Last Year’s Record Annual Sales of 2.2696 Trillion KRW

Strong Performance in Key Areas Including Games, Payments, and Advertising

Operating Profit of 55.5 Billion KRW... Up 42.2% Year-on-Year

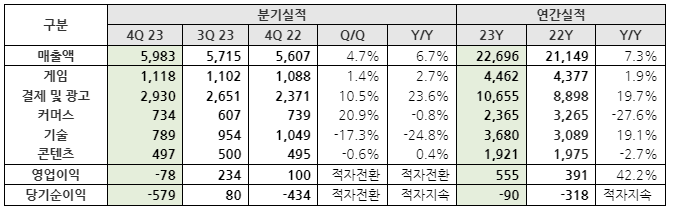

NHN announced on the 14th that it recorded consolidated sales of KRW 2.2696 trillion and operating profit of KRW 55.5 billion last year. Sales increased by 7.3% compared to the previous year, and operating profit rose by 42.2%.

In the fourth quarter of last year, sales reached a quarterly record high of KRW 598.3 billion, up 6.7% year-on-year. However, due to one-off factors such as the recognition of bad debt write-offs for long-term uncollected receivables in the commerce division and the deduction of previously recognized sales in the technology division, an operating loss of KRW 7.8 billion was recorded, turning to a deficit compared to the same period last year.

Looking at the sales by division in the fourth quarter, the gaming division recorded KRW 111.8 billion, up 2.7% year-on-year, driven by growth in the mobile gaming sector. Mobile web board game sales increased by 7.4% year-on-year, and overall mobile game sales rose 4.9% year-on-year due to the collaboration effect of the new title Uparu Odyssey and Japan's Compass.

The payment and advertising division achieved KRW 293 billion, up 23.6% year-on-year, thanks to growth centered on NHN Payco's core business and an increase in payment volume from major domestic and overseas merchants of NHN KCP. In particular, Payco recorded a transaction amount contributing to sales of KRW 1.4 trillion, up 11% year-on-year, composed of point payments, coupons, and corporate welfare solutions, maintaining a stable growth trend.

The commerce division saw a 0.8% decrease year-on-year due to continued uncertain external conditions but recorded KRW 73.4 billion, up 20.9% quarter-on-quarter, due to changes in the fee structure of NHN Global in the U.S.

The technology division recorded KRW 78.9 billion, down 24.8% year-on-year, as steady growth continued in the private and financial cloud sectors, but some sales were deducted due to temporary delays in service provision for public projects under contract.

The content division's performance showed a 0.4% increase year-on-year to KRW 49.7 billion. NHN Comico continues to maintain stable traffic centered on the romance fantasy genre, and NHN Link is experiencing continuous growth in sales related to concert ticket sales and content production even after the end of the professional baseball season.

NHN plans to focus on business this year with the goal of achieving the largest operating profit in its history. In particular, following a 38.2% decrease in annual marketing expenses last year compared to the previous year, the company intends to continue this cost control trend this year and focus on improving the fundamentals of each business.

In the gaming business, NHN will further expand the user base of web board games with differentiated content unique to Hangame, and especially plans to present various events in the second half of the year to celebrate the 10th anniversary of the release of ‘Mobile Poker.’ Additionally, ‘Uparu Odyssey,’ which laid a successful foundation in Korea after its release in October last year, will launch globally in June this year, and ‘Darkest Days’ will start recruiting CBT testers from the end of February, conduct the first CBT at the end of March to verify gameplay, and officially launch in the third quarter of this year.

NHN Payco continued its profitability improvement trend by achieving the lowest quarterly operating loss in the fourth quarter, resulting in an annual operating loss of KRW 15.7 billion last year, an improvement of KRW 33.9 billion compared to the previous year. Payco plans to focus on solid growth centered on its core business this year with the goal of turning profitable by 2025.

NHN Cloud plans to actively respond to the rapidly increasing domestic AI infrastructure demand and contribute to the creation of the AI ecosystem based on industry-leading infrastructure capabilities such as the ‘Gwangju National AI Data Center.’ NHN Tecorus, which operates an MSP business in Japan, expects sales to increase by more than 30% this year, building on a 27.5% year-on-year increase in annual sales last year and a strategic collaboration agreement with Amazon AWS signed in January.

Meanwhile, NHN announced a shareholder return policy totaling KRW 66.6 billion, including the company's first-ever cash dividend since its founding, share repurchases, and share cancellations. The year-end cash dividend is KRW 500 per share, totaling KRW 16.9 billion. It is scheduled to be paid in April after approval at the shareholders' meeting next month.

The company will begin purchasing approximately 790,000 shares worth KRW 20 billion starting today. Additionally, about 1.17 million shares (KRW 29.7 billion), equivalent to 3.4% of the total issued shares, will be canceled on the 26th of this month.

Jung Woo-jin, CEO of NHN, said, “This year, NHN aims to achieve the highest operating profit ever and will continue a profitability-centered internal management policy. We also plan to strengthen our shareholder return policy so that we can share the company's profit growth with our shareholders.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.