Annual net profits of major Japanese listed companies with March fiscal year-ends are estimated to set record highs for the third consecutive year. With solid corporate earnings and inflows of foreign currency due to the weak yen, the Tokyo Stock Exchange, which is approaching the peak of the 'bubble era,' is also expected to continue its rally.

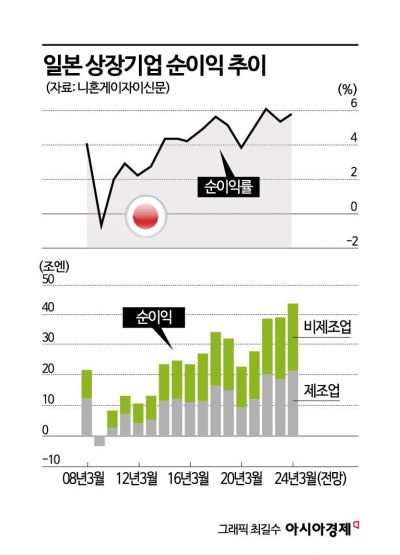

According to the Nihon Keizai Shimbun on the 16th, an aggregation and analysis of earnings forecasts for 1,020 companies listed on the Tokyo Stock Exchange indicate that net profits for the 2023 fiscal year (April 2023 to March 2024) are expected to increase by 13% from the previous year to 43.5 trillion yen (approximately 386 trillion won). The newspaper reported that "net profits will set record highs for three consecutive terms."

This surpasses the initially expected annual net profit of 40 trillion yen and a growth rate of 6%. By industry, both manufacturing (21.4 trillion yen) and non-manufacturing (22.1 trillion yen) sectors are projected to grow by 16% and 11%, respectively, setting record highs. The net profit margin relative to sales is expected to improve to 5.8% compared to 5.5% in the same period last year. Excluding the 2021 fiscal year (6.1%), which saw a base effect immediately after COVID-19, this is the highest level since the 2008 financial crisis. The net profit margin relative to sales is a key indicator that influences return on equity (ROE), making it a metric of high interest to investors.

Factors behind these strong earnings include economic and liquidity recovery within Japan, the weak yen, and corporate price hikes in response to inflation. The Nihon Keizai Shimbun cited the automobile industry as a representative sector. Toyota Motor Corporation, Japan’s largest automaker and the world’s largest car manufacturer, is expected to exceed 4 trillion yen in net profit for the 2023 fiscal year for the first time in history, supported by price increases, strong sales, and the weak yen. The company recently raised its operating profit guidance by 80% year-on-year to 4.9 trillion yen and became the first Japanese company to surpass a market capitalization of 50 trillion yen. Based on the previous day’s closing price, Toyota’s market capitalization was 55.1772 trillion yen (approximately 490 trillion won), about 54 trillion won more than Samsung Electronics (436 trillion won). This ranks Toyota as the second largest in Asia after Taiwan’s TSMC, marking the first time in about seven and a half years that Toyota’s market cap has surpassed Samsung Electronics.

In particular, the weak yen has significantly expanded net profits for export companies. While the yen-dollar exchange rate recently surpassed 150 yen, most companies assumed a rate of about 142 yen. The newspaper evaluated that "(the weak yen) is a factor that further boosts manufacturing profits centered on automobiles" and that "the recovery of tourism demand, including foreign visitors to Japan, is also having a positive impact on earnings." Additionally, price hikes by major companies such as Oriental Land, which operates Tokyo Disneyland, and Matsuya Foods are also expanding profitability and contributing to the strong earnings performance.

These strong corporate earnings are also raising expectations for a rally in the Tokyo stock market. The benchmark Nikkei 225 index, after hitting a 34-year high the previous day, showed a rise of around 1.7% on the same day. As of the morning session, it surpassed the 38,810 level, approaching the all-time high of 38,915 recorded at the end of 1989. Yasuhiko Kuramochi, a market strategist at Mizuho Securities, commented immediately after the market close the previous day, saying, "Overall earnings are strong," and "a new record high is approaching."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.