Mortgage Loans Up 0.8% in One Month... Household Loan Balances Increase for 9 Consecutive Months

Policy Loan Products and Services Launched One After Another... Financial Sector's 'Competitive Interest Rate Cuts'

Total Household Debt Management vs. Household Interest Burden Relief

'Stress DSR' Implemented from First Half of the Year

"I expected household loans to increase, but I did not anticipate it reaching this level."

The scale of household debt, which has been identified as one of the ticking time bombs of the Korean economy as its ratio to Gross Domestic Product (GDP) exceeds 100%, is moving in the exact opposite direction of the government's management intentions. The volume of household loans from commercial banks has been on the rise since May last year, accelerating sharply from September, and has increased by about 3 trillion won again this year.

As the government and financial sector's goal to manage household debt with a 1.5-2% growth rate this year is threatened from the beginning of the year, concerns are emerging about a conflict between policies aimed at easing household interest burdens and those strengthening the Debt Service Ratio (DSR) regulations, which have different objectives.

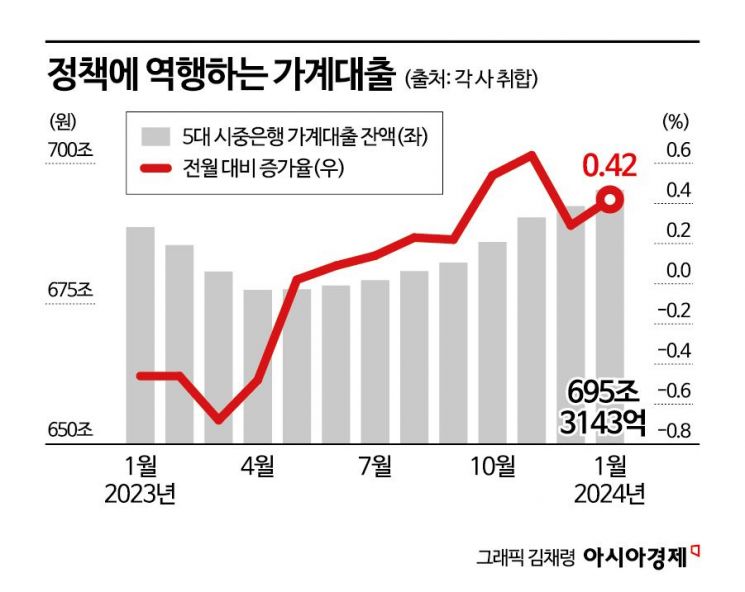

According to the financial sector on the 2nd, the outstanding household loans of the five major domestic commercial banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) as of the end of January stood at 695.3143 trillion won, up 0.42% (2.9049 trillion won) from 692.4094 trillion won in the previous month. The largest contributor to household loans, mortgage loans, increased by 0.83% (4.4329 trillion won) from 529.8922 trillion won to 534.3251 trillion won.

The trend of increasing household loans, which has continued for nine months, intensified in the second half of last year. The outstanding household loans, which fell from 688.6478 trillion won in January last year to 677.4691 trillion won in April, rose to 677.6122 trillion won in May and increased by 17.8 trillion won over the following nine months until last month. The month-on-month growth rate clearly shows an upward trend from September. The balance in October last year increased by 0.54% compared to September, and November recorded 0.64%, 0.1 percentage points higher.

Successive Policy Loan Products and Services... Competitive Interest Rate Cuts through Loan Refinancing

Interpretations suggest that the increase in household loans reflects the impact of various policy loan products and expectations of falling interest rates. The government launched policy loan products such as Didimdol Loan and Bogumjari Loan and started a refinancing service for credit loans in cooperation with the financial sector from May last year to reduce household interest burdens. In January this year, the refinancing service was successively expanded to mortgage and jeonse (long-term deposit) loans. This process stimulated interest rate competition in the financial sector, with cases confirmed where interest rates on new general mortgage loans dropped by up to 1.4 percentage points.

An official from a commercial bank explained, "The demand for mortgage loans increased due to the influence of policy loan products such as Didimdol Loan and Bogumjari Loan," adding, "Expectations that market interest rates have already passed their 'peak' also contributed to the increased demand for loans." He further noted, "The interest rate on the 5-year financial bond, which serves as the benchmark for the bank's fixed-rate (hybrid) loan products, has fallen, leading to more demand for such loans," and added, "Loan demand for moving expenses related to children's education at the start of the new school term and refinancing services are also likely partially reflected."

It cannot be ruled out that demand to secure loans in advance ahead of the 'Stress DSR' implementation in the first half of this year also contributed. The government plans to manage the increased household debt by applying the 'Stress DSR' first to bank mortgage loans from the 26th of this month, expanding it to bank credit loans and second-tier financial institutions' mortgage loans in June, and applying it to all loans in the financial sector from the second half of the year. However, considering the side effects of a sudden limit reduction, only 25% of the stress interest rate calculated from the difference between the highest interest rate in the past five years and the current rate will be applied in the first half, and 50% in the second half. From next year, 100% of the calculated additional interest rate will be reflected.

Another commercial bank official analyzed, "There have been cases where loan demand surged just before the strengthening of DSR regulations in the past," adding, "It is possible that demand reflecting concerns about loan amount reductions ahead of the 'Stress DSR' implementation is also included."

Total Household Debt Management vs. Household Interest Burden Relief: 'Policy Conflict?'

Last year, Korea's household debt ratio to GDP was 104.5%, the highest among 34 countries surveyed by the Institute of International Finance (IIF). If the nine-month continuous increase in household loans until January continues this year, there are concerns about whether the household debt management plans presented by the five major financial groups (KB, Shinhan, Hana, Woori, NH Nonghyup) will be upheld. They conveyed to financial authorities last month their intention to manage the household loan growth rate within 1.5-2% this year.

With the possibility of a last-minute surge in loan demand ahead of regulatory tightening, criticism that the policy effect of lowering market interest rates has rather stimulated demand seems unavoidable. Additionally, new special newborn loans amounting to 27 trillion won, which are exempt from recent DSR regulations, were newly implemented this year, and measures to ease redevelopment and reconstruction regulations have also been introduced, increasing the number of variables to watch closely.

A financial sector official diagnosed, "Major financial groups have set a target to keep household debt growth within 2% this year, but judging by January alone, it is uncertain whether some groups will achieve this goal," adding, "It is possible that government policies with different objectives have partially stimulated loan demand."

On the 24th, a notice regarding loans is displayed in front of a commercial bank in Gangnam-gu, Seoul, where the government has eased jeonse loan regulations for genuine demand from low-income households but plans to introduce strong supplementary measures for household debt, such as increasing the installment repayment ratio. Photo by Jinhyung Kang aymsdream@

On the 24th, a notice regarding loans is displayed in front of a commercial bank in Gangnam-gu, Seoul, where the government has eased jeonse loan regulations for genuine demand from low-income households but plans to introduce strong supplementary measures for household debt, such as increasing the installment repayment ratio. Photo by Jinhyung Kang aymsdream@

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)