Regional Bank Stocks Fall Simultaneously

Worst Since Last Year's Regional Bank Bankruptcy Crisis

Possibility of Commercial Real Estate Default

Fed's Early Rate Cut Possibility Recedes

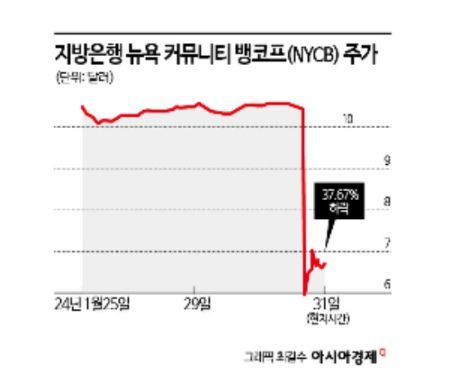

The stock price of New York Community Bancorp (NYCB), the largest among U.S. regional banks, plummeted by 38% in a single day. This has led to concerns that the risks facing regional banks, which were highlighted during the Silicon Valley Bank (SVB) collapse in March last year, are resurfacing.

On the 31st (local time), the ‘SPDR S&P Regional Banking ETF’ (KRE), composed of U.S. regional bank stocks, closed down 5.9% from the previous session. Similarly, the ‘KBW Nasdaq Regional Banking Index’ (KRX) also fell by 6.0%. This marks the largest drop since the SVB collapse in March last year.

NYCB Stock Price Plummets 38%

The sell-off was triggered by NYCB, one of the larger regional banks. Having grown into a mid-sized bank with $100 billion in assets by acquiring failed banks such as Signature Bank, NYCB had attracted attention for generating profits even as regional banks struggled with increased funding costs due to high interest rates.

However, its earnings deteriorated sharply, shocking the market. On that day, its stock price dropped by a staggering 37.7%. The primary reason was a shift to losses. In the fourth quarter of last year, it reported a loss of $260 million. This was in stark contrast to a net profit of $199 million in the same period the previous year. Additionally, loan loss provisions amounted to $552 million, more than ten times the market estimate of $45 million.

As a result, there was also an analysis that shareholder dividends were reduced. Thomas Cangemi, CEO of NYCB, said, “It was a difficult decision, but we decided to reduce the quarterly dividend from 17 cents per share to 5 cents.” He added, “This necessary measure will provide a stronger foundation for the company’s future growth.”

Regional Bank Crisis Resurfaces

U.S. regional bank stocks had significantly narrowed their losses since late October last year amid expectations of a pivot by the Federal Reserve (Fed). The anticipation was that interest rate cuts would increase loan margins and reduce deposit interest burdens, thereby improving earnings. However, the results shown by NYCB clearly revealed that the fundamental strength has not improved.

With diminishing expectations for an early Fed rate cut, warnings have emerged that losses among regional banks could continue to grow. Regional banks have seen profitability deteriorate due to reduced net interest margins caused by deposit outflows amid high interest rates and the decline in value of bonds, which make up a large portion of their assets.

Focus on Commercial Real Estate Default Concerns

The prevailing view is that the next crisis for regional banks will be commercial real estate. Default concerns have increased as more property owners fail to repay loans. Commercial real estate loans require principal and interest repayment or refinancing upon maturity, but high interest rates over the past two years and the work-from-home culture established after COVID-19 have prevented vacancy rates from improving.

According to real estate information firm Trepp, the volume of commercial real estate loans maturing in the U.S. by 2027 is $2.2 trillion. The volume of commercial loans maturing last year was $541 billion. If commercial real estate owners fail to repay their debts, it will inevitably have a greater negative impact on the financial soundness of smaller regional banks.

Global investment bank Morgan Stanley noted in an investment memo that while bank stocks appear cheap, it is too early to be confident due to the uncertain timing of interest rate cuts. Wells Fargo emphasized the importance of preparing for numerous scenarios in its outlook for bank stocks this year. However, Truist Financial predicted that regional bank stocks have more room to rise this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.