Steady investments in the domestic pharmaceutical and bio industries are showing results in the form of improved performance. Traditional pharmaceutical companies have driven increased domestic and international sales with their self-developed new drugs, and performance expansion through technology exports has continued. The Contract Development and Manufacturing Organization (CDMO) sector recorded its highest-ever performance last year by expanding production facilities.

Daewoong Pharmaceutical posted its best-ever performance last year with consolidated sales of KRW 1.3753 trillion and operating profit of KRW 122.6 billion. The company self-assessed that "the sustained growth of prescription drugs such as the domestic new drugs 'Pexuclu' and 'Enblo,' as well as the botulinum toxin 'Nabota,' which is performing well in the global market, was effective." Pexuclu, a new drug for gastroesophageal reflux disease launched in 2022 (accumulated sales of KRW 72 billion), and Nabota (KRW 147 billion) led the sales increase. SK Biopharm succeeded in turning a profit in the fourth quarter last year, driven by strong sales of the epilepsy treatment 'Cenobamate.' An SK Biopharm official stated, "Previous profit turnarounds were due to one-time revenues such as licenses," and added, "This profit turnaround is significant because it was achieved through growth in sales revenue."

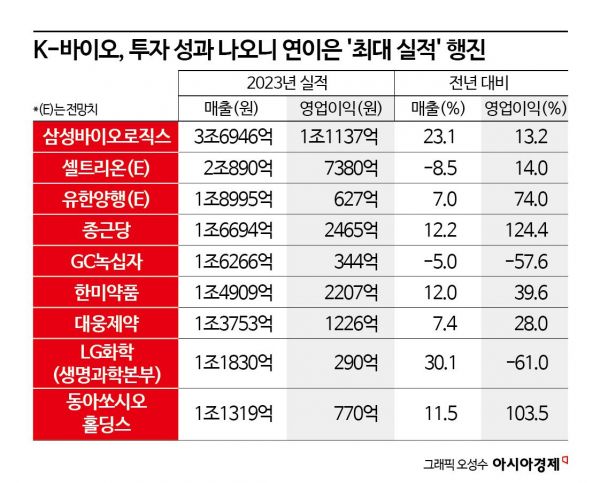

Chong Kun Dang Pharmaceutical and Hanmi Pharmaceutical saw their sales soar thanks to large-scale technology exports. Chong Kun Dang's operating profit increased by 124% year-on-year to KRW 246.6 billion, supported by technology exports of new drug candidate substances. The contract payment of USD 80 million (approximately KRW 106.6 billion) received from Novartis in November last year for the technology export of 'CKD-510,' being developed as a treatment for Charcot-Marie-Tooth disease and atrial fibrillation, contributed to this. Hanmi Pharmaceutical recorded its highest-ever sales last year with KRW 1.4909 trillion. Milestones from the entry into phase 2b clinical trials of the non-alcoholic steatohepatitis treatment epinofegduotide, licensed to MSD, and growth of self-developed improved and combination new drugs contributed to the strong performance.

This year, cases of sales growth through new drug sales are expected to continue steadily. Celltrion will launch the autoimmune disease treatment new drug 'Zimpentra' in the U.S. market on the 29th. The company expects Zimpentra to generate KRW 600 billion in sales in the U.S. alone this year. Securities firms predict that Celltrion will achieve sales of KRW 2.563 trillion, a 22.7% increase this year, driven by contributions from Zimpentra and biosimilars.

Yuhan Corporation is also expected to exceed KRW 2 trillion in annual sales for the first time among traditional pharmaceutical companies this year, as domestic sales of the non-small cell lung cancer treatment 'Reclaza' begin in earnest. Hyemin Heo, a researcher at Kiwoom Securities, analyzed, "Yuhan Corporation's consolidated sales this year are expected to be KRW 2.1574 trillion," adding, "Performance improvement is anticipated due to the base effect, expansion of Yuhan Chemical, and insurance coverage for first-line treatment with Reclaza."

The domestic pharmaceutical and bio company with the highest sales last year was the CDMO company Samsung Biologics. It posted sales of KRW 3.6946 trillion and operating profit of KRW 1.1137 trillion. Its pharmaceutical developer subsidiary, Samsung Bioepis, also showed strong performance by surpassing KRW 1 trillion in annual sales for the first time in its 12-year history.

Samsung Biologics' achievements are thanks to continuous production capacity expansion and acquisition of new platforms. The world's largest single-factory production capacity (240,000 liters) 4th plant began full operation in June last year, ushering in the era of 'KRW 1 trillion quarterly sales' in the second half. The company plans to have a total production capacity of 1.324 million liters by 2032, led by the 5th plant scheduled for completion in April next year. On the platform front, it will complete and start production at an antibody-drug conjugate (ADC) production facility within the year. Samsung Biologics expects annual sales exceeding KRW 4 trillion this year, growing 10-15% thanks to these efforts.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.