High Interest Rates, PF Defaults, and Economic Uncertainty Slow Buying Momentum

Construction Companies: "We Won't Take Orders If It Means Losses"

This Year's Order Targets Far Below Last Year's Performance

The downward trend in housing prices continues, and transaction volumes are decreasing. As a result, construction companies have lowered their order targets. Although the Ministry of Land, Infrastructure and Transport is rolling out real estate policies such as easing regulations on reconstruction and redevelopment and reorganizing first-generation new towns ahead of the general elections in April, these measures are considered insufficient to dispel the cold wave hitting the market.

Housing Transaction Volume and Prices Decline One After Another

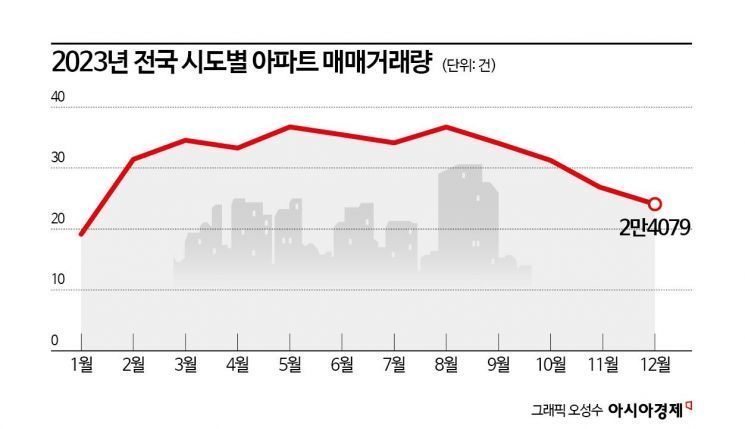

According to Real Estate Planet on the 19th, the monthly nationwide apartment transaction volume decreased for four consecutive months from August last year (36,734 cases) to December (24,079 cases). During the same period, Seoul's volume dropped to less than half (3,857 cases → 1,786 cases). The metropolitan area (12,503 cases → 7,093 cases) and provinces (20,374 cases → 15,200 cases) also saw transaction volumes decrease by more than 5,000 cases each.

High interest rates, risks of real estate project financing (PF) defaults, and economic uncertainty have dampened buyer sentiment. From the fourth quarter of last year, the suspension of general-type special housing loans further reduced buying demand. After the special housing loans worth 43.4 trillion KRW were released in the second and third quarters of last year, transaction volumes briefly increased.

Ham Young-jin, head of the Zigbang Big Data Lab, said, "While urgent sales properties were exhausted in January this year and new special loans for newborns were introduced, transaction volumes are expected to slightly increase compared to December last year, but housing sale prices remain as low as in early 2013. With the suspension of the Cheongyak Home website next month and the general elections in April, there is a tendency for the spring peak season to be missing."

On the 14th, in a real estate-dense shopping area in Songpa-gu, Seoul, where the decline in real estate prices and the transaction freeze phenomenon continue, apartment listings with market prices are posted. Photo by Kang Jin-hyung aymsdream@

On the 14th, in a real estate-dense shopping area in Songpa-gu, Seoul, where the decline in real estate prices and the transaction freeze phenomenon continue, apartment listings with market prices are posted. Photo by Kang Jin-hyung aymsdream@

The decline in housing prices has deepened. In January, the nationwide comprehensive housing (apartments, row houses, detached houses, etc.) sale prices fell by 0.14% compared to the previous month, a larger drop than in December last year (-0.10%). The metropolitan area (-0.14% → -0.18%), Seoul (-0.07% → -0.12%), and provinces (-0.07% → -0.11%) all showed similar patterns.

The Korea Real Estate Board stated, "In the metropolitan area, buyer hesitation deepened due to the uncertain real estate market, and prices were adjusted downward due to transactions focused on urgent sales properties. Seoul showed a downward trend across all regions." In Nowon-gu (-0.22%) and Dobong-gu (-0.17%), urgent sales transactions occurred amid almost no buyer inquiries. Seocho-gu (-0.17%) also saw urgent sales properties exhausted in complexes with inventory accumulation in Jamwon-dong and Banpo-dong.

Reluctance to Take Orders to Avoid Losses... Construction Companies Lower Targets

Construction companies have already lowered their housing project order targets for this year. This is a decision to reduce risks such as unsold inventory amid the ongoing real estate market downturn. Rising construction costs due to high inflation are also cited as a reason for reluctance to secure new orders. A representative from Construction Company A said, "Even if a project is located in a prime area in Seoul, construction companies are not interested if construction costs are low. According to current market prices, construction costs must be at least 8 million KRW per 3.3㎡, and projects below this threshold are considered to cause losses if undertaken." This can be seen in the case of the redevelopment of Noryangjin 1 District in Dongjak-gu, Seoul, where multiple construction companies including Samsung C&T and GS Engineering & Construction gave up bidding after construction costs were set at 7.3 million KRW per 3.3㎡.

According to Korea Investment & Securities, construction companies' housing order targets this year are far below last year's achievements. Hyundai Engineering & Construction set its order target for housing (apartments) and architecture (offices) at 9.1 trillion KRW this year, slightly down from last year's order amount of 9.496 trillion KRW. Daewoo Engineering & Construction, which secured 8.406 trillion KRW in housing and architecture orders last year, also significantly lowered its target to 6.889 trillion KRW this year. DL E&C set its housing order target at 4 trillion KRW this year, which is 40% lower than last year's performance of 6.719 trillion KRW.

Kang Kyung-tae, a researcher at Korea Investment & Securities, analyzed, "Construction companies are focusing their order targets this year on overseas plants and civil engineering projects outside the housing sector. They are trying to erase the housing sector from their sales and order targets."

A representative from Construction Company B said, "It is better not to engage at all because projects with poor profitability are likely to backfire and result in losses." Daewoo Engineering & Construction is a representative example. Due to difficulties in collecting payments for multiple apartment projects in provinces, Daewoo set aside 110 billion KRW in bad debt provisions in the fourth quarter of last year. A representative from Construction Company C said, "There are rumors that PF defaults will start to surface in earnest after the general elections in May," and predicted, "The domestic housing market will worsen more than last year."

Kang Min-seok, head of the real estate team at KB Financial Group Management Research Institute, stated, "The January price outlook index released by KB Real Estate recorded 80, declining over the past four months, indicating that the proportion of 'price decline outlook' remains higher than 'price increase outlook'." However, he added, "Considering expectations for interest rate cuts, the possibility of a wider decline than at the beginning of the year is low."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)