Last Month's Nationwide Buy-Sell Index 21.2, Up 2.4P from Previous Month

Rises for First Time in 4 Months... Trading Volume Also Rebounds

Experts Say "Temporary Recovery... Need to Monitor Trading Activation"

Last month, the real estate sentiment index turned upward for the first time in four months. Apartment transaction volumes in the Seoul metropolitan area also increased slightly. These figures suggest that the economy has gained momentum since the government announced measures to revitalize the real estate market earlier this year. However, experts analyzed this market sentiment shift as a kind of 'flash' recovery. They expressed opinions that it may be insufficient to serve as a catalyst to reverse the sluggish market atmosphere.

Three Major Real Estate Sentiment Indices Slightly Rise... Housing Transaction Volume Also ↑

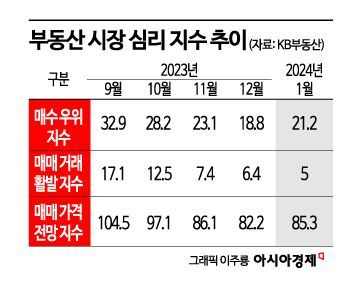

According to KB Real Estate on the 8th, last month, the nationwide Buyer Dominance Index was 21.2, up 2.4 points from the previous month (18.8). This marks a rebound after four months. This figure had peaked at 32.9 in September last year and then continuously declined from 28.2 in October to 23.1 in November. The Buyer Dominance Index is based on 100, with lower values indicating fewer buyers.

Along with the Buyer Dominance Index, the Real Estate Market Sentiment is also reflected in the Active Transaction Index and the Price Expectation Index, both of which showed signs of recovery. The Active Transaction Index rose 1.4 points from 5 in December last year to 6.4 last month. This figure had also been declining from 17.1 in September to 12.5 in October and 7.4 in November before turning upward after four months. A higher Active Transaction Index indicates more active transactions, while a lower one indicates sluggishness.

The Price Expectation Index increased from 82.2 to 85.3 during the same period, indicating that more people expect prices to rise. This index had been falling from 104.5 in September last year to 97.1 in October and then 86.1 in November.

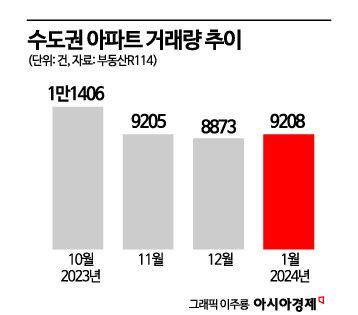

Apartment transaction volumes increased slightly. According to Real Estate R114, the number of apartment transactions in the Seoul metropolitan area, which had been declining from 11,406 in October last year to 9,205 in November and 8,873 in December, rebounded to 9,208 last month. The increase was driven by Gyeonggi Province, which rose from 5,728 transactions in December last year to 5,970 in January this year, and Incheon, which increased from 1,353 to 1,536 during the same period.

Effects of GTX, Relaxation of Reconstruction Regulations... "Possibility of Decline Still Remains"

There is an analysis that the announcement of the Seoul Metropolitan Area Express Train (GTX) routes and the passage of the Special Act on Old Planned Cities acted as positive factors. Yeokyung Hee, a researcher at Real Estate R114, explained, "Transaction volumes increased mainly in Gyeonggi areas such as Deokyang-gu in Goyang, Siheung City, Yeongtong-gu in Suwon, Giheung-gu in Yongin, and Hwaseong City," adding, "Their commonality is that these areas are expected to have higher future value due to development prospects."

The reduction in mortgage loan interest rates, which eased the burden of purchasing homes somewhat, also appears to have influenced the increase in transactions. Yoon Sumin, a real estate specialist at NH Nonghyup Bank, said, "Since the end of December last year, mortgage loan interest rates in the 3% range have started to appear, and with the introduction of refinancing loan platforms, a temporary rebound opportunity seems to have been created." The lower bound of mortgage loan interest rates at the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?fell from the mid-4% range at the end of last year to the low 4% range this month for variable rates, and from the mid-3% range to the low 3% range for fixed (hybrid) rates.

Some voices point out that this change in sentiment is a temporary recovery. They argue that it is only a 'flash' recovery and cannot be seen as a shift to a major upward phase in the real estate market. Kim Inman, director of Kim Inman Real Estate Economic Research Institute, said, "As the frozen real estate market thaws, those who had postponed buying are gradually purchasing, but it is difficult to view this as a major uptrend or a reversal of the overall atmosphere." Researcher Ye also noted, "Since transactions are mainly occurring with urgent sale properties, it is necessary to observe whether this will lead to price increases and transaction activation," adding, "Concerns about a decline remain due to factors such as the 'Stress DSR (Debt Service Ratio)' to be implemented this month."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.