5.96% Decline in January

Contrasting with Soaring Nasdaq and Nikkei

Falls More Than China Amid Economic Recession

Despite Government's Successive Market Stimulus Measures

Expected to Remain in a Trading Range in the First Half of the Year

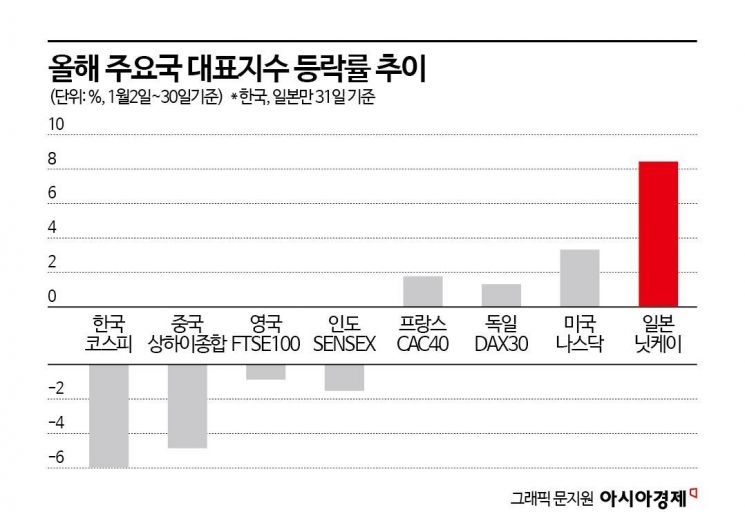

The KOSPI index recorded the worst performance among major global stock indices in the first month of the new year. This was due to weak corporate earnings in the fourth quarter of last year and a cooling of expectations for interest rate cuts, which dampened buying momentum. As the Korean stock market failed to escape bottom levels, the government has recently emphasized resolving the 'Korea discount' (undervaluation of the Korean stock market) and has introduced a series of stimulus measures to boost the market, but the downward trend of the KOSPI has not stopped.

According to the Korea Exchange on the 1st, the KOSPI fell 5.96% from the beginning of this year through January 31, making it the worst performer among representative indices of the G20. Even when expanding the scope to a total of 24 indices listed in the G20, it ranked last except for China's Shenzhen Composite Index (-13.32%). Compared to the U.S. Nasdaq index, which rose 3.32%, and Japan's Nikkei 225 index, which rose 8.43% during the same period, the KOSPI's performance was dismal. It fell more than the Shanghai Composite Index (-4.85%), which raised concerns about an economic recession.

Kang Min-seok, a senior researcher at Kyobo Securities, explained, "In January, the stock market experienced a period of decoupling from advanced markets. Despite the reduced possibility of a U.S. interest rate cut in March, the U.S. stock market rose on the momentum of artificial intelligence (AI), but the domestic market showed a sluggish trend, coupling with the Chinese market, which was weighed down by renewed concerns about the economy, resulting in increased downward pressure."

The KOSPI, which had approached the 2600 level following the Santa rally at the end of last year, continued its downward trend from the beginning of the year, recording the largest drop since the 2008 financial crisis (-7.9%). On January 31, the KOSPI closed at 2497.09, down 1.72 points (-0.07%) from the previous session. During January, institutional investors sold off stocks worth 6.2273 trillion won, dragging the index down. Individuals and foreigners were net buyers, purchasing 3.0635 trillion won and 3.7285 trillion won worth of stocks, respectively.

Labor Gil, a researcher at Shinhan Investment Corp., analyzed, "The KOSPI maintained a cautious stance amid foreign futures supply and demand, declines in big tech stocks, and anticipation of the Federal Open Market Committee (FOMC) meeting. With trading volume around 3 trillion won, there is a lack of supply and demand, and no clear leading sectors, resulting in a continued sector rotation market."

As the KOSPI fell into a slump, Korean investors have turned their attention to advanced markets such as the U.S. and Japan. According to the Korea Securities Depository, Korean investors' net purchases of U.S. stocks this year reached 660 billion won, while net purchases of Japanese stocks amounted to 10 billion won.

External factors such as the retreat of interest rate cut expectations, concerns about China's economic recession, and geopolitical risks including the Middle East and North Korea have poured cold water on the KOSPI market. Earnings that could turn the market sentiment around have also failed to support it. According to financial information provider FnGuide, among companies with earnings consensus (average estimates from three or more securities firms) for the fourth quarter of last year, a total of 82 companies had announced preliminary results by January 31. Of these, 59 reported operating profits below consensus. Thirteen companies either turned to losses or saw an expansion in their losses.

In the securities industry, it is expected that the index will remain in a box range during the first half of the year. To break out of this box range, a clear direction regarding interest rate cuts must emerge. Lee Woong-chan, a researcher at Hi Investment & Securities, said, "We expect the index to remain in a box range during the first half of the year. It is anticipated that signals for interest rate cuts will be confirmed in the second quarter, and the KOSPI will attempt to rise again to the early January peak level."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.