KCCI Analyzes Sales Data from 6,500 Offline Retail Stores

Consumer Goods Market Growth Rate 6 Times Higher

Convenience Stores Lead Growth at 19.3%

It has been found that sales of private brand (PB) products significantly increased last year due to the impact of economic recession and high inflation.

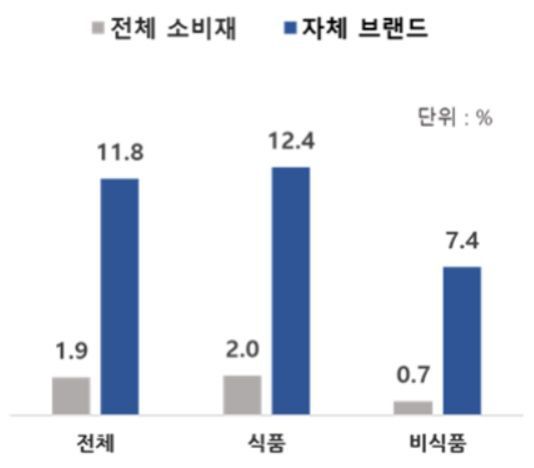

The Korea Chamber of Commerce and Industry announced on the 14th that according to the analysis of 'Retailers' PB Product Sales' conducted by the global market research firm NielsenIQ (NIQ), the domestic PB product market size grew by 11.8% year-on-year over the past year (Q4 2022 to Q3 2023). During the same period, the overall consumer goods market grew by only 1.9%, showing a difference of about six times.

PB refers to products produced in cooperation with manufacturers by retailers and released under their own brand names, such as Emart No Brand, Lotte Only Price, and GS25 Yours. By reducing marketing and distribution costs and lowering consumer prices, PB products have gained popularity in the era of high inflation.

The Korea Chamber of Commerce and Industry analyzed, "As consumer prices sharply rose last year, price-sensitive consumers increased their purchases of PB products, which are inexpensive relative to quality."

The growth trend of the PB market was more prominent in the food sector than in non-food. Last year, the non-food sector market growth rate was 7.4%, whereas food recorded a growth rate of 12.4%, driving the overall PB market growth. This is interpreted as consumers with weakened spending sentiment reducing unnecessary non-food expenditures while maintaining consumption activities focused on essentials such as food and beverages.

The offline retail format with the highest PB share of total sales was large discount stores (8.7%). Corporate Supermarkets (SSM, 5.3%) and convenience stores (4.1%) followed. In terms of PB sales growth rate, convenience stores stood out the most. While all major formats recorded higher growth rates compared to the overall consumer goods market, convenience stores had the highest at 19.3%, followed by large discount stores (10.3%) and SSM (5.7%).

Meanwhile, the share of PB sales in the entire consumer goods market in South Korea was 4%, with food and non-food accounting for 3.9% and 4.6%, respectively. As of Q3 last year, the global PB sales share in the overall consumer goods market was 21%, with South Korea recording a lower level compared to Europe (32.4%), Hong Kong (13%), and Singapore (6%).

Jang Geun-mu, Director of the Korea Chamber of Commerce and Industry’s Distribution and Logistics Promotion Institute, said, "In Europe, the PB market grew significantly as practical consumption patterns were established during periods of economic stagnation, and South Korea is recently showing a similar trend. Considering that the global retail industry’s average PB share is 21%, the domestic market is expected to continue growing, so retailers need to further strengthen their PB lineups."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)