FSS Discloses Fire Insurance Compensation and Subscription Precautions

Mr. A, who runs a restaurant, suffered damages worth approximately 5 million KRW due to the destruction of interior fixtures and supplies caused by a liquefied petroleum gas (LPG) explosion. Fortunately, the incident did not escalate into a fire. Mr. A requested insurance compensation from his fire insurance company, but the claim was denied on the grounds that the damage was not caused by fire.

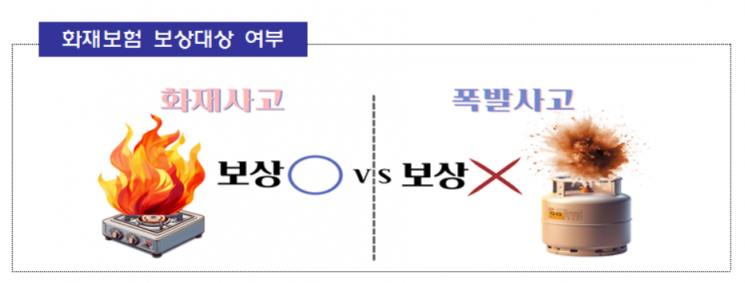

Fire refers to a combustion phenomenon involving heat or light, essentially a "disaster caused by fire." An LPG gas explosion is a rapid oxidation reaction that occurs independently of fire and therefore does not qualify as a fire. In fire insurance policies for general fires or factory fires, excluding residential properties, damages caused by explosions or ruptures are not covered.

On the 6th, the Financial Supervisory Service disclosed precautions regarding fire insurance claims and subscriptions that financial consumers should be aware of. Since the risk of fire accidents increases during winter, the agency selected key points focusing on frequently occurring fire insurance dispute cases.

Mr. B, who operates a wholesale meat business, suffered a loss of raw materials worth about 10 million KRW due to a fire in a warehouse outside his store and filed an insurance claim, which was rejected. This was because the warehouse was not included as an insured object. The insurance policy listed the insured property as "OO Hanwoo, 1st floor of the building, 100㎡, 38 Geumso-daero, Yeongdeungpo-gu, Seoul." The warehouse that caught fire was a 30㎡ container located at a different address than the one stated in the policy, resulting in the denial of compensation. Even if the insured verbally informed the agent to include annex buildings or warehouses at the time of subscription, compensation is difficult if these are not recorded in the policy.

Mr. C, who runs a clothing export company, suffered a loss of clothing inventory worth 30 million KRW due to a fire in a warehouse and filed an insurance claim, which was denied. At the time of insurance subscription, Mr. C designated the clothing inventory stored in Warehouse A as the insured object, considering that the inventory was frequently moved in and out. However, after relocating the goods to Warehouse B, he failed to notify the insurer of the change in the location of the insured property. Mr. C was unaware that items located outside the designated insured location are excluded from coverage. When the location of the insured property changes due to business relocation or other reasons, the insurer must be notified of the address change.

Mr. D, who operates a pension, requested compensation of 1 billion KRW for reconstruction costs after the pension building was completely destroyed by fire. However, the insurer responded that considering the building’s 15 years of age, they would deduct depreciation and pay 800 million KRW. Fire insurance compensates for losses based on the actual market value at the time of the accident, following the principle of no profit. For fixed assets, depreciation is deducted from reconstruction costs (replacement cost), reflecting factors such as useful life and elapsed years. Depreciation also applies to repair costs for partial damages. However, if the insured has subscribed to a special clause that compensates based on new value rather than market value (such as a building restoration cost support clause), reconstruction costs can be covered.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.