April BOJ Negative Interest Rate End Expected

ETF Promising for Long-Term Yen Investment Purpose

The Bank of Japan (BOJ), Japan's central bank, is expected to lift its negative interest rate policy in April. As expectations grow for the yen's value to rise, funds are flowing into exchange-traded funds (ETFs) that generate additional profits when the yen rebounds.

According to the asset management industry on the 1st, KODEX Japan TOPIX100 has risen 8.6% so far this year. Its net assets have exceeded 20 billion KRW. The KBSTAR U.S. Treasury 30-Year Yen Exposure (Synthetic H) ETF, which was listed on December 27 last year, has shown an upward trend since the 25th of last month. Individual net purchases have surpassed 30 billion KRW. Among Japan-related ETFs listed on the Korea Exchange, the TIGER Japan Yen Futures ETF, which is the only one that directly invests in the yen, fell to 8,245 KRW on November 17 last year but recently recovered to around 8,600 KRW.

KODEX Japan TOPIX100 is a currency-exposure product that manages investment trust assets similarly to the fluctuation rate of the Japan TOPIX 100 index, while KBSTAR U.S. Treasury 30-Year Yen Exposure invests in 30-year U.S. Treasury bonds, pursuing both capital gains and foreign exchange gains from yen value fluctuations.

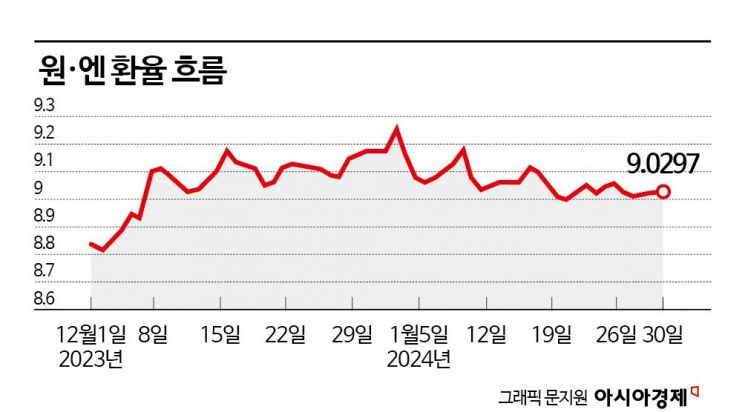

The won-yen exchange rate has remained near its lowest level since the 2010s, leading to an increase in investors expecting a rebound in the yen's value. Kim Cheon-heung, a manager at Samsung Asset Management, explained, "The BOJ adjusted this year's inflation forecast from 2.8% to 2.4% and the real GDP growth rate from 1.0% to 1.2%. Unlike most countries that raised interest rates after the COVID-19 pandemic, Japan maintained its rates, causing the yen's value to fall to its lowest level against the won in 15 years." He added, "Following the U.S. interest rate cut trend, many countries including Korea are expected to lower rates. Considering Japan's economic resilience with a raised GDP growth forecast, we expect relative strength in the yen."

If you want to invest in asset classes based on the yen to expect additional profits, yen-exposure ETFs are promising. Based on underlying assets, there are Japan representative index ETFs, semiconductor ETFs, and U.S. long-term bond ETFs. The Japan representative index ETF 'TIGER Japan Nikkei 225' and the Japan representative thematic ETF 'TIGER Japan Semiconductor FACTSET' are also gaining attention as yen-exposure products for investing in Japanese stocks and the yen. Kim In-sik, a researcher at IBK Investment & Securities, said, "The factors behind the Japanese stock market's strength include the spillover benefits from U.S.-China conflicts and institutional and environmental changes for corporate value recovery. The yen depreciation led to foreign capital inflows and improved export stock performance, combined with exchange rate effects, pushing the market to new highs." He emphasized, "From a long-term investment perspective, the KBSTAR U.S. 30-Year Bond Yen Exposure product appears to have a relatively clear direction."

Experts in the asset management industry advise that using ETFs is useful in a phase expecting a yen rebound. Lee Do-seon, manager of the ETF management division at Mirae Asset Global Investments, introduced, "Investing in the Japan Yen Futures ETF does not incur separate currency exchange fees unlike exchanging yen, and it allows easy investment with small amounts like stocks."

Yook Dong-hwi, head of the ETF Strategy Office at KB Asset Management, explained, "The larger the interest rate gap between the U.S. and Japan, the weaker the yen is against the dollar. This implies the possibility of a yen rebound when U.S. interest rates fall." He added, "Using ETFs allows simultaneous investment in U.S. long-term bonds and the yen."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.