Do Not Be Swayed by Temporary Signals

Although South Korea's inflation indicators are gradually decreasing, there is still momentum for price adjustments and the possibility of additional cost shocks, so it is not yet considered to have entered a price stabilization phase, according to an analysis.

On the 29th, the Bank of Korea stated this in a BOK Issue Note titled "Case Analysis and Implications of the Transition to a Price Stabilization Phase."

Recently, domestic inflation has shown signs of slowing down. With growing expectations that prices will stabilize in the long term, the expected inflation rate has declined for two consecutive months.

However, the report pointed out that it is difficult to be certain that the economy has already entered a price stabilization phase. Jeong Seong-yeop, Deputy Head of the Policy Analysis Team at the Bank of Korea's Monetary Policy Department and the author of the report, said, "Historically, in cases where the transition to a price stabilization phase failed, despite the presence of price adjustment momentum, policymakers hastily misinterpreted the technical base effects following a large inflation shock as entry into a price stabilization phase and prematurely shifted to a monetary easing stance."

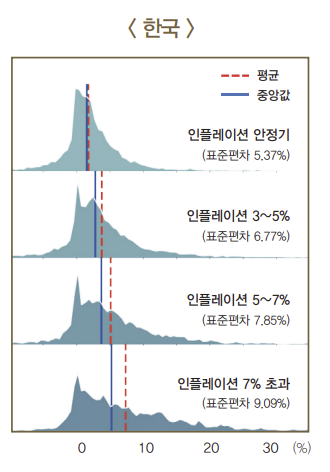

The current inflation situation in Korea is analyzed as one where inflation appears stable due to base effects, but price adjustment momentum and the risk of inflation recurrence still coexist.

On the other hand, examining the characteristics of past transitions from high inflation periods to price stabilization phases, the report noted that the transmission of inflation across sectors decreased, the interaction between prices and inflation expectations diminished, and headline inflation gradually converged toward underlying inflation.

The report stated, "While inflation indicators are gradually declining, residual risks related to the final stages of entering a price stabilization phase remain," and suggested, "Whether re-entry into a price stabilization phase occurs needs to be confirmed from various perspectives, including cross-sector transmission, expected inflation, and underlying inflation."

It added, "To avoid placing excessive significance on temporary positive signals (head fakes) from some price indicators, it is necessary to continue patiently and comprehensively analyzing and judging the trend movements of various indicators."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.