Decline in ELS Issuance Amount Continues for 3 Consecutive Months

Significant Decrease in ELS Issuance Related to Hong Kong H Index

Early Redemption Also Delayed

The large-scale losses in Hong Kong H Index (Hang Seng China Enterprises Index) equity-linked securities (ELS) have materialized, leading to a contraction in the ELS market. The issuance amount has been continuously decreasing. In particular, the issuance of ELS based on the Hong Kong H Index has significantly declined.

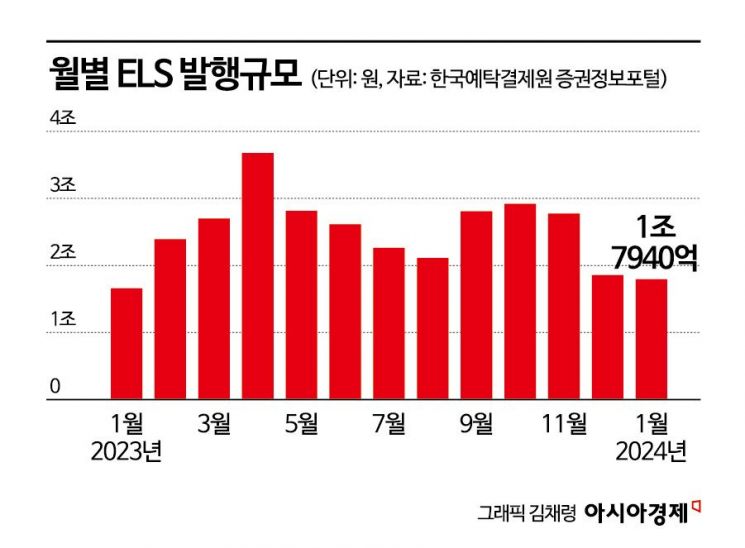

According to the Korea Securities Depository's securities information portal (SAVRO) on the 7th, the issuance amount of ELS in January this year recorded 1.794 trillion KRW, continuing the downward trend. The issuance amount of ELS has been steadily decreasing since it reached around 3.6 trillion KRW in April last year. Although there was a brief increase in September to October last year, it returned to a decline in November and fell below 2 trillion KRW in December.

This decrease in issuance amount is interpreted as a repercussion of the Hong Kong H Index ELS loss incident. Jeong In-ji, a researcher at Yuanta Securities, explained, "Concerns related to the Hong Kong H Index are at the core of the decrease in ELS issuance amount," adding, "The occurrence or anticipation of large-scale maturity losses related to the Hong Kong H Index is causing the issuance of ELS itself to shrink."

In particular, the issuance of ELS related to the Hong Kong H Index has sharply declined. The issuance amount of ELS based on the Hong Kong H Index recorded 35.07705 billion KRW in January this year. This is a significant decrease compared to 112.97567 billion KRW in January last year. The Hong Kong H Index ranked 5th in the issuance scale of ELS underlying assets in January last year but dropped to 9th place in January this year. Researcher Jeong said, "The issuance ratio of ELS related to the Hong Kong H Index is plummeting," noting, "It used to account for about 20% of the total issuance amount, but it decreased to 14% in December last year and fell to around 2% in January this year."

The impact of the Hong Kong H Index ELS is also delaying early redemptions. ELS issued in July last year mostly entered their first interim evaluation in January this year, but 18% of them failed early redemption. Researcher Jeong pointed out, "About 69% of the amount that failed early redemption includes the Hong Kong H Index as the underlying asset," adding, "The remaining 31% mostly consists of stock-type or mixed-type ELS including stocks such as LG Chem. Among index-type ELS, the most problematic underlying asset for early redemption is the Hong Kong H Index."

The ELS redemption amount in January this year was 3.511 trillion KRW, with early redemption amounting to about 2.308 trillion KRW, resulting in an early redemption rate of 65.7%. This is a sharp drop from the usual early redemption rate exceeding 90%. Although the scale of early redemptions itself decreased, the increase in maturity redemptions and mid-term redemptions is interpreted as a cause for the decline in the early redemption rate. ELS related to the Hong Kong H Index that did not meet conditions at the early redemption stage were redeemed at maturity, and some investors in Hong Kong H Index ELS decided on mid-term redemption, leading to an increase in maturity and mid-term redemptions.

Researcher Jeong In-ji said, "Most of the ELS redeemed at maturity are related to the Hong Kong H Index, and the volume redeemed in January this year was issued in January 2021," adding, "Among the maturity redemption amount, 917.2 billion KRW is related to Hong Kong H Index ELS, and the remaining volume does not include the Hong Kong H Index."

The estimated loss amount for Hong Kong H Index ELS maturing this year is about 7 trillion KRW. Jeong Yeon-hong, a researcher at Mirae Asset Securities, explained, "The large-scale issuance of Hong Kong H Index ELS in 2021 failed early redemption, leading to 15 trillion KRW maturing this year with an estimated loss of around 7 trillion KRW," adding, "The maturities are front-loaded with 10 trillion KRW in the first half and 5 trillion KRW in the second half, and monthly, it will peak at 2.7 trillion KRW in April and then follow a downward curve."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)