The Hyundai Research Institute announced on the 28th that South Korea's economic growth rate is expected to reach 2.2% this year.

In the '2024 Revised Outlook for the Korean Economy' published on the same day, the Hyundai Research Institute forecasted that the real Gross Domestic Product (GDP) growth rate will be 2.3% in the first half and 2.1% in the second half, resulting in an annual growth rate of 2.2%.

This matches the government's projection (2.2%) and is slightly higher than the Bank of Korea's forecast (2.1%).

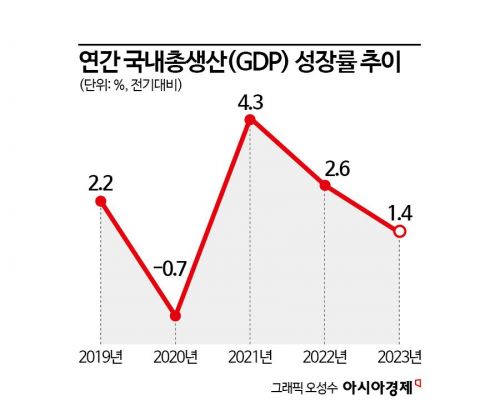

The institute noted that despite sluggish domestic demand such as private consumption and facility investment in the third quarter of last year, the contribution of net exports to growth surged to 1.4 percentage points (p), and the improvement in external demand led the growth rate to rise sharply from 0.9% in the second quarter to 1.4%. They expect this recovery trend to likely continue going forward.

The coincident index of economic activity, which reflects the current economic situation, fell for six consecutive months to 98.9 points in November last year, but the decline narrowed, indicating that the economy is approaching a bottom. Additionally, the leading index of economic activity, which indicates future economic trends, has risen for seven consecutive months since April last year, reaching 99.9 points, close to the baseline of 100 points.

Examining risks by sector, consumption is expected to have limited recovery potential due to sustained high inflation and high interest rates, which reduce real disposable income.

Construction investment is forecasted to decline due to poor leading indicators and defaults in real estate project financing (PF). The business survey index (BSI) for construction sector funding performance is below 100, and as construction companies' debt ratios expand, financial soundness and funding conditions are deteriorating.

Facility investment is not expected to see a strong rebound due to impaired corporate investment capacity caused by high interest rates, accumulated debt, and delayed recovery in investment sentiment.

Exports face risks such as delayed improvement in companies' perception of export market recovery, economic differentiation, and increased exchange rate volatility, the institute pointed out.

Regarding employment, although last year's unemployment rate and employment rate recorded historic lows and highs at 2.7% and 62.6%, respectively, there was a differentiated trend centered on health and social welfare services for women and the elderly.

An official from the institute said, "The domestic economic growth rate is expected to recover to the low 2% range as previously forecasted," adding, "To achieve this, alongside improvements in external demand, active policy efforts are necessary to establish a solid domestic demand base through the recovery of economic sentiment among domestic economic agents."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)