Korean Battery Top 3 Hold 23.1% Market Share

According to SNE Research Results

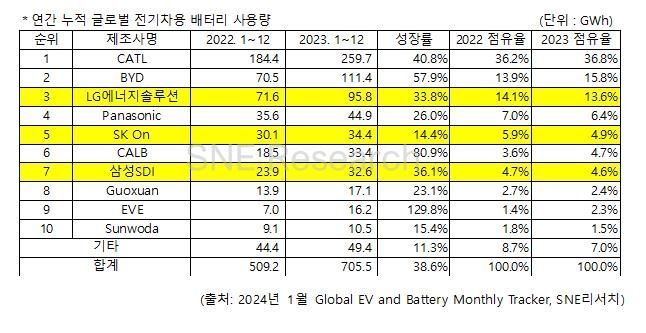

Despite the slowdown in electric vehicle growth, the usage of batteries for electric vehicles increased by 38.6% year-on-year last year. China's CATL and BYD ranked first and second respectively. The market share of the three Korean battery companies recorded 23.1%, down 1.6 percentage points (p) from the previous year.

According to market research firm SNE Research on the 7th, the total battery usage installed in electric vehicles (EV, PHEV, HEV included) registered in various countries from January to December 2023 was approximately 705.5 gigawatt-hours (GWh), an increase of 38.6% compared to the same period last year.

By company, China's CATL took first place with a 36.8% market share, growing 40.8% from the previous year. CATL maintains a solid market share by supplying batteries not only to the domestic Chinese market but also to global vehicles such as Tesla Model 3/Y, BMW iX, and Mercedes EQS.

BYD ranked second with a 15.8% market share, achieving an impressive growth rate of 57.9%. BYD has secured price competitiveness by establishing a vertically integrated supply chain management (SCM) that includes both battery supply and vehicle manufacturing.

Third place was LG Energy Solution (13.6%), which grew 33.8% compared to the previous year. LG Energy Solution supplies batteries to vehicles popular in Europe and North America, such as Tesla Model 3/Y, Volkswagen ID. series, and Ford Mustang Mach-E.

LG Energy Solution plans to maintain its market leadership by accelerating the development of high-voltage mid-nickel ternary batteries and lithium iron phosphate (LFP) battery technology, as well as by commencing full-scale mass production of 46mm cylindrical batteries.

SK On (4.9%) and Samsung SDI (4.6%) ranked fifth and seventh, respectively.

SK On supplies batteries to Hyundai Ioniq 5, Kia EV6/EV9, and Ford F-150 Lightning. Recently, SK On has reportedly completed significant development of prismatic and LFP batteries, which are in high demand in the market, raising expectations for market share expansion primarily in North America. Samsung SDI supplies batteries to BMW iX/i4/i7, Audi Q8 e-tron, Fiat 500e, and Rivian R1T/R1S.

Japan's Panasonic ranked fourth with a 6.4% market share, while China's CALB ranked sixth with 4.7%.

Panasonic, one of Tesla's major battery suppliers, grew 26.0% year-on-year. A significant portion of Panasonic's battery usage comes from batteries installed in Tesla Model Y vehicles in the North American market. Panasonic is reportedly planning to launch improved 2170 and 4680 cylindrical batteries.

Despite the strong performance of Korean companies over the past year, they could not match the quantitative growth of Chinese companies. BYD, which held a 13.9% market share and ranked third in 2022, overtook LG Energy Solution to take second place this year. The rankings of CALB and Samsung SDI also reversed. Among the top 10 companies, six are Chinese, three are Korean, and one is Japanese.

The 2023 electric vehicle market has entered a chasm phase where early adopter-driven initial demand has ended, and growth has stagnated due to high interest rates, high inflation, and economic downturn. Major electric vehicle manufacturers are adjusting production volumes, and the decline in prices of key secondary battery minerals has reduced profitability for battery-related companies.

The industry is concerned that the secondary battery market conditions may worsen further this year. SNE Research stated, "Due to the carbon neutrality policies and strengthened carbon regulations of major countries, the electric vehicle market will overcome short-term growing pains and continue sustainable growth in the mid to long term. In particular, significant investments aimed at maintaining competitiveness and improving profitability are expected, especially in the North American market where electric vehicle penetration is relatively low."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.