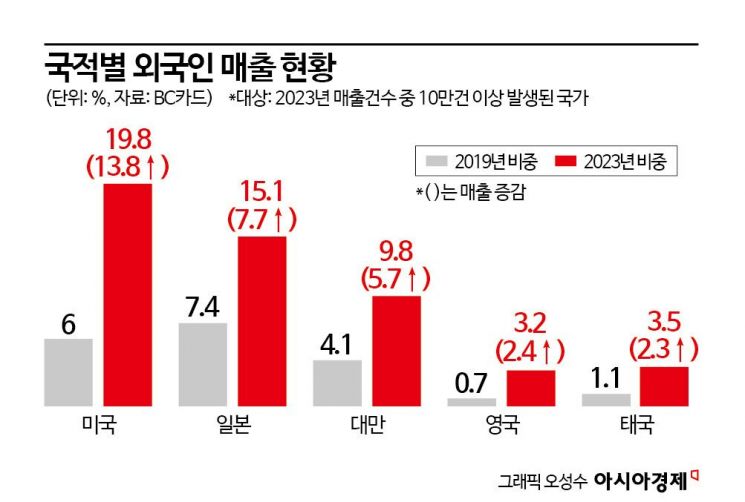

On the 20th, Asia Economy commissioned BC Card to analyze foreign tourist consumption trends by nationality, region, and industry. The data showed that compared to pre-pandemic 2019, the nationality that increased domestic spending the most last year was Americans. The U.S. share was only 6% in 2019 but rose by 13.8 percentage points to 19.8% in 2023, marking the largest increase among the top five countries.

Following the U.S., Japan (7.7 percentage points), Taiwan (5.7 percentage points), the U.K. (2.4 percentage points), and Thailand (2.3 percentage points) showed significant increases. In contrast, the share of Chinese spending, which accounted for 66.5% in 2019, sharply dropped to 15.7% last year. This decline is attributed to the Chinese government's travel control policies. Although Chinese travel to Korea began to reopen in the fourth quarter of last year, it has not yet recovered to previous levels.

The industries where Americans spent the most last year were restaurants (including coffee shops) and department stores/duty-free shops, but the sector with the most significant spending increase compared to 2019 was entertainment. The entertainment sector, including pubs, accounted for 5.1% of total American spending, roughly double the 2.4% in 2019. For Japanese tourists, the supermarket share increased the most from 5.2% in 2019 to 10.3% in 2023. Conversely, cosmetics sales halved from 7.4% in 2019 to 4.3% in 2023. Taiwanese tourists showed an 8.7 percentage point increase in the share of spending at restaurants and department stores/duty-free shops.

Analyzing Seoul sales, which accounted for 71% of all foreign payment transactions last year, Seongsu-dong (Seongdong-gu, 973%↑), Yeouido (Yeongdeungpo-gu, 479%↑), and Hannam-dong (Yongsan-gu, 429%↑) saw sharp increases compared to 2019. Seongsu-dong, densely packed with cafes, restaurants, clothing and accessory stores, and experiential spaces (such as instant photo booths and karaoke rooms), attracted significant spending from foreigners seeking to experience K-content.

Hyundai Department Store The Hyundai Seoul located in Yeouido-dong, Yeongdeungpo-gu, Seoul.

Hyundai Department Store The Hyundai Seoul located in Yeouido-dong, Yeongdeungpo-gu, Seoul. [Photo by Hyundai Department Store Group]

Yeouido's sales share surged from 1.7% in 2019 to 10.9% last year, a 10.2 percentage point increase. A BC Card official noted, “While sales in department stores and duty-free shops in Jung-gu, Seoul, declined, Yeouido’s sales increased notably following the opening of The Hyundai Seoul (Hyundai Department Store).” Indeed, major duty-free shopping areas such as Sogong-dong in Jung-gu and Jamsil 3-dong in Songpa-gu saw sales transactions drop sharply by 90% and 88%, respectively, during the same period. Jangchung-dong also decreased by 77% compared to 2019.

Hannam-dong showed significant changes in sales share by industry. Although restaurants accounted for the largest share at 14.1% among newly popular commercial areas frequented by foreigners, this was a sharp decline from 40% in 2019. Conversely, shopping sales accounted for nearly 80%, indicating a concentration trend.

Sales transactions in the Gyeonggi region were recorded at 7% (2019) and 10% (last year) compared to Seoul. Among these, two locations in Pyeongtaek ranked first and second in sales, influenced by the presence of U.S. military bases. Most of these sales were in the food and beverage sector, with pubs showing the largest growth in Gyeonggi Province, increasing from 1.6% in 2019 to 11% last year.

Busan showed similar levels to Gyeonggi. Notably, sales from transportation modes (rail, express buses, taxis, etc.) last year were higher than other sectors. A BC Card official explained, “Thanks to the BTS fandom, various tourist spots (such as Gamcheon Culture Village and Geumjeongsan) have also gained attention, leading to increased KTX sales and consumption by foreign individual tourists visiting various attractions in Busan.”

Last June, ARMYs (BTS fans) from around the world gathered at Yeouido Hangang Park in Seoul, where BTS's 10th anniversary festival (BTS 10th Anniversary Festa) was held, entering the event venue. Photo by Yonhap News

Last June, ARMYs (BTS fans) from around the world gathered at Yeouido Hangang Park in Seoul, where BTS's 10th anniversary festival (BTS 10th Anniversary Festa) was held, entering the event venue. Photo by Yonhap News

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)