Financial Authorities to Announce Legislative Notice on Revised Supervisory Regulations

Includes Support Measures for Excellent Loan Companies to Borrow from Commercial Banks

Mixed Reactions from Commercial Banks Except KB Kookmin Bank

"IBK and Others Should Step Up"

Evaluations Call for Measures to Overcome Negative Image

Financial authorities are revising the excellent lending industry system that allows the lending industry to borrow from commercial banks to prevent low-credit borrowers from being driven to illegal private loans. The main point is to reduce the funding costs of companies leading credit supply to low-credit borrowers so that more low-credit borrowers can receive loans. However, while the industry welcomes this, it also sees the need for ways to overcome the negative image attached to the lending industry.

The Financial Services Commission and the Financial Supervisory Service plan to announce a legislative notice for the revision of supervisory regulations related to the excellent lending industry system for low-income earners in the first quarter of this year. The excellent lending industry system is a system that allows lending companies that meet certain requirements, such as loan conditions for low-credit borrowers, to borrow from banks in order to encourage the expansion of credit supply to low-income groups. It was created out of concern that lending companies would reduce loans to low-credit borrowers and drive them to illegal private loans after the statutory maximum interest rate dropped from 24% per annum to 20% in 2021. Companies are selected if the outstanding balance of credit loans to low-credit borrowers in the bottom 10% credit score bracket is 10 billion KRW or more, or if the loan proportion is 70% or more.

As early as next month, six commercial banks and lending companies are expected to meet to discuss funding procurement. This meeting is related to the support measures for credit supply efforts by excellent lending companies announced by financial authorities at the end of last year. The authorities stated, “We plan to enhance mutual trust through cooperation between financial companies and the lending industry and to induce smooth capital supply.”

So far, the lending industry has procured funds from secondary financial institutions such as savings banks. Because they cannot receive funds from commercial banks with lower interest rates than secondary financial institutions, their basic funding costs are high. The higher the interest rate, the more sharply the funding costs increase. On the other hand, the statutory maximum interest rate continues to decline, making it impossible to raise credit loan interest rates. As a result, the lending industry tries to increase profit margins by reducing loans to low-credit borrowers who have a relatively high risk of delinquency. Low-credit borrowers in urgent need of loans fall into a vicious cycle of being driven to illegal private loans.

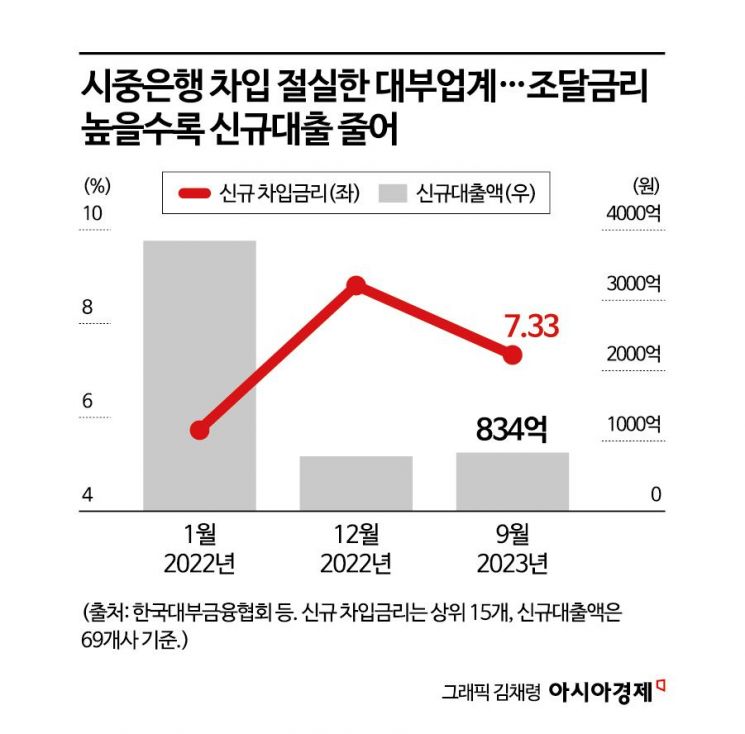

In fact, the new borrowing interest rate of the top 15 lending companies soared from 5.74% in January 2022 to 8.81% in December, then remained at 7.33% in September last year. During the same period, the new loan amounts of 69 lending companies were 384.6 billion KRW, 78 billion KRW, and 83.4 billion KRW respectively, showing a correlation with borrowing interest rates. As the lending industry, the last financial sector within the system, reduced new loans, the possibility of low-credit borrowers moving to the illegal private loan market is high.

The industry's response to borrowing from banks is lukewarm because commercial banks feel burdened about lending funds to the lending industry. Since the announcement of the lending industry improvement by financial authorities, KB Kookmin Bank is the only commercial bank that has announced financial support for excellent lending companies. A representative from a lending company said, “Commercial banks are reluctant to lend because they fear being stigmatized as ‘lending industry middlemen.’” The industry believes that banks that lend to companies, such as Industrial Bank of Korea, should first provide loans to lending companies so that other commercial banks can follow.

The lending industry also said that fundamental measures are needed to overcome the negative image attached to lending companies. There is a stereotype that views lending companies as loan sharks. Therefore, there is a proposal to allow excellent lending companies to change their names. In 2021, Park Su-young, a member of the People Power Party, proposed an amendment to the Lending Business Act to use the term ‘consumer credit’ instead of ‘lending business’ for excellent lending companies. According to the Lending Business Act, only registered lending companies can use the lending trade name, but illegal private loan operators also use the lending name.

The industry argues that allowing entry into fintech (finance + technology) platforms is also necessary. Currently, 19 companies have been selected as excellent companies, but none are listed on online financial platforms such as KakaoPay or Naver Pay. Another lending company representative said, “Even excellent lending companies could reduce costs and improve the lending industry image if they could be listed on platforms or advertise, moving away from the existing telemarketing loan proposal method.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)