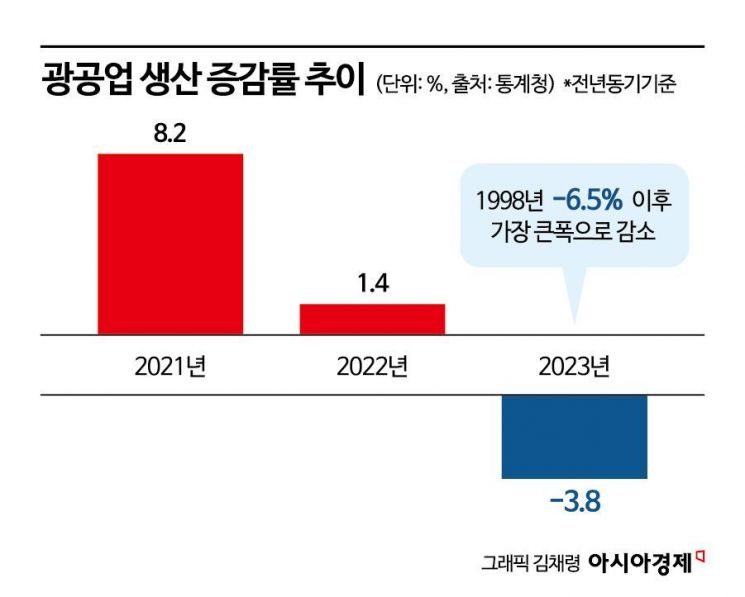

Industrial Production Drops by Largest Margin Since 1998

Retail Sales Decrease by 1.4% Due to High Interest Rates and Other Factors

Last year, while production in the service sector increased, manufacturing production sharply declined due to the semiconductor downturn. Retail sales also continued to decrease for the second consecutive year as consumer spending capacity shrank amid high interest rates and other factors.

According to the 'December 2023 and Annual Industrial Activity Trends' released by Statistics Korea on the 31st, overall industrial production increased by 0.7% compared to the previous year, driven by growth in the service and construction sectors. This marks the third consecutive year of growth following 5.3% in 2021 and 1.4% in 2022. The increase was largely influenced by higher production in the service sector, particularly in finance and insurance.

The semiconductor downturn dealt a severe blow to mining and manufacturing production. Mining and manufacturing production fell by 3.8% year-on-year, mainly due to a 3.9% decline in manufacturing, which accounts for the majority of mining and manufacturing output. This is the largest drop in 25 years since 1998 (-6.5%). The sluggish semiconductor exports through the first half of last year contributed to this decline. The average operating rate in manufacturing dropped by 3.5 percentage points to 71.3%, marking the largest decline in 25 years since the 1998 financial crisis (-11.5 percentage points).

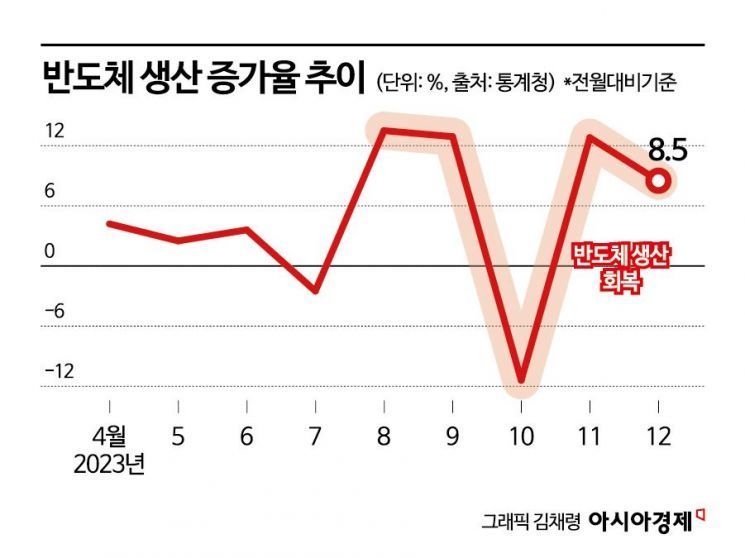

However, semiconductor exports began to recover significantly in the second half of the year, leading to a 0.6% increase in mining and manufacturing production in December 2023 compared to the previous month. Semiconductor inventories decreased by 20.9%, the largest drop since December 2001 (-21.2%). This recovery was driven by increased demand for AI servers, which boosted exports of high-capacity memory semiconductors and led to production recovery. Consequently, manufacturing production also rose by 0.6%. The Ministry of Economy and Finance assessed that "manufacturing production, which was sluggish at the beginning of the year, showed a clear recovery trend centered on manufacturing production and exports as the year progressed."

Private consumption also showed a clear slowdown. Retail sales fell by 1.4%, marking a negative trend for the second consecutive year following a 0.3% decline the previous year. The decrease in retail sales was the largest in 23 years since 2003 (-3.2%). While sales of durable goods such as passenger cars increased by 0.2%, sales of non-durable goods like food and beverages (-1.8%) and semi-durable goods such as clothing (-2.6%) declined. Gong Mi-sook, Director of Economic Trend Statistics at Statistics Korea, explained, "High interest rates and exchange rates appear to have influenced the consumption slowdown," adding, "The decline in semi-durable goods (such as clothing) and non-durable goods (such as food and beverages) contributed statistically to the decrease."

It seems unlikely that the consumption slowdown will reverse in the near term. Retail sales in December 2023 decreased by 0.8% from the previous month as the effects of Black Friday and other events faded. Although inflation is easing, downside risks such as household debt and real estate project financing (PF) risks remain. A Ministry of Economy and Finance official predicted, "Due to high interest burdens and significant spending pressures, it will structurally take time for consumption to recover." The official added, "The trend does not look favorable, so recovery is not expected to be rapid."

Facility investment also declined by 5.5% due to the semiconductor downturn, marking the largest drop in four years since 2019 (-5.6%). Facility investment decreased in machinery (-7.2%) and transportation equipment such as automobiles (-0.4%). However, facility investment in December 2023 rose by 5.5% from the previous month due to increased investment in machinery. Construction investment weakness is also becoming apparent. Construction output (constant prices) increased by 7.7% due to higher construction and civil engineering work, but construction orders (current prices), which indicate future construction activity, fell sharply by 19.1% due to the real estate market downturn.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)