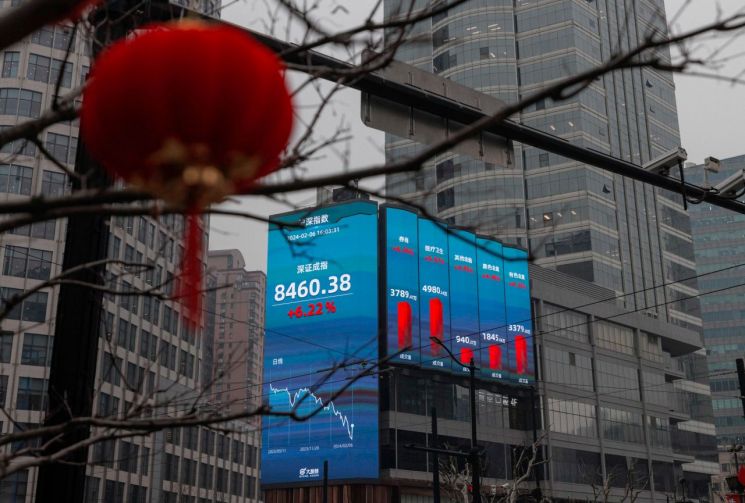

China's stock market closed higher on the 7th amid expectations of government stimulus measures. The positive news that poured in the previous day continued to exert influence, driving the upward trend.

On this day, the Shanghai Composite Index closed at 2829.7, up 1.44% from the previous day, while the Shenzhen Component Index rose 2.93% to 8708.24. The CSI300 Index, a major Chinese benchmark, increased by 0.96% to 3343.63, and the small-cap focused CSI1000 Index surged 4.47% to 4797.85. In contrast, the Hang Seng Index fell 0.40% to 16,072.38, and the Hang Seng China Enterprises Index (Hong Kong H Index) closed down 0.95% at 5421.53.

The market is increasingly optimistic that Chinese authorities will discuss various measures to support the stock market. The day before, Central Huijin, an investment firm affiliated with China's sovereign wealth fund, announced plans to increase investments in China equity-linked ETFs to stabilize the capital market. Meanwhile, the China Securities Regulatory Commission (CSRC) announced plans to attract more mutual and private funds, brokerage firms, and social security funds to the market, and to encourage more share buybacks as ways to bring in new capital and maintain market stability.

On the same day before market close, Bloomberg reported that Chinese President Xi Jinping is scheduled to receive direct briefings on stock market developments, giving the impression that the country's top leader is personally overseeing the market, which acted as a positive factor. Earlier, major foreign media reported last month that the Chinese government is considering establishing a stock market stabilization fund worth 2 trillion yuan (approximately 368.94 trillion KRW).

However, some market participants warn that the recent rally could worsen the situation. Brock Silvers, Chief Investment Officer at Kaiyuan Capital in Hong Kong, told the South China Morning Post (SCMP) that "the current rally may ultimately be seen as an exit for investors," and predicted that "authorities are unlikely to provide long-term relief measures." He added, "Artificial restrictions by authorities on short selling and derivatives will not change the negative sentiment toward the Chinese stock market."

Meanwhile, the Chinese mainland stock market will be closed from the 9th to the 16th of this month for the Lunar New Year holiday. Hong Kong will have half-day trading on the 9th and will be closed on the 12th and 13th.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)