Start of Negotiations on Cold-Rolled Steel Sheet Import Quotas

Factory Operations Reduced Due to Import Volume Restrictions

POSCO has entered negotiations with the Mexican government regarding the import quota (allocation) for cold-rolled steel sheets. Concerns are rising that the Mexican government, which abruptly raised tariffs significantly targeting Chinese steel at the end of last month to protect its domestic steel industry, is building additional trade barriers. POSCO has dispatched responsible executives to Mexico and has begun discussions with government officials on the import quota.

According to industry sources on the 25th, the export volume of POSCO's cold-rolled steel sheets to Mexico will be determined based on the outcome of negotiations between POSCO and the Mexican government.

Since 2009, POSCO has been operating a galvanized steel sheet (CGL) plant in Altamira City, Tamaulipas State, Mexico. A significant portion of the cold-rolled steel sheets exported to Mexico are used here. CGL refers to the process of continuously heat-treating cold-rolled coils, dipping them in molten zinc for plating, and then correcting their shape to produce galvanized steel sheets. The galvanized steel sheets produced at this plant are used as exterior panels for automobiles.

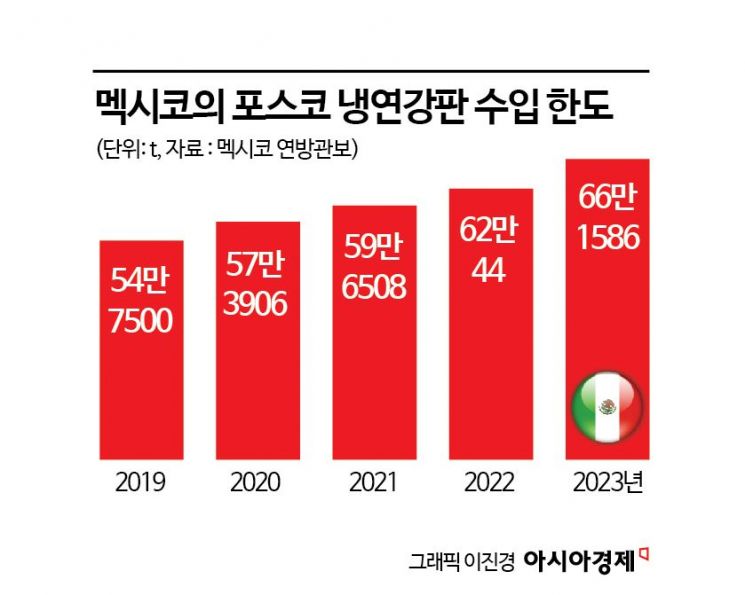

Since 2012, POSCO has been negotiating with the Mexican government every five years on the import volume limits of cold-rolled steel sheets, which are raw materials for galvanized steel sheets. After the Mexican government raised anti-dumping issues due to low-priced exports, instead of imposing tariffs, they applied import volume restrictions. South Korea's export quota volume of cold-rolled steel sheets to Mexico increased from 547,500 tons in 2019 to 661,586 tons last year.

However, this volume is insufficient to fully accommodate POSCO Mexico's production scale, which reaches 900,000 tons annually. Due to import restrictions, the plant's operating rate remains at 60-70%. From POSCO's perspective, to operate the plant efficiently, it is necessary to either remove the import restrictions or significantly increase the quota volume.

In particular, POSCO's exported cold-rolled steel sheets are subject to tariff benefits under Mexico's "Industrial Promotion Program (PROSEC)," making the issue even more sensitive. PROSEC is a measure aimed at fostering the competitiveness of Mexico's domestic industries by imposing low tariffs of 0-7% on machinery, equipment, parts, and materials imported for use in production processes of specific industries such as automobiles.

POSCO plans to use this opportunity to persuade the Mexican government to eliminate the quota, as it has operated quotas on low-tariff imports for the past 10 years. They also plan to emphasize that increasing the quota volume could benefit economic activities within Mexico.

However, there is a sense of difficulty as Mexico has recently shown a strong protectionist stance toward imported steel products. Mexico is the 15th largest steel producer in the world. In August last year, it announced the temporary imposition of tariffs on 392 products, including steel, until 2025. About 170 steel product items are subject to tariffs of up to 25%. Additionally, in December last year, Mexico raised tariffs on Chinese steel imports by approximately 80%.

A POSCO official said, "The Mexican government is currently reviewing regulations, including the appropriateness of the quota volume," and added, "We plan to actively cooperate with the local government's administrative procedures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)