Sengbohyeop, Survey on Job Perception and Satisfaction

14-19 Years of Experience Earn Up to 80 Million Won

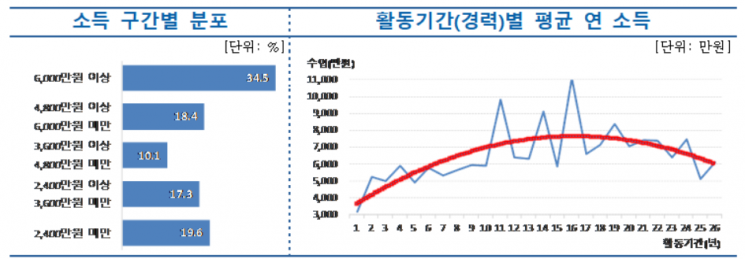

34.5% Have High Proportion Earning 60 Million Won

Life insurance planners were found to earn an average annual income of 55.63 million KRW.

The Life Insurance Association announced on the 31st that it conducted the "2023 Occupational Awareness and Satisfaction Survey" targeting 1,400 life insurance planners affiliated with 15 life insurance companies and corporate insurance agencies (GA) subsidiaries.

The average annual income of life insurance planners was 55.63 million KRW, a 14% increase compared to 48.75 million KRW in 2021. Income increased with experience, reaching the highest point (an average of 80.3 million KRW) among those with 14 to 19 years of experience. Planners earning more than 60 million KRW annually accounted for the largest proportion at 34.5%, followed by those earning less than 24 million KRW at 19.6%.

The current satisfaction score for the life insurance planner profession was 67.9 points, up 4.9 points from 63 points in 2021. Compared to the 2021 Korean Occupational Information Survey (Ministry of Employment and Labor), this is higher than the overall job satisfaction score across all occupations (63.2 points) and the satisfaction score for management, office, finance, and insurance jobs (67.2 points). Satisfaction (61.7%) was more than 10 times higher than dissatisfaction (6.0%).

When asked about satisfaction with various factors, a high proportion responded positively regarding time utilization, colleague relationships, activity type, and income.

Regarding future demand for life insurance, 33.5% responded that it would "decrease." The outlook that demand would "increase or remain at the current level" was 66.5%.

Regarding the desired length of future tenure as a life insurance planner, 34.6% responded "15 years or more," and 21.1% responded "10 years or more but less than 15 years." There was a clear difference according to planner experience, with longer desired tenure as experience increased.

Seven out of ten planners (68.7%) considered "coverage details and coverage amount" as the most important factor when recommending products during insurance consultations. Only 1.4% considered "sales commission," which is directly related to planner income, as the most important factor.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.