Stable Income and Tax Benefits Popular

KB Securities 3-Year Maturity Product

Interest Payment Suspended for the First Time Last Month

Chinese Government's Large-Scale Stock Market Boost

Short-Term Rebound Expected for H Index

Interest Payments May Resume

"The private banker (PB) at the bank who recommended the product explained that if U.S. interest rates are cut, the Hong Kong stock market will rebound. Although there is still a long time until maturity, the index has been plummeting day after day, so I can't help but feel uneasy." (Investor A)

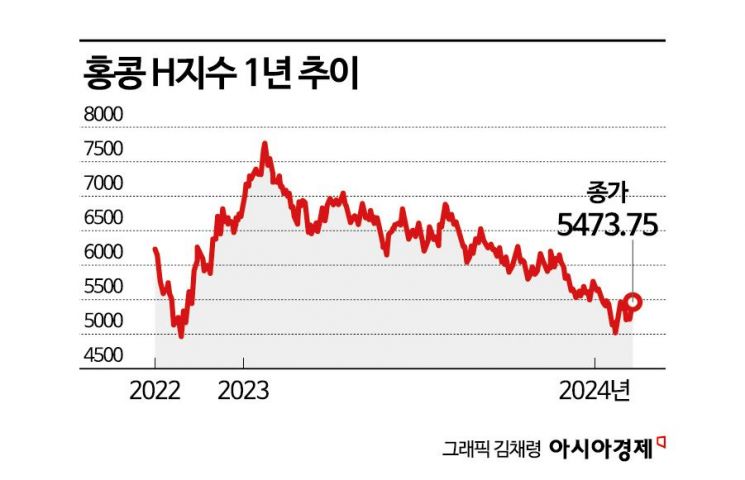

Amid the growing fallout from the 'Hong Kong H Index (Hang Seng China Enterprises Index) Equity-Linked Securities (ELS) crisis,' it has been confirmed that some monthly payment ELS products have also suspended their January monthly interest payments. However, as the Chinese government continues to roll out large-scale stock market stimulus measures, there is hope for a short-term rebound in the H Index and a resumption of interest payments.

According to the financial investment industry and the Korea Securities Depository on the 7th, KB Securities' 'KB Securities 7812 ELS,' a 3-year maturity product issued in January 2022, failed to pay monthly interest for the first time on the 19th evaluation date, January 10. This was because among the three underlying assets?the Hong Kong H Index, the U.S. S&P 500 Index, and the Euro Stoxx 50 Index?the H Index did not meet the monthly income payment condition of 'at least 65% of the strike price' at the initial reference price determination date. On that day, the H Index closed at 5421.23, below the monthly income payment threshold of 5437.5. A total of 7.8 billion KRW worth of this product was sold through commercial banks and others.

This product is a no knock-in (No Knock-in) type monthly payment ELS that pays income amounts if the monthly payment barrier is met each month. Originally, monthly payment ELS were considered relatively stable sources of income among investors because even if a final loss is confirmed at maturity, there is no need to return the monthly income already paid. The tax-saving effect was also a popular factor.

The fact that the Chinese government is continuously introducing large-scale stock market stimulus measures is positive. China’s sovereign wealth fund, Central Huijin Investment Ltd., announced, "We will continue to increase holdings of exchange-traded funds (ETFs) to maintain smooth operation of the capital market." Despite the People's Bank of China governor announcing a reserve requirement ratio cut plan on the 24th of last month (local time), foreign capital outflows continued, prompting the government to hurriedly introduce additional stimulus measures. The Hong Kong H Index closed on the 6th at 5473.75, up 4.91% from the previous session.

While the short-term outlook is hopeful, long-term concerns remain greater. If the Hong Kong H Index maintains its current level, KB Securities 7812 ELS investors can expect to meet the monthly income payment threshold (5437.25) on the next evaluation date, February 10, and anticipate the resumption of interest payments. A financial investment industry official explained, "Typical monthly payment ELS apply the monthly payment barrier retroactively on each evaluation date, so whether payment was made the previous month does not affect the following month."

However, being a monthly payment ELS does not free investors from the possibility of losses at maturity. In this product’s case, there is a condition that each underlying asset must record at least 65% of the initial reference price on the maturity evaluation date. The loss rate is reflected according to the price of the underlying asset with the largest drop, corresponding to the index decline. Since early redemption is unlikely, it has become increasingly necessary to monitor the index until maturity repayment.

Since 2022, despite reopening, the Chinese stock market has shown signs of contraction as the real economy recovery has fallen short of expectations. Last July, the consumer price inflation rate recorded minus (-) 0.3%, leading to assessments that China is facing deflation (a decline in prices) due to insufficient aggregate demand. Moon Nam-jung, Global Strategist at Daishin Securities, noted, "This year, China’s economy and stock market are at a crossroads, either emerging from a dark and gloomy manhole or descending into a deeper pit," emphasizing that "ultimately, a recovery in the real estate market is urgently needed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)