As the government is reportedly considering applying value-up programs to KOSDAQ-listed companies as well, the 'low PBR' craze is spreading across the entire stock market.

According to the Korea Exchange, as of the 24th of last month, trading volumes of low PBR-related exchange-traded funds (ETFs) have surged by up to several dozen times depending on the product. The KOSPI index, which had fallen to 2429.12, also rose more than 8% in about three weeks, surpassing the 2600 level.

PBR (Price-to-Book Ratio) is a figure that indicates how many times the stock price is traded relative to the net asset value per share, and is commonly used as a value investment indicator to evaluate a company's market value along with PER (Price-to-Earnings Ratio).

PBR can be easily calculated by dividing market capitalization by net assets, dividing the stock price by BPS (Book Value Per Share), or multiplying ROE (Return on Equity) by PER. If the PBR is below 1, it means the stock price is undervalued compared to the book value.

"Don't judge by PBR alone... Evaluate growth potential to distinguish the good from the bad"

Experts agree that buying low-priced stocks unconditionally is not the right answer, as low-priced stocks usually have reasons for their low prices, so caution is needed. They emphasize that instead of looking at PBR alone, it is necessary to evaluate actual shareholder return potential and growth prospects, such as continuous shareholder return policies and ROE improvement, to distinguish the good from the bad.

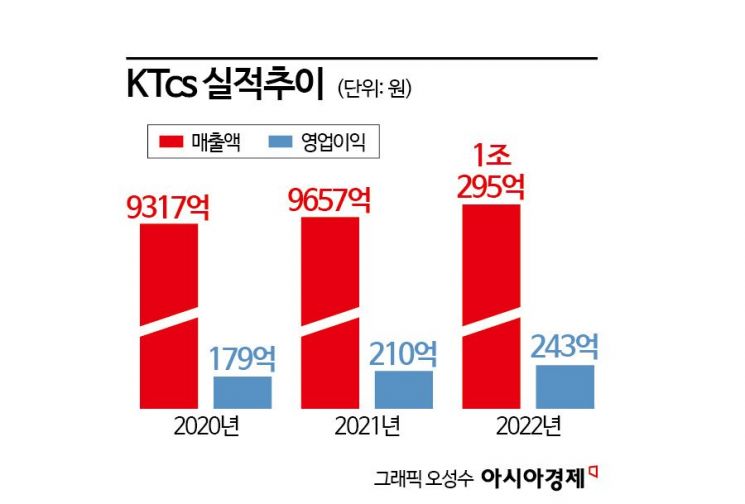

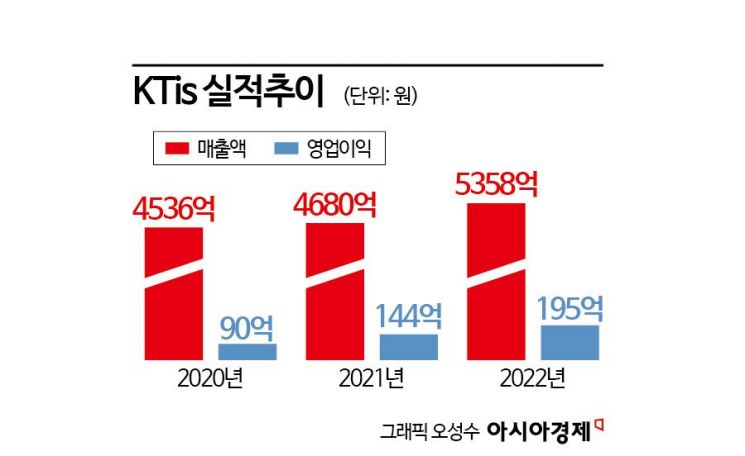

One method of evaluating the value of listed companies is to compare key investment indicators of the KOSPI and KOSDAQ indices with those of individual companies. Let's take KTcs and KTis, KOSPI-listed companies affiliated with KT, which recently announced their provisional 2023 earnings, as examples.

KTcs recorded sales of 635.2 billion KRW (107.4% year-on-year) and operating profit of 11.5 billion KRW (70.9% year-on-year), while KTis achieved sales of 593 billion KRW (110.7% year-on-year) and operating profit of 20.5 billion KRW (105% year-on-year).

Over the past three years (from the end of 2021 to the third quarter of 2023), the PBR and ROE of the KOSPI decreased by 0.25 times and 4.2 percentage points (p), respectively, while those of the KOSDAQ decreased by 0.56 times and 3.5 p, respectively.

In contrast, KTcs's PBR and ROE increased by 0.09 times and 2.3 p, respectively, while KTis's PBR decreased by 0.03 times and ROE increased by 3.1 p.

ROE (Return on Equity) is the most frequently mentioned indicator for stock selection amid the low PBR craze, and experts advise selecting stocks whose ROE is steadily rising or has significant potential to rise.

PBR can be calculated by multiplying ROE and PER. While PER is influenced by stock price and net income and cannot be artificially adjusted, ROE can be increased by lowering equity through returning retained earnings to shareholders via dividends, share buybacks, and cancellations.

It is also noteworthy that KTcs and KTis continue active shareholder return policies, including sustained dividend policies and purchasing treasury shares worth 5 billion KRW in 2022 (approximately 5.96% of KTcs's market capitalization and 6.75% of KTis's market capitalization).

The main business of KTcs and KTis is contact center operations, with a business proportion of 34.2% for KTcs and 61.8% for KTis on a consolidated basis as of the third quarter of last year.

Among these, the contact center outsourcing business for public institutions and general companies, i.e., contact centers of companies other than KT, recorded sales of about 95 billion KRW from the National Tax Service, LG Electronics, etc., for KTcs, and about 110 billion KRW from the Integrated Research Fund Management System of multiple ministries, KB Insurance, etc., for KTis.

The contact center business is one of the representative AI beneficiary businesses that has evolved into AICC (Artificial Intelligence Contact Center) by adopting AI technology and is leading in generating profits. Both companies are nurturing AICC as a future profit base business.

According to global market research firm Research and Markets, the AICC market is expected to grow from 11.5 billion USD (approximately 15.3 trillion KRW) in 2020 to 36.1 billion USD (approximately 48 trillion KRW) by 2025.

Meanwhile, financial authorities have been preparing a 'corporate value-up program' since the beginning of the year to encourage undervalued companies to devise shareholder return and stock price improvement measures themselves to resolve the Korea discount.

On the 24th of last month, Kim Ju-hyun, Chairman of the Financial Services Commission, revealed the implementation directions at a meeting with securities company CEOs, including ▲disclosure of comparisons of key investment indicators (PBR, ROE, etc.) by market capitalization and industry ▲recommendation to announce corporate value improvement plans ▲consideration of developing a Korea Premium Index (tentative name) composed of excellent companies that enhance corporate value.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.