Subscription Period from 29th to 31st until 2 PM

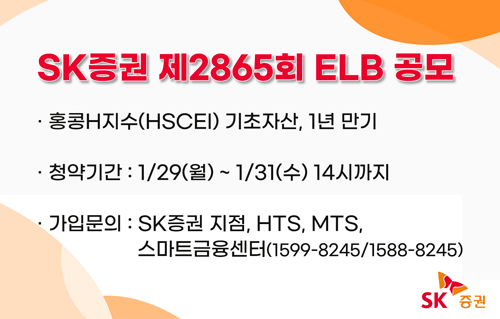

On the 29th, SK Securities announced that it will offer the 1-year maturity 'SK Securities No. 2865 Derivative Linked Bond (ELB)' to the public until the 31st.

The 'SK Securities No. 2865 Derivative Linked Bond (ELB)' is a 1-year principal-protected product based on the Hong Kong H Index (HSCEI).

If the underlying asset index is equal to or above the initial reference index on the maturity evaluation date and has never risen more than 25% above the initial reference index, it pays a combined return of 3.50% on the principal and 20% of the increase rate of the underlying asset index, providing a maximum pre-tax annual return of 8.50%.

Even if the underlying asset index rises more than 25% above the initial reference index or falls below the reference index, a pre-tax return of 3.50% on the principal is paid.

However, principal loss (0~100%) may occur due to early redemption or other reasons, and detailed information should be referred to in the prospectus.

The subscription period is until 2 PM on January 31. Subscriptions are possible in units of 1 million KRW or more, with a minimum subscription amount of 1 million KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.