Increase in Chinese Tourists 'Insufficient'

Paradise and GKL Fail to Rebound

"Recovery of Zhong Economy Needed" for Stock Price Rebound

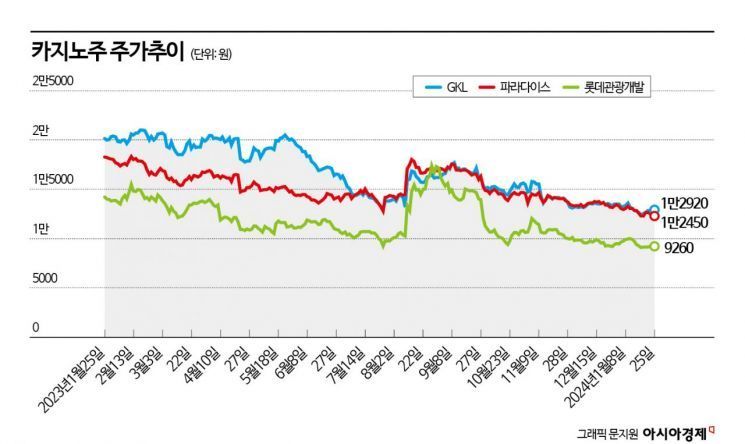

Casino stocks are struggling to rebound. This is due to the slow increase in Chinese tourists. Investor sentiment is also negatively affected by the poor performance of global casino companies.

Paradise closed at 12,450 won on the 25th, down 140 won (1.11%) from the previous trading day. On the 17th, it recorded a 52-week low closing price of 12,300 won. Other casino stocks such as GKL and Lotte Tour Development have also continued their sluggish trend, falling to their 52-week lows recently.

This decline is attributed to the slow growth of Chinese tourists. According to the Korea Tourism Organization, 6,023,021 Chinese tourists visited Korea in 2019 before the outbreak of COVID-19. However, from January to November last year, only 1,765,749 Chinese tourists visited. This is nearly 400,000 fewer than the 2,120,560 Japanese visitors during the same period.

In particular, despite China allowing group tours to Korea in August last year, the increase in visitors has not been rapid. The number of Chinese visitors to Korea was 259,659 in August, followed by 263,940 in September, 249,483 in October, and 221,469 in November, failing to exceed 300,000. Compared to the monthly average of over 500,000 from August to November 2019, it is still about half.

The reason for the slow increase in tourists is attributed to China’s economic situation. China is facing various adverse factors such as a real estate market slump, weak domestic demand, and concerns about deflation (a decline in prices amid economic stagnation). Lee Hwan-wook, a researcher at Yuanta Securities, said, "The effect of the Chinese government allowing group tours to Korea has been minimal so far," adding, "Although multiple factors have played a role, the most decisive cause is judged to be the sluggish Chinese economy."

There is also an opinion that the poor performance of global casino companies, not the issue of Chinese tourists, is having an impact. Ji In-hae, a researcher at Shinhan Investment Corp., explained, "In fact, the Chinese VIP drop amount flowing into Paradise and GKL remains solid," adding, "The global casino multiples have significantly declined due to the contraction of Chinese casino consumption amid the real estate market downturn."

However, the securities industry emphasizes that a recovery in the Chinese economy is ultimately necessary for a rebound in casino stocks. Lee said, "Currently, the Chinese economy is going through an intense deflation phase," adding, "The combination of real estate slump and export weakness increases the possibility of a prolonged period." He continued, "Considering that past deflation phases experienced by China lasted from as short as one year to as long as two years, it seems that the current deflation phase has passed about 50-70% of its course."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)