Includes all small financial sectors such as Savings Banks, Mutual Finance, and Credit Card Companies... Separate Application Required

First Refund on March 29, 1.8 Trillion KRW to be Distributed to 240,000 People

'Low-Interest Refinancing Program' Eligibility Extended to May 31 of Last Year

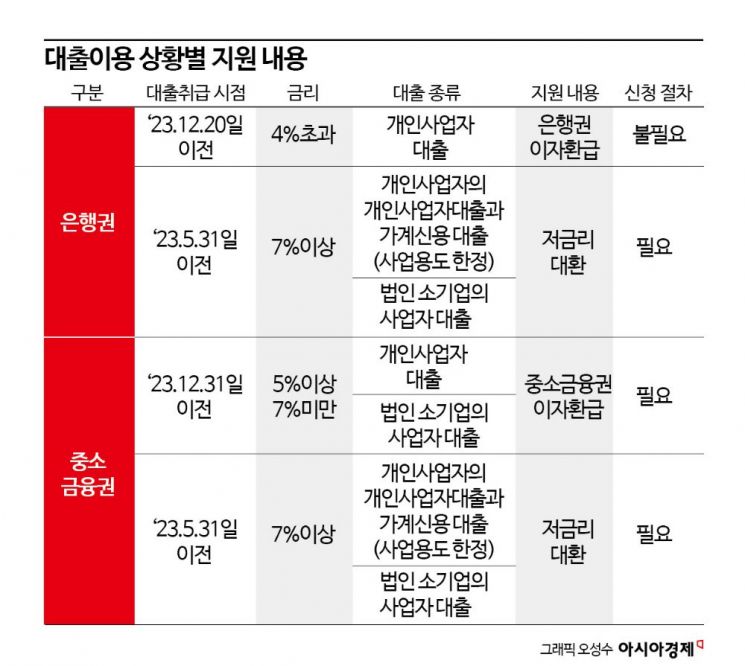

The interest refund (cashback) program prepared by financial authorities and banks for small business owners was completed in the first phase by the 8th, and now the secondary financial sector?including savings banks, mutual finance institutions (Nong, Su, Shinhan cooperatives, forestry cooperatives, Saemaeul Geumgo), and credit card companies and capital companies?is sequentially starting refunds for small business owners who took out high-interest loans at rates of 5-7%.

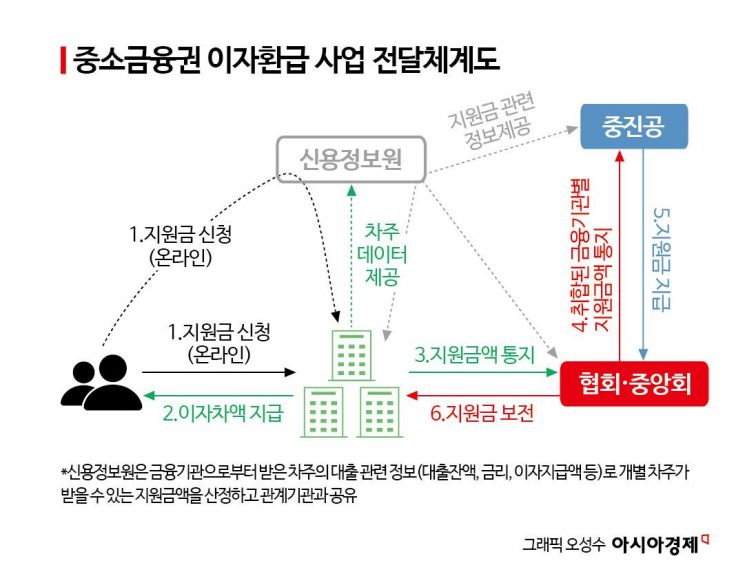

According to the financial sector on the 12th, ahead of the implementation of the secondary financial sector’s interest cashback program scheduled for the end of March, the financial authorities are building a system to provide information on subsidies among related organizations such as the Credit Information Center, associations and central organizations, and the Small and Medium Business Corporation. Unlike the interest cashback program conducted by banks, the secondary financial sector’s cashback will be executed through about 3,600 financial institutions and requires a separate application procedure.

Since it is difficult for the secondary financial sector to operate the interest cashback program with its own funds, the National Assembly approved a budget of 300 billion KRW on December 21 last year to reduce the interest burden on borrowers in the secondary financial sector. Based on this budget, from the end of March, secondary financial institutions will refund part of the interest paid by eligible borrowers, and the Small and Medium Business Corporation will reimburse the refunded amount to the respective financial institutions as financial support.

The estimated number of eligible recipients is about 400,000. These are individual business owners and small corporations holding business loans with interest rates between 5% and less than 7% in the secondary financial sector as of December 31 last year. Certain industries, such as real estate rental, are excluded from eligibility. The maximum loan amount eligible for interest support per person is 100 million KRW, and the maximum refund amount per individual is 1.5 million KRW.

Regarding interest rate brackets, for loans with rates between 5.0% and 5.5%, a uniform 0.5 percentage point (p) is applied to refund interest; for rates between 5.5% and 6.5%, the difference between the applied rate and 5% is reflected in the interest support; and for rates between 6.5% and 7.0%, a uniform 1.5%p is applied to refund interest. For example, if the loan balance is 80 million KRW with an interest rate of 6%, the one-year interest difference is 800,000 KRW {80 million KRW × 1%p (6% - 5%)}.

The refunded interest will be paid quarterly at the end of March 29, June 28, September 30, and December 13. Borrowers who have paid interest for more than one year as of the quarter-end date will receive a one-year interest refund. If the loan contract period does not exceed one year before March 29, the borrower can receive the refunded interest amount at the end of the upcoming quarter after paying interest for one year.

It is important to note that unlike the refund procedure in the banking sector, since the 300 billion KRW secured by the Small and Medium Business Corporation is used as the funding source, a borrower’s consent for information provision is required, and a separate application procedure is necessary. The financial authorities expect that if all eligible recipients apply, about 240,000 small business owners will receive an average of 750,000 KRW each in the first quarter, totaling 180 billion KRW.

A financial authority official explained, "Once the related organizations’ IT systems are established and various preliminary tests are completed, applications will be accepted from eligible borrowers around mid-March," adding, "Detailed information on the support method and procedures will be disclosed in early March."

Meanwhile, the financial authorities will also expand and reorganize the 'low-interest refinancing program' that has been underway since September last year. Considering the purpose of the low-interest refinancing program to support small business owners struggling with high-interest loans that inevitably increased during the COVID-19 recovery process, the eligibility period for loans subject to refinancing will be extended to May 31, 2023, when the COVID-19 crisis level remained 'severe.'

Additionally, after refinancing, the loan interest rate will be capped at a maximum of 5.0% (down from the previous 5.5%) for one year, and the guarantee fee of 0.7% will be waived, reducing the cost burden by up to 1.2%. The revised refinancing program will reflect the expanded eligible loans in a dedicated refinancing program database (DB) and will be implemented in the first quarter of this year after credit guarantee fund contributions by banks for guarantee fee reductions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.