57.5% of Crude Oil Imports Recovered Through Exports

"Expansion of Aviation Fuel Exports... Support Needed for SAF Market"

The refining industry is responding to the decline in exports to China by expanding the number of export destination countries. It is overcoming the limitations of being a non-oil-producing country and expanding the territory of petroleum product exports.

The Korea Petroleum Association announced on the 25th that last year, the refining industry, including SK Energy, GS Caltex, S-OIL, and HD Hyundai Oilbank, exported a total of 466.72 million barrels of petroleum products to 70 countries worldwide. This is a slight decrease compared to the previous year (470.91 million barrels).

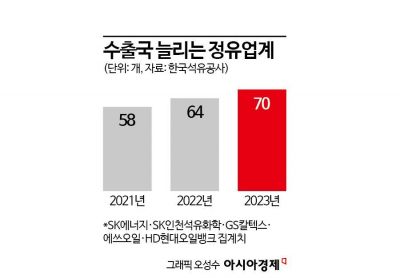

The number of export countries increased for the second consecutive year. The number of export countries rose from 58 in 2021 to 64 in 2022, and to 70 last year. The diversification of export countries has emerged recently as exports of petroleum products to China have decreased. The Petroleum Association analyzed, "It appears that a response strategy is being implemented to discover and focus on new export countries in line with global environmental changes and the carbon-neutral era."

China had been South Korea’s largest export partner for six consecutive years since 2016, but due to the zero-COVID policy and increased self-sufficiency in petroleum products within China, the share of exports to China sharply declined from 29.5% in 2020 to 7.5% last year. The ranking of export countries also slipped to fifth place.

The gap left by China was filled by Australia. Around 2021, BP and ExxonMobil shut down the Kwinana (145,000 b/d) and Altona (86,000 b/d) refineries in Australia, reducing the country’s total refining capacity by 50%. The shortfall had to be met through imports, and domestic refiners quickly increased export volumes. The export country ranking, which was sixth in 2020, surged to first place for two consecutive years. Domestic refiners exported petroleum products not only to Asian countries such as Japan and China but also to Western countries including the United States, France, and the United Kingdom, as well as African countries like Angola and Kenya, and even Middle Eastern oil-producing countries such as the UAE, Oman, Saudi Arabia, and Iraq.

Through these export expansion efforts, refiners are also contributing to alleviating the national trade deficit. For more than a decade, the refining industry has recovered over 50% of crude oil import costs through exports. Last year, out of $80.6 billion in crude oil imports, $46.37 billion (58%) was recovered through petroleum product exports, marking the second-highest recovery rate ever, following 60% in 2022. Based on export value, petroleum products ranked fourth among major national export items announced by the Ministry of Trade, Industry and Energy in 2023, securing a position among the top five items for three consecutive years and solidifying their status as an export industry.

The export volume share by product was diesel (41%), gasoline (21%), jet fuel (18%), and naphtha (8%). Gasoline exports recorded an all-time high of 99.86 million barrels, nearly doubling exports to the United States. From this year, some domestic refiners have contracted to supply finished gasoline products long-term to the U.S. mainland, and gasoline exports to the U.S. are expected to expand further. Jet fuel exports also steadily recovered by 6.8%, mainly to the U.S., Australia, and Japan, approaching pre-COVID demand levels.

The International Energy Agency (IEA) forecasts low growth in oil demand this year due to economic slowdowns in major countries, improvements in energy efficiency, and shifts in transportation fuels. The International Air Transport Association (IATA) expects the aviation sector to continue growing despite the economic downturn, with the number of air passengers reaching a record high of 4.7 billion. From next year, sustainable aviation fuel (SAF) use will be mandated starting with the EU due to environmental regulations, and the domestic refining industry will need strategies to expand SAF demand in the future.

A representative from the Korea Petroleum Association stated, "Government-level policy support is necessary to establish a domestic SAF production base to enhance the export competitiveness of the domestic petroleum industry in response to new environmental changes." They added, "The refining industry will actively respond to environmental changes this year by leveraging its competitiveness to export high value-added products and diversify export countries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.