UK Semiconductor Design Company Arm Stock Soars

Total Assets 20.2 Trillion Won, Ranked Around 30th Worldwide

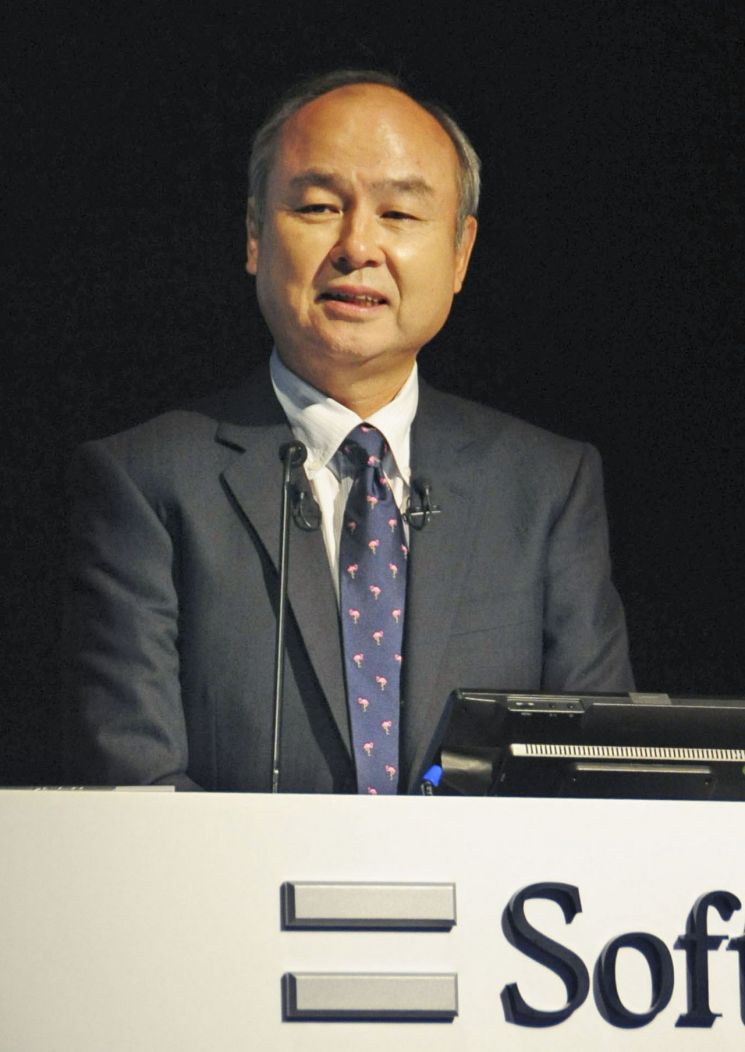

Bloomberg reported on the 13th (local time) that SoftBank Chairman Masayoshi Son's net worth has increased by $3.8 billion (approximately 5 trillion KRW) this year, thanks to the sharp rise in shares of the UK semiconductor design company Arm.

As of the 13th, Son's assets stood at $15.1 billion (about 20 trillion KRW), significantly up from $11.3 billion (about 15 trillion KRW) at the end of last year. According to the Bloomberg Billionaires Index, he ranks within the top 30 among the world's 500 richest people.

The increase in Son's assets is attributed to the rise in Arm's stock price, a UK semiconductor design firm in which SoftBank holds a 90% stake. Since Arm's earnings announcement on the 7th, its stock price surged 90% over three days, nearly tripling from the initial public offering price of $51. Riding this momentum, SoftBank's stock, in which Son holds about one-third of the shares, is trading near its highest level in three years.

Masahiro Yamaguchi, a senior analyst at SMBC Trust Bank, said, "Since the assets held by SoftBank are maintaining an upward trend, there is still room for SoftBank's stock price to rise." He added, "While Arm's stock price increase may seem overheated, it remains attractively priced if supported by solid future earnings growth." However, he noted, "NVIDIA's earnings report next week will serve as a milestone to gauge whether Arm's recent surge has been excessive."

Victor Galliano, an analyst at Smartkarma, pointed out that Arm's stock price is excessively overvalued based on the fact that NVIDIA, which shows similar growth, has an expected PER about half that of Arm. Kirk Buddree of Astris Advisory also warned, "Arm's price relative to net earnings is seriously high."

Meanwhile, SoftBank's stock is still trading at a level significantly below its net asset value. This is attributed to the Vision Fund, SoftBank's major asset, still suffering losses due to the post-pandemic downturn.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)