KIDI "Comprehensive Coverage of Various Insurance Information"

The Korea Insurance Development Institute announced that it will officially open an insurance information big data platform, which gathers various knowledge, information, and statistics related to insurance in one place, on the 15th.

Until now, general consumers have found insurance difficult and felt it was not easy to find the information they wanted. In response, the Korea Insurance Development Institute built this platform to help improve consumers' access to and utilization of information by allowing them to easily use various services in one place.

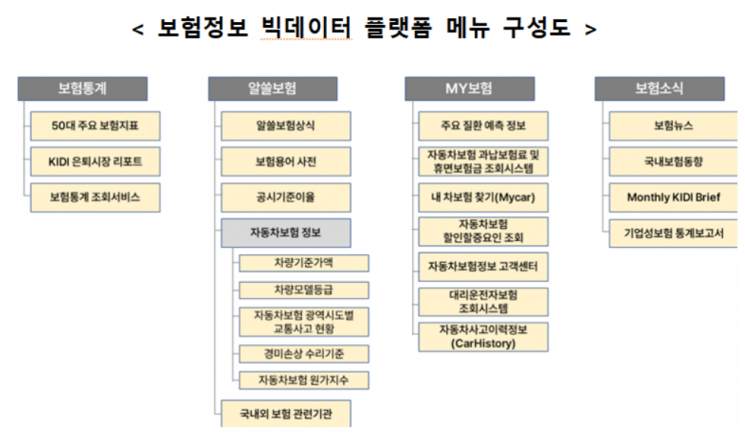

The platform is mainly composed of 23 services categorized into four sections: 'MY Insurance', 'Useful Insurance', 'Insurance Statistics', and 'Insurance News'. In MY Insurance, users can check the insurance they have subscribed to and the insurance they need, such as 'Major Disease Prediction' based on health checkup information and 'Automobile Dormant Insurance Refund Inquiry' providing insurance refund information.

Useful Insurance provides practical insurance information such as insurance terms and knowledge, as well as the standard vehicle value and vehicle model grade of one’s car.

Insurance Statistics consists of menus that allow easy and convenient access to insurance-related statistics, such as the annual insurance premium paid per person and the number of automobile insurance subscriptions.

Insurance News gathers the latest research materials and press releases related to insurance, including recently published academic papers and amendments to laws and regulations.

The 'Insurance Information Big Data Platform', which provides everything from insurance knowledge to expert knowledge and statistics, is expected to be useful not only for general consumers but also for insurance major students and various other users.

Heo Chang-eon, President of the Korea Insurance Development Institute, said, “We created new services where none existed and gathered ongoing services in one place,” adding, “We plan to continuously develop this big data platform, where diverse information tailored to consumers’ perspectives is collected, utilized, and disseminated, so that insurance can be more easily accessible to the public.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.