Martial Arts, Report on 'Suggestions for Smooth Succession of Export Companies'

"Business Continuity and Responsible Management Require Succession"

40.2% Give Up Succession Due to Tax Burden

Export company executives believe that business succession is important for the continuity and responsible management of their companies, but many are considering selling or closing their businesses due to tax burdens and negative social perceptions.

Survey graph from the report "Suggestions for Smooth Business Succession of Export Companies." Photo by Korea International Trade Association

Survey graph from the report "Suggestions for Smooth Business Succession of Export Companies." Photo by Korea International Trade Association

The Korea International Trade Association (KITA) published a report titled "Suggestions for Smooth Business Succession of Export Companies" on the 28th, containing these findings.

The report includes results from a "Survey on Business Succession in the Trade Industry" conducted by KITA in December last year, targeting 799 representatives of member companies. Among the 799 companies surveyed, 96.6% were small and medium-sized enterprises (SMEs), 2.6% were mid-sized companies, and 0.8% were large corporations. Based on last year's sales, 91.9% of the companies had revenues of 50 billion KRW or less.

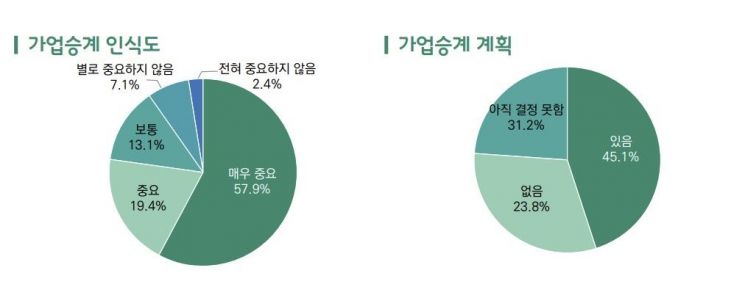

Regarding the importance of business succession for corporate continuity and sustainable management, 77.3% responded that it is important (very important 57.9%, important 19.4%). Those who answered "average" accounted for 13.1%, while only a small percentage said it was not very important (7.1%) or not important at all (2.4%).

As for plans for business succession, 45.1% answered "yes," 23.8% said "no," and 31.2% responded "undecided."

The biggest reason for considering business succession was the possibility of responsible management (46.4%, multiple responses allowed). This was followed by inheritance of tangible and intangible assets (37.9%), consistent corporate management style (37.8%), ability to establish long-term investment plans (28.3%), and succession of entrepreneurial spirit (27.8%).

The main reason for not considering business succession was tax burdens such as inheritance and gift taxes, cited by 40.2%. Other reasons included difficult business environments (31.8%), consideration of third-party professional managers (21.8%), children’s refusal to succeed (10.5%), and selling or closing the business (9.0%).

Survey graph from the report "Suggestions for Smooth Business Succession of Export Companies." Photo by Korea International Trade Association

Survey graph from the report "Suggestions for Smooth Business Succession of Export Companies." Photo by Korea International Trade Association

When asked about difficulties related to business succession, 74.3% of respondents cited tax burdens. When asked if they had ever considered selling or closing the business instead of succession due to tax issues, 42.2% answered "yes."

Expected benefits of smooth business succession included expanded overseas market entry (57.3%), increased technology development and investment (43.2%), promotion of entrepreneurship (37.8%), and job creation (35.0%).

Although the government has implemented the business succession inheritance tax deduction system since 2008, many respondents were either unaware of the system (37.4%) or had only heard of it (26.5%). Those who knew a little (25.4%) or knew well (10.6%) were relatively fewer.

Regarding the inheritance and gift tax deferral system for business succession newly established last year, the majority (42.2%) said they did not know much about it. Those who had only heard of it (27.4%), knew a little (22.2%), or knew well (8.3%) were fewer.

The vast majority of export company executives (89.1%) believed that, for smooth business succession, it is necessary to enact a comprehensive law covering both tax and non-tax policies rather than just improving the current legal system.

The report pointed out that "the high tax burden, with a nominal top tax rate reaching 50%, acts as an obstacle to business succession," and emphasized the need to establish a foundation for producing companies that last over 100 years by lowering inheritance tax rates, improving the stock premium evaluation system for major shareholders, relaxing heir requirements, and easing conditions for business succession support programs.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.