Woojinentek Doubles on Listing Day

Hits Upper Limit Price Next Day

Average Competition Rate of 5 Companies at 1645 to 1

IPO Subscription Expected to Get More Intense

Expecting Return of Large-Scale IPOs

Woojin Entech, which entered the domestic stock market for the first time this year, recorded a 'double-double (4 times the public offering price)' on the day of its listing and hit the upper price limit the next day. As market funds flock to the initial public offering (IPO) market, the surge in Woojin Entech is expected to intensify the competition for subscription to public offering stocks. With an increasing number of preliminary listed companies setting high public offering prices through demand forecasting, expectations are growing that large-scale public offering stocks will reappear after two years.

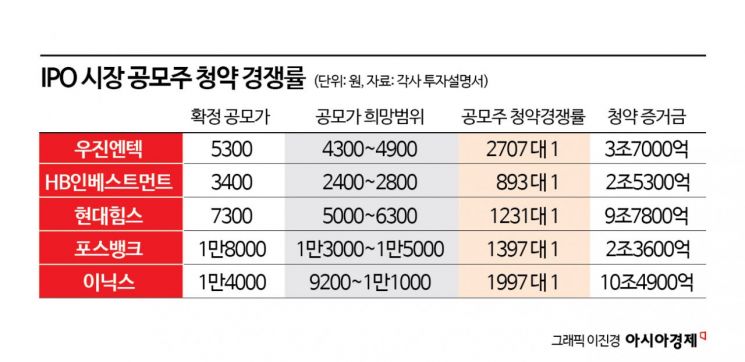

According to the financial investment industry on the 26th, five companies?Woojin Entech, HB Investment, Hyundai Hims, POSBANK, and Inix?that conducted public offering subscriptions for general investors this year have gathered subscription deposits amounting to 28.86 trillion KRW.

Among the four companies, Inix received subscription deposits totaling 10.4863 trillion KRW during the two-day public offering subscription for general investors from the 23rd to the 24th. Hyundai Hims attracted 9.78 trillion KRW in subscription deposits. Woojin Entech, which surged about 420% compared to the public offering price of 5,300 KRW just two days after listing, gathered 3.6946 trillion KRW in subscription deposits. HB Investment and POSBANK recorded subscription deposits of 2.529 trillion KRW and 2.3592 trillion KRW, respectively.

The average subscription competition rate for the five companies was 1,645 to 1, higher than the 1,173 to 1 recorded in 2021, which had a high average competition rate on an annual basis. Last year, the average subscription competition rate in the IPO market was 691 to 1.

Oh Kwang-young, a researcher at Shin Young Securities, explained, "Since the fluctuation range on the day of public offering listing was expanded from June 26 last year, interest in public offering stocks has increased."

As interest in investing in public offering stocks grows, the proportion of companies deciding the public offering price above the upper limit of the desired range is also increasing. According to last year's public offering price confirmation status, about 77% were set above the upper limit of the desired range, up 23 percentage points from 54% in 2022. The proportion of companies setting the public offering price exceeding the upper limit was 50%, more than double the previous five-year average of 24%. The proportion of companies setting the public offering price below the lower limit of the desired range was 23%, down from 43% the previous year.

All six companies?including the five that conducted subscriptions and Studio Samik, which completed demand forecasting and is currently conducting subscriptions?exceeded the upper limit of the public offering price range suggested by the underwriters. Studio Samik, which conducted demand forecasting for institutional investors over five trading days starting from the 17th, finalized the public offering price at 18,000 KRW, exceeding the desired range of 14,500 to 16,500 KRW.

With funds flowing into the IPO market from the beginning of the year, the investment banking (IB) industry expects the reappearance of large-scale public offering stocks. Since LG Energy Solution's listing in January 2022, there have been no public offering stocks worthy of being called large-scale in the IPO market for nearly two years. Choi Jong-kyung, a researcher at Heungkuk Securities, identified APR, which is conducting the first demand forecasting in the KOSPI market this year, Plantech and HD Hyundai Marine Solutions, which are at the bill submission stage, as major companies expected to list this year. He also expressed expectations for the re-challenge of companies that withdrew their listings, such as Seoul Guarantee Insurance and K Bank.

He added, "LG CNS, SK Ecoplant, NHN Commerce, Seongrim Advanced Industry, and Cosmo Robotics will also consider the right timing for listing," and "The listing of new technology stocks such as Bithumb Korea, Yanadoo, IGAWorks, and SikSin will also add vitality to the IPO market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.